Integrate FreshBooks and QuickBooks Online with OneSaas

by Intuit•1• Updated 2 weeks ago

Learn how to integrate FreshBooks and QuickBooks Online.

Connect

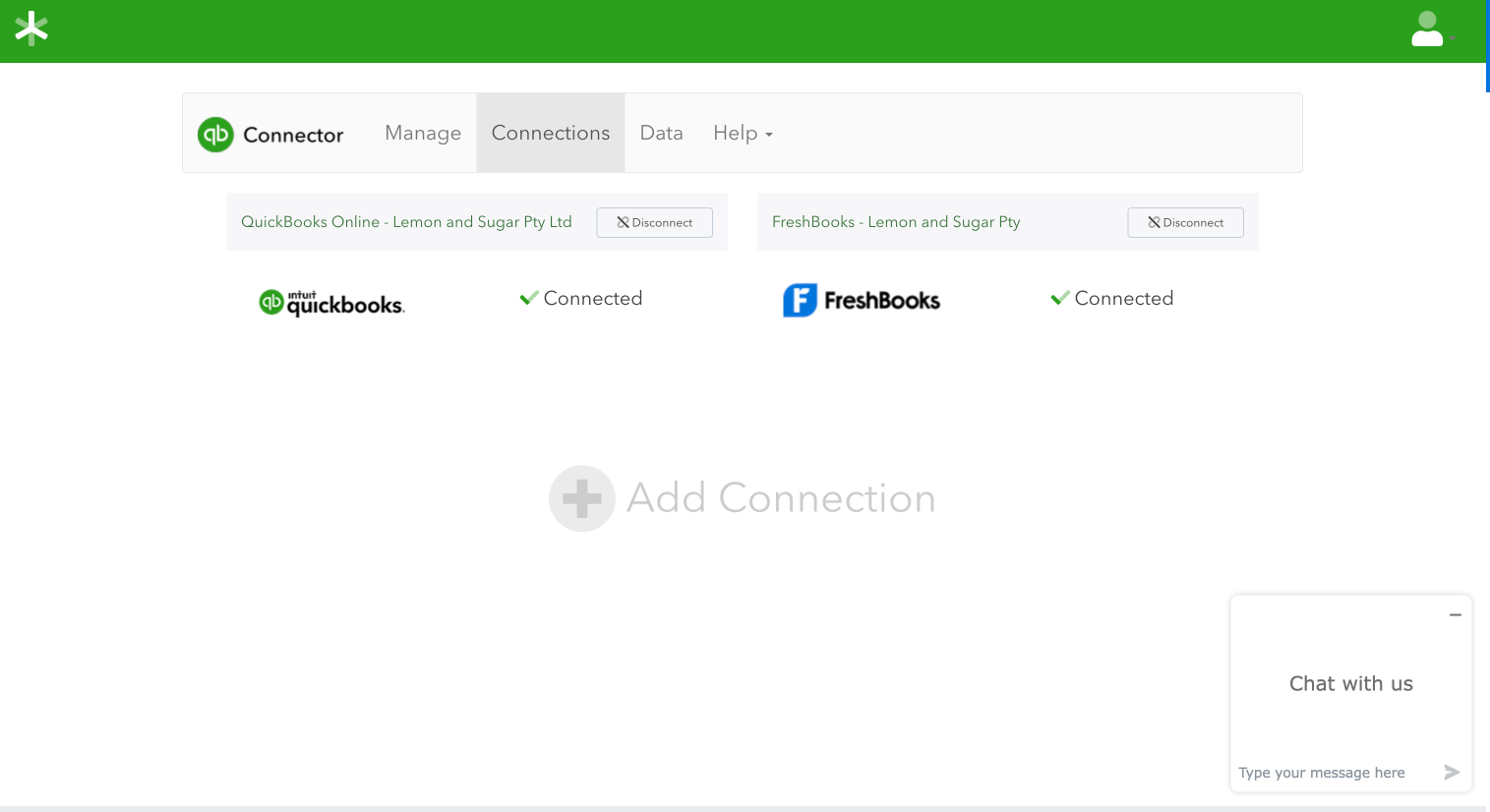

Begin by connecting your apps to QuickBooks Connector. If you haven't already connected your apps, you can follow our guides to integrating FreshBooks and QuickBooks Online. Select Manage to move forward.

