You can add a deduction for Loan Repayment or Cash Advance Repayment, upirzada.

Here's how to set it up:

- Go to the Workers tab and select Employees.

- Select the employee.

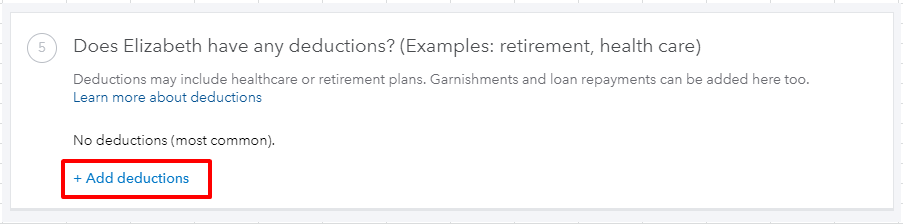

- Click Add deductions.

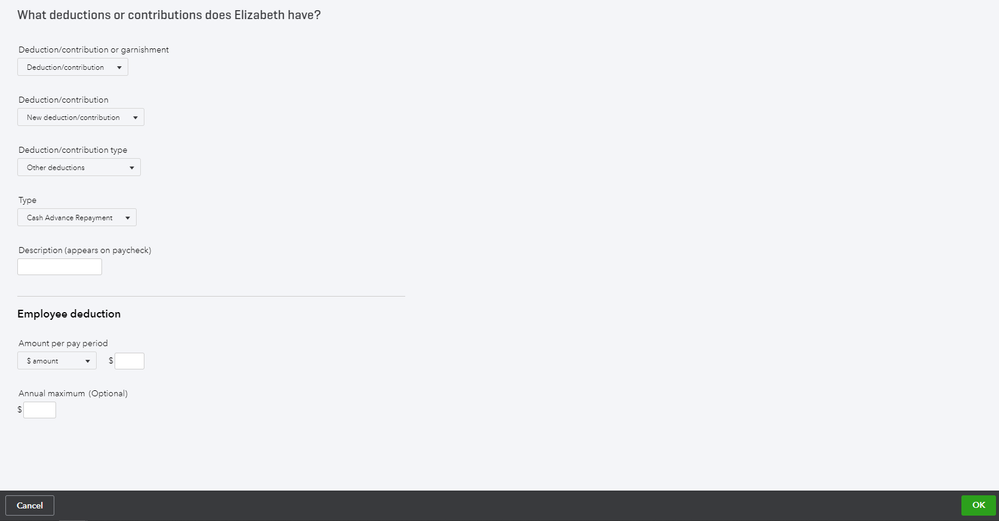

- Under the Deduction/contribution or garnishment drop-down, select Deduction/Contribution.

- Choose New deduction/contribution under Deduction/contribution drop-down.

- Select Other deductions under Deduction/contribution type drop-down.

- Under Type drop-down, select Loan Repayment or Cash Advance Repayment.

- Enter a description of the deduction on the Description field to appear on the paycheck.

- From the Amount per pay period drop-down, select how you'll deduct it. Either by percentage or exact amount.

- Select OK. Then, Done.

Once done, you can run a payroll and verify the paycheck before approving it to make sure the deduction is calculating.

Please let me know if you have other concerns. The Community is always here to help. Have a great day!