ProFile 20 is a bundle of 20 returns that provides a more cost-efficient alternative to preparers than buying individual OnePay returns.

What modules and tax years does ProFile 20 support?

ProFile 20 supports T1/TP1 returns for tax years 2015 through 2023.

Who is ProFile 20 best suited for?

ProFile 20 is best suited for preparers who have 20 or fewer T1/TP1 returns to file. ProFile 20 is more cost-efficient than purchasing the same number of OnePay returns.

Is batch EFILE supported?

No, batch EFILE is not supported with ProFile 20.

When am I charged for using one of my ProFile 20 returns?

ProFile 20 customers are charged a return for the following activities:

- EFILE a return

- Print a return using the T1 Condensed setting

ProFile 20 customers see a confirmation window when a return is about to be used.

Am I charged for a ProFile 20 return if I just prepare the return?

No. ProFile 20 customers can prepare as many T1/TP1 returns as they like without being charged.

Does ProFile 20 work with Flexible Licensing?

Yes.

How many ProFile 20 licenses can I buy at one time?

Only a single ProFile 20 license may be purchased at one time.

If more than 20 returns need to be filed or printed, preparers can purchase a OnePay or the full, unlimited version of ProFile.

Can I use my ProFile 20 license to open files in next year's module if I have returns left from the previous year?

No, you would need to purchase a license for the latest module in order to create and save files, even when the module is only a draft/uncertified version.

Purchasing ProFile 20

Visit the ProFile 20 website or call our Sales team to purchase ProFile 20. You can also reach our website in the program by going to Help, selecting Manage Licenses and then selecting Purchase license.

Accessing ProFile 20 after purchase

ProFile 20 customers receive an email containing their License Key or License Number.

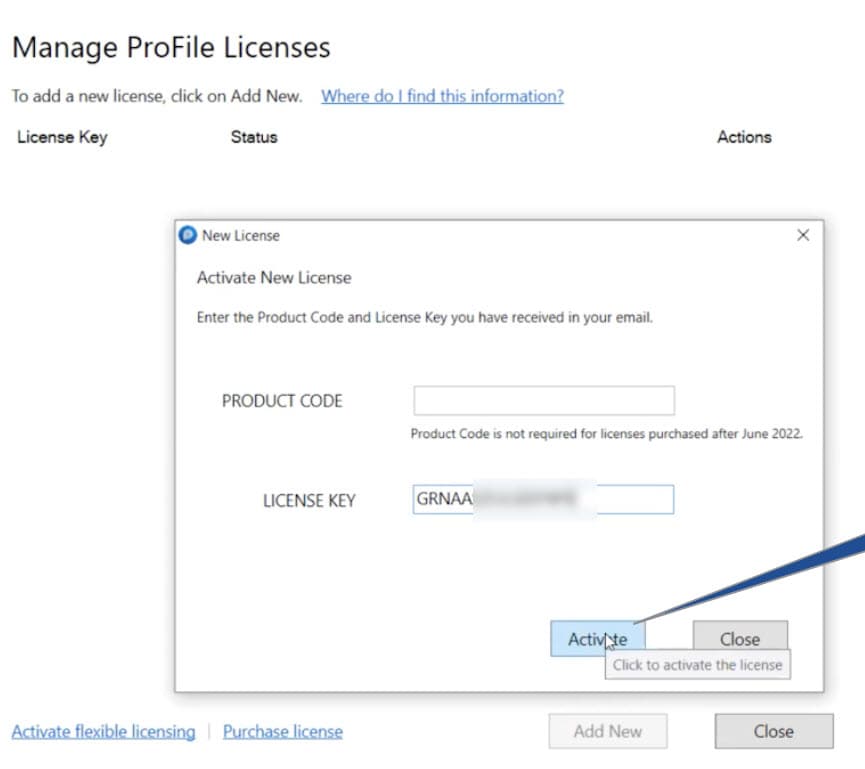

- Open ProFile.

- Select the Manage Licenses option from the Help drop-down menu in the top toolbar. The License wizard displays.

- Click the Add New License button; the ProFile License Activation window displays.

4. Enter the and License Key or License Number from the email and click the Activate button.

Note: As of version 2021.4.8, Product Codes are no longer needed for licenses purchased on or after June 6, 2022. Older licenses still require accompanying Product Codes found on the receipt.

The ProFile license activates. You can now print and EFILE T1/TP1 returns using ProFile 20.