Configure

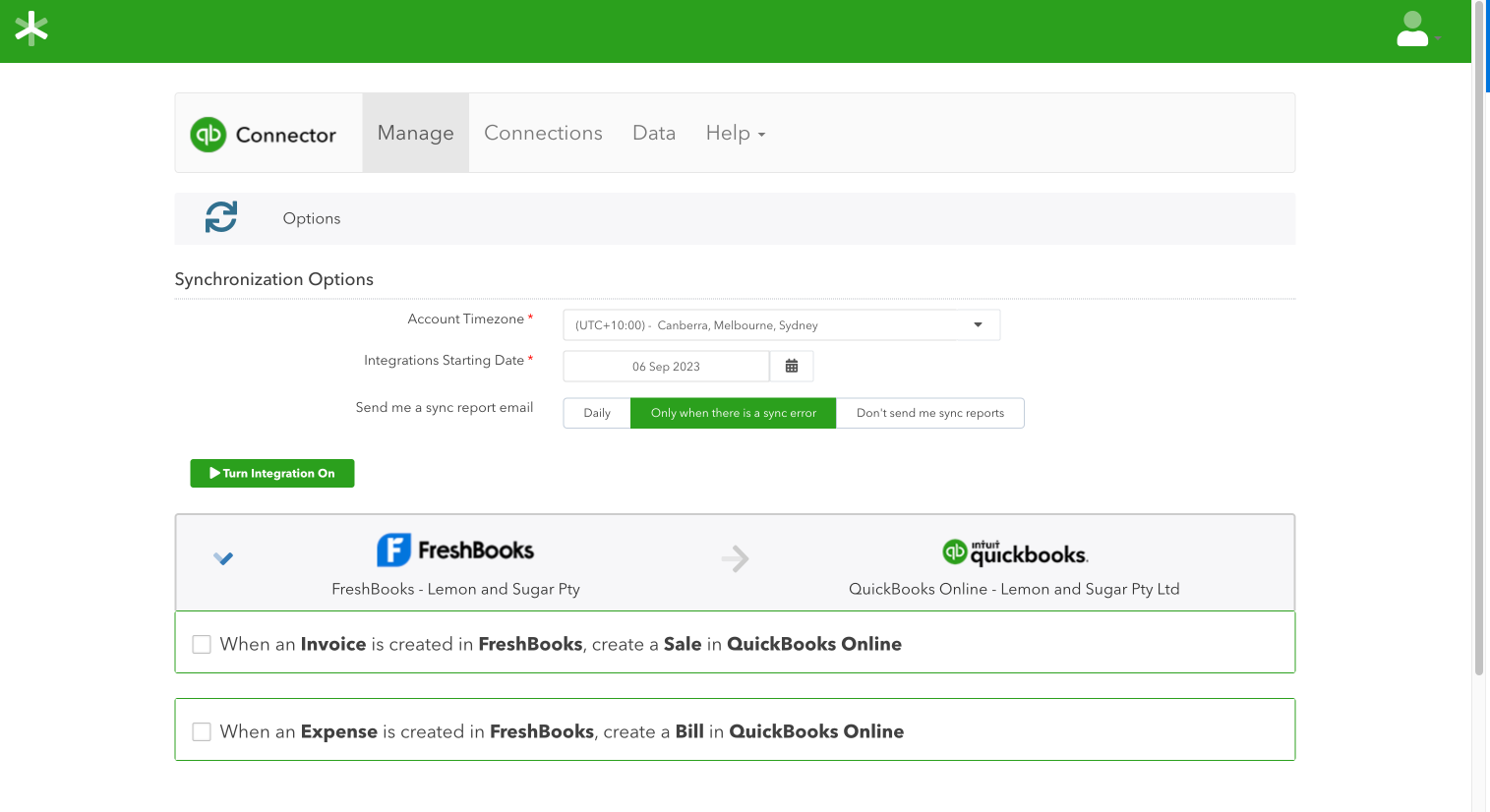

The configuration process described below is for a standard integration between FreshBooks and QuickBooks Online. If you're also connecting a third app, then you'll have to configure this as you go through the setup process.

