EFILE is an automated service from the CRA that allows approved tax preparers to transmit individual income tax return information to the CRA directly from EFILE-certified tax preparation software.

Office and preparer information

All modules have an Info worksheet. Included on this worksheet is a Preparer Information section with details and information about the preparer. ProFile automatically transfers this information to other forms associated with the return, such as letters to the client, T183, and T1013.

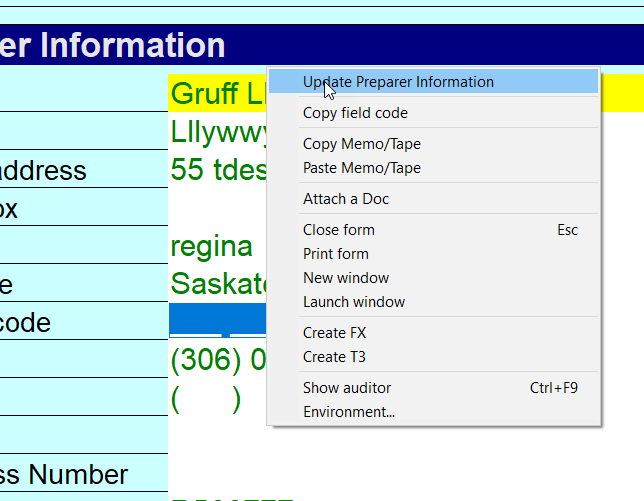

Any time this information is changed or modified under the Environment options the information has to be updated on the Info page by right-clicking anywhere on the page and selecting Update Preparer Information.

The Audit tab

ProFile automatically updates the EFILE status to Eligible as soon as no errors that prevent filing appear in the Active Auditor. To address any outstanding auditor errors or warnings, open the Active Auditor and look at the remaining audit messages. Correct any errors, or use the sign-off review marks to clear any messages that do not apply.

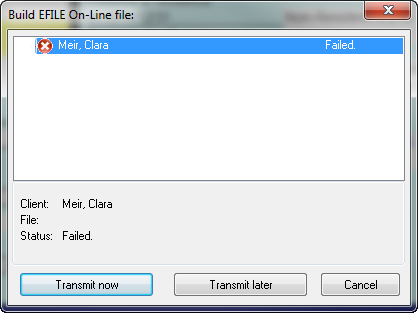

If the return becomes eligible, but ProFile still fails to build the file for transmission:

- Navigate to the Options menu.

- Select Environment.

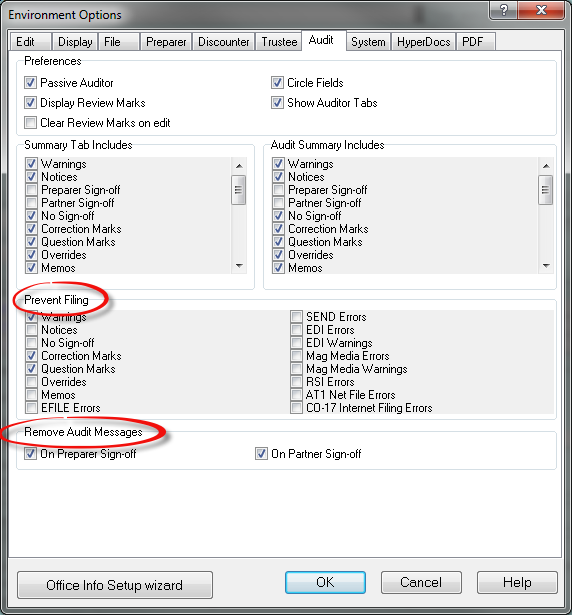

- Select the Audit tab and check the following:

- Review the options selected under the Prevent Filing header. The options selected here may be preventing the return from undergoing EFILE. Though the return may be eligible, if, for example, it has Notices checked under this heading, the transmission file will not be built by the software.

- Under the heading Remove Audit Messages, ensure that both On Preparer sign-off and On Partner sign-off are checked.

Software fails to build a transmission file and does not display an error message

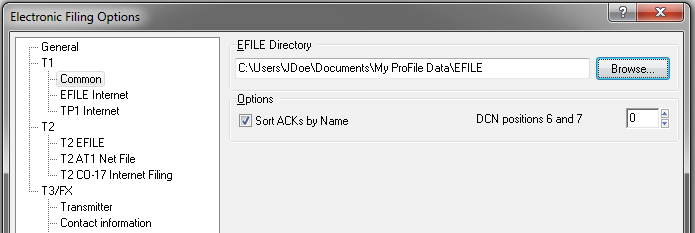

If the file path where ProFile is supposed to save the transmission file does not exist, ProFile will fail to build the file, and displays an error without a message.

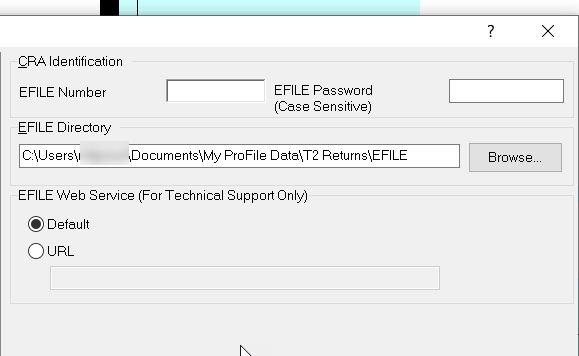

Confirm that the EFILE path is correct by selecting Options under the EFILE menu.

Note: The paths under Common, T2 EFILE, T2 AT1 Net File, must all have valid paths, even if returns for those modules or Provinces are not being prepared.

Folder permission and user access

ProFile may not have the necessary permissions to access (read/write) the folder where the returns are being saved. The folder properties can be modified by the system/network administrator.

ProFile may not be able to access the folder where the returns are saved in a multi-user environment. If the same PC is being used by several users, the location of the file may not necessarily be accessible for the current user.

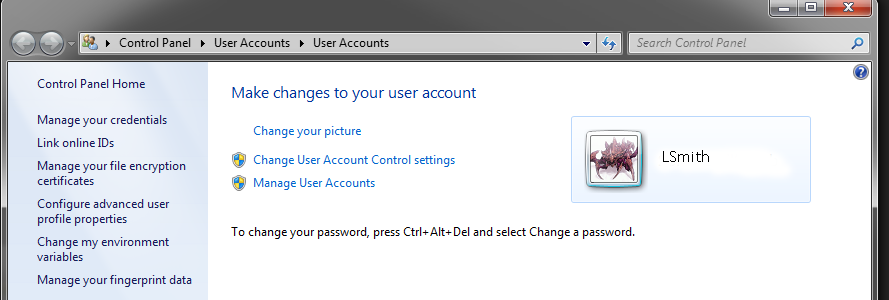

Ensure that the user name logged on the machine matches the user name on the EFILE directory path.

For example, under Options in the EFILE menu, under the subheading Common, the user listed in the address may not match the current user logged on to the machine.

| Current Windows user: LSmith

| EFILE directory path: C:\Users\[NAME]\Documents\My ProFile Data\EFILE

|

Ensure that the folder is shared or made accessible to multiple users.

EFILE password

Before a return can be transmitted to the CRA, the user must enter a valid EFILE password into the software.

- Select EFILE in the top toolbar menu.

- Select Options... and then select EFILE Internet.

- Enter your EFILE password and EFILE Number, if not already done.

EFILE error 2252, HBP, and LLP

Verify that the return is correct.

If the return contains no errors, contact the CRA to confirm the amounts entered.