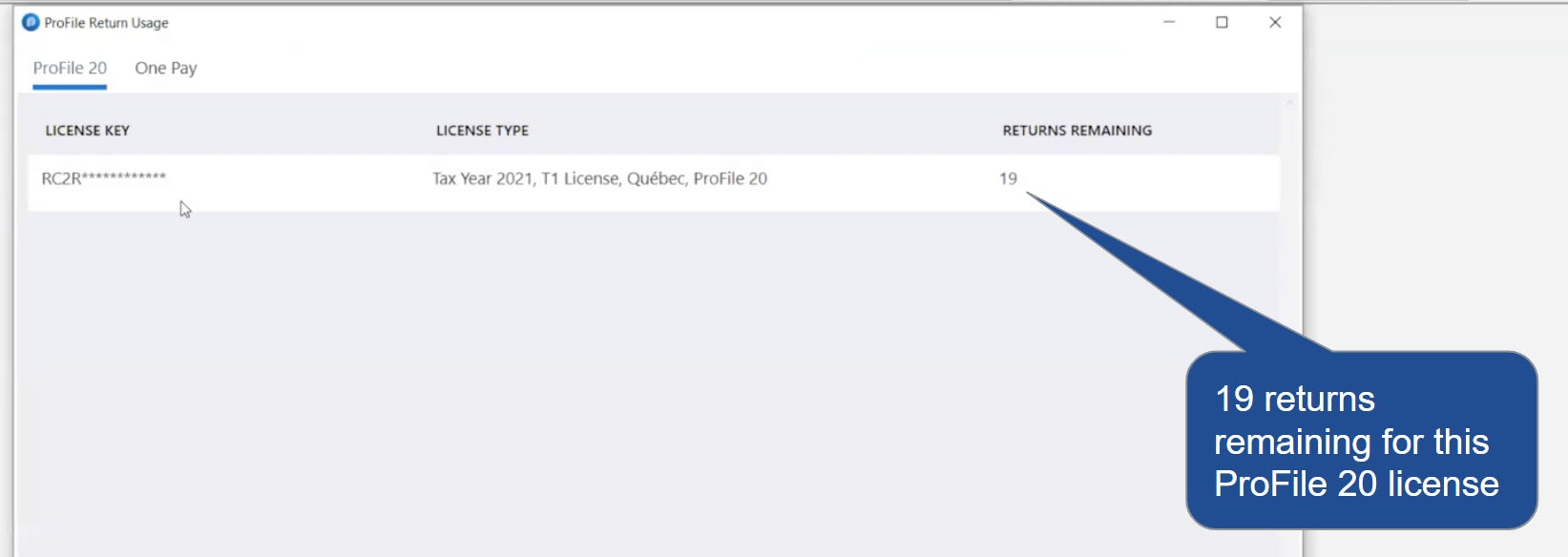

Checking your remaining ProFile returns

Select the Return Usage... option from the File drop-down menu in the top toolbar.

This window lists returns previously submitted using ProFile 20 and indicates the remaining returns.

Troubleshooting ProFile 20 issues

I made an error on a return that I printed. Do I get charged a ProFile 20 return for correcting it or doing a ReFILE?

ProFile 20 customers are charged for a second ProFile 20 return only if any of the following are changed on a return:

- Client name

- Client Social Insurance Number (SIN)

- Client birthdate

A preparer is not charged a ProFile 20 return if reprinting a return or undertaking a ReFILE. In addition, preparers can reprint a return as many times as they like after using a ProFile 20 return to print.

I get a message that only one ProFile 20 license can be activated on my machine when I try to activate my license...

Only one ProFile 20 license may be activated on a machine regardless of year.

To remove other ProFile 20 licenses, navigate to Help -> Manage Licenses -> Details and select the Delete Selected License button.

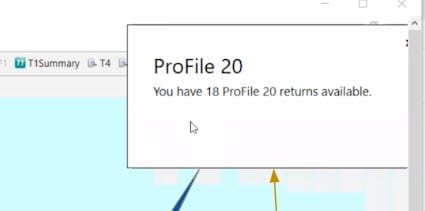

Will I be notified how many ProFile 20 returns I have remaining when submitting or printing a return?

An assessment window displays the remaining number of ProFile 20 returns when a return is used.

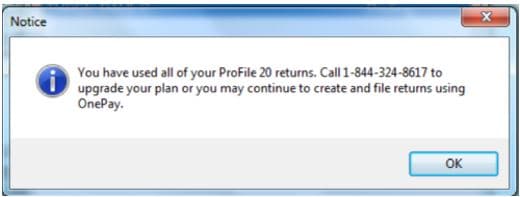

Will I be informed when all ProFile 20 returns have been used?

A notification window indicates when all ProFile 20 returns have been used.

Will I get a refund for unused ProFile 20 returns?

No, there are no refunds provided for unused ProFile 20 returns.

Can I use the remaining returns on my ProFile 20 license from last year for this year?

No. Any remaining ProFile 20 returns would need to be used to e-file or print supported previous year returns only.