You will be presented with workflows, which are all optional. In this walkthrough, these workflows will be tackled to demonstrate the full capabilities of the setup process.

- Invoices from FreshBooks to be sent to QuickBooks Online

- Expenses from FreshBooks to be sent to QuickBooks Online

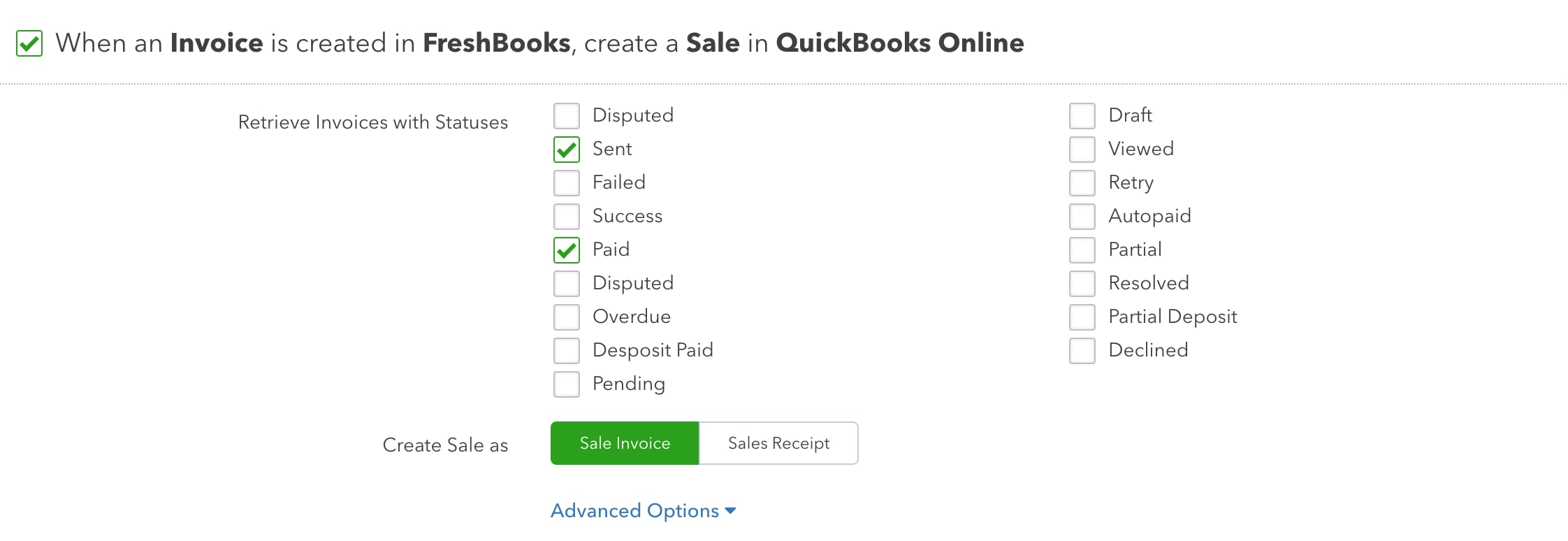

- Start the configuration process by selecting the first workflow to sync FreshBooks invoices with QuickBooks Online, as shown below.

Once you've selected the first option to create invoices in your QuickBooks Online, you'll be asked to:- Select the FreshBooks invoice statuses from which the app will retrieve sales to sync to your accounting system. Depending on the nature of your business, you may want to also sync invoices in the Pending or Autopaid statuses.

- Select how FreshBooks invoices will appear in your accounting system. In the case of QuickBooks Online, choose if you want your FreshBooks invoices to be sent to QuickBooks Online as sale invoice or sales receipts. Select the appropriate option for your business.

