Bank payments and Non-Sufficient Funds (NSF) fees

by Intuit•1• Updated 8 months ago

What is the NSF fee if a customer’s Bank payment is returned?

If a customer’s bank payment is returned, you will be charged an NSF fee of $25.00.

How do I view NSF fees that have been charged to my account?

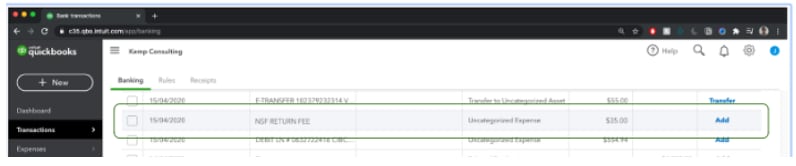

To view NSF fees charged to your account, open your bank feed in QuickBooks Online and review your entries.

NSF transactions are listed as NSF RETURN FEE.

When will NSF fees be charged?

There will be 1 monthly charge deducted from your bank account for all NSFs incurred in the month. Charges for NSFs will be deducted on the fifth day of the month after which the NSF was incurred.

What happens to my Merchant account when my customer’s payment results in an NSF?

While you will be charged 1 NSF fee for each Bank payment rejected, NSFs do not impact your QuickBooks Payments Merchant account.

Money movement services are provided by Intuit Canada Payments Inc.

More like this