ProFile users may experiencie CRA EFILE error 2123 for T1.

The error text may read as follows:

| The entry in this field is not valid for processing purposes. Values entered in field codes have a defined length, which for most fields is up to 9 digits. This error could result from missing delimiters such as "*" indicating the end of the field code and its value. |

The error text may also read as follows:

| 2123: Your client is no longer entitled to claim the employment insurance overpayment because this return is filed more than three years after the end of the tax year. |

The error indicates an EI overpayment on a statute-barred refund return.

ProFile users may also experience CRA EFILE error 90312 for T1.

The error text usually reads as follows:

| Error Message: Failed. CRA: 90312: One of the following situations exists on your client's return: 1) The province of residence is "Quebec" and the sum of the claims for EI premiums at field 312 and EI overpayment at field 450 does not balance with the amount entered for total EI premiums withheld on all information slips field 5028. 2) The province of residence is "other than Quebec" and the sum of the claims for EI premiums at field 312/5026 and EI overpayment at field 450 does not balance with the sum of the amount entered for PPIP premiums withheld on all information slips at field 5027 and the amounts entered for total EI premiums withheld on all information slips at field 5028. |

Resolutions

Override the overpayment to value 0 (in effect, not asking for a refund of the overpayment).

It is also necessary to adjust the amount requested on S1 (line 312) and field 5028 from the EFILE screen, or the error also displays.

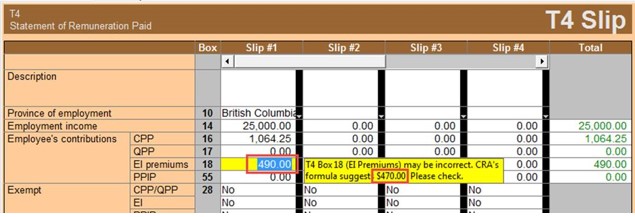

Resolution if there is only one T4

Adjust the EI amount (box 18) on the T4 to what it should be, as suggested by the warning message.

For example, if the required amount is $470.00, and the T4 has $490.00, the amount in box 18 should be adjusted to $470.00.

This can become challenging when there is more than 1 T4, as it is necessary to consider the total amount of EI needed.

Resolution if there is more than one T4

- Override line 450 on the T1 jacket to 0.

- Override line 312 on Schedule 1 to data found on the T2204, line 10.

- Override line 5028 on the T1Efile form to data found on the T2204, line 10.

If the above overrides were unsuccessful...

1. Undo the overrides and reduce the CPP and EI amounts on the T4s to 0.

2. Attempt EFILE again.