- Select Advanced options to see the advanced settings.

- Invoice number prefix - The prefix you input here's added to all invoices retrieved from your FreshBooks account. For example, if you have invoice 1234 in FreshBooks and you add the prefix FB in the configuration, your invoice will be retrieved into QuickBooks Connector with the invoice number FB1234 and sent to QuickBooks Online accordingly.

- Assign to Class/Assign to Location - These two options allow you to choose a default class or location within your QuickBooks Online system. This is an option unique to QuickBooks Online, and is available only if you have set up classes or locations within your QuickBooks company file.

- Original customer / Customer's organization / Generic online sale customer - Most accounting systems require a customer record to be specified when a sales invoice is created. This particular option allows you to choose the nature of the customer record that is being created. The default option is Original customer; however, if your FreshBooks customers specify a company name and you prefer to have that appear within your accounting system instead, then you can opt for the Customer's organization option. Alternatively, if you don't want any customer records to be created within your accounting system, you can select the Generic online sale customer option. This means all sales will be synced to your accounting system against a generic FreshBooks customer record. You can read more about how this works here.

- Automatic invoice numbers - This option allows you to disregard the FreshBooks invoice number completely, and use the sequential numbering convention within your accounting system. Note: To generate invoice numbers in QuickBooks, the Custom transaction numbers option in the Sales settings must be off.

- Discount product - Ensure all discount line items that aren't assigned to a specific discount product are assigned to the default discount product selected here. You can select your own from the dropdown menu, or use the default already selected.

- Rounding off product - Select the preferred product to be used when sending rounding discrepancies as a line item. Learn how special products work.

- DueDate offset - A due date type will be assigned if transactions don't have a due date. This is calculated using the transaction date, the due date offset, and the type specified. If not set, the transaction date is used as the due date.

- Allow credit card payments - select this option if you want to allow credit card payments for the transactions.

- Match FreshBooks products with QuickBooks Online. In order for sales to properly integrate with your accounting system, you'll need to have all of your FreshBooks items set up with unique Item Names.

Note: With QuickBooks Online integrations, we have two product matching options:- NAME: We match the product's SKU field from FreshBooks to the product's NAME field in QuickBooks Online.

- SKU: We match the product's SKU field from FreshBooks to the product's SKU field in QuickBooks Online.

