Thanks for visiting the Community, tmcculloch.

You can set a vacation policy for your employees in which they'll be paid 10% of the gross pay each period. You'll also need to set up a deduction item for the Union trust fund.

I'll show you how:

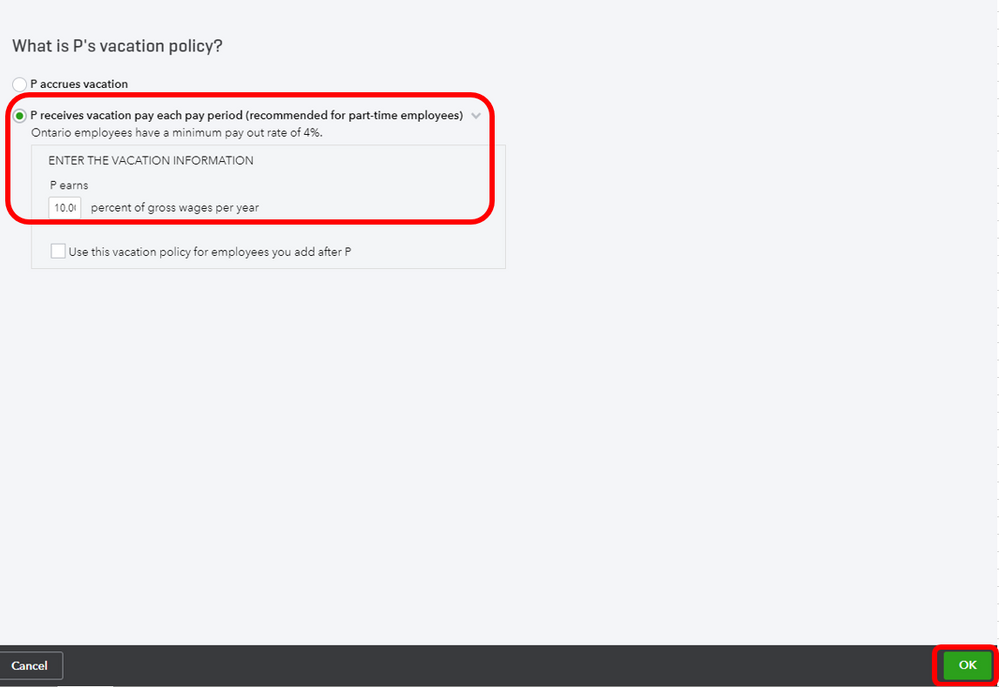

To create a vacation pay policy:

- Select the Employees tab on the left menu

- Hit the name to open the employee details screen.

- Click the pencil icon next to the What is employee's vacation policy?

- Tick the radio button next to employee receives vacation pay each pay period (recommended for part-time employees) and enter 10 in the percent box.

- Hit OK.

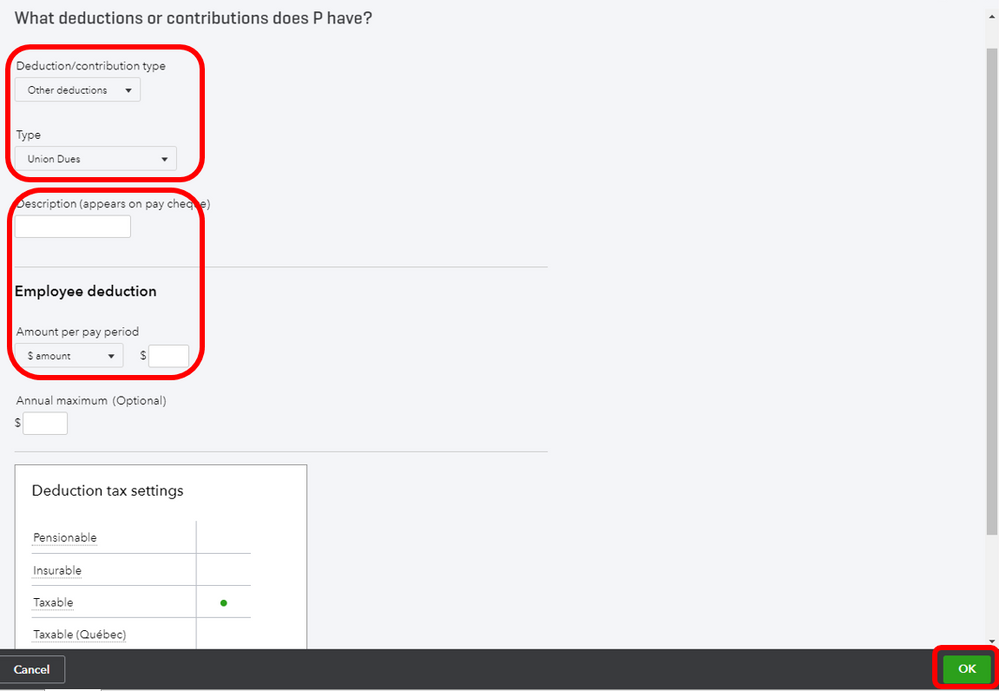

To create a deduction item:

- Follow the first two steps above.

- Then, hit the pencil icon next to Does P have any deductions or contributions? (ex. retirement, health care).

- Once you create a paycheque, you should have a field for vacation pay and Union trust fund deduction.

- Under Deduction/contribution type, select Other deductions and Union Dues under Type.

- Enter the needed details such as Description and Amount per pay period.

- Hit OK.

Please check this article for the complete details about vacation pay:

If you have any questions or clarifications about QuickBooks, please leave a comment below. I'm always here for you.