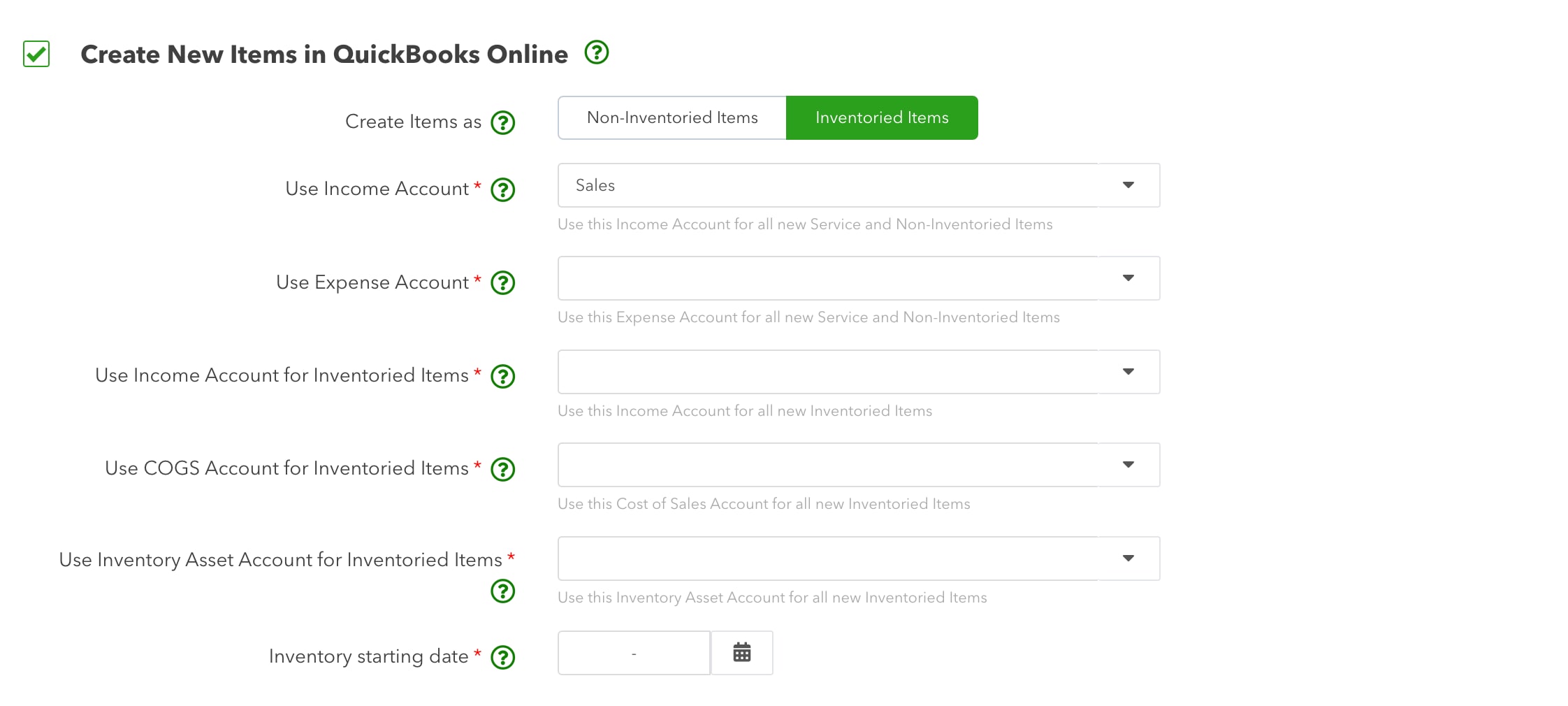

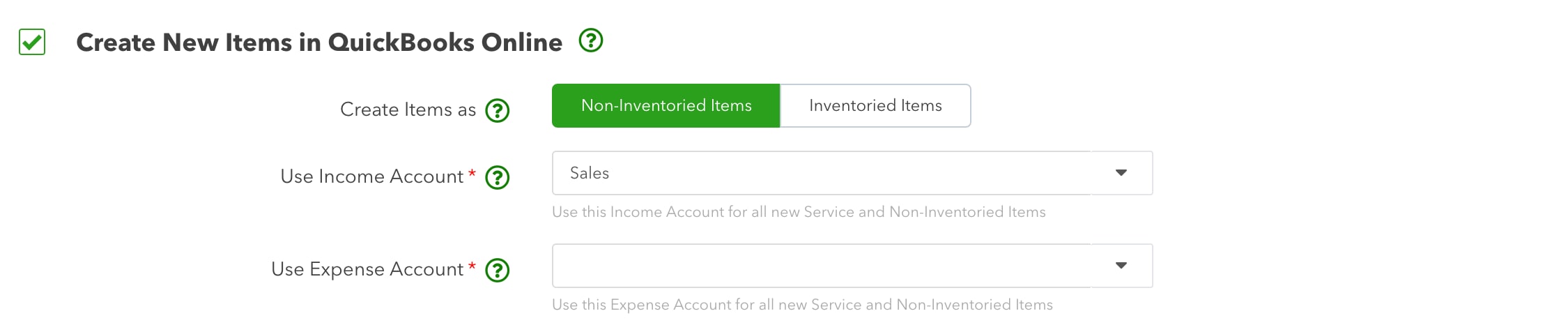

- If you'd like QuickBooks Connector to create new items in QuickBooks Online, you can enable this option. In the Items settings configuration section, you'll need to select the Income and Expense accounts to be used for your inventoried and non-inventoried items from Use Income Account and Use Expense Account dropdowns respectively. Learn about the integration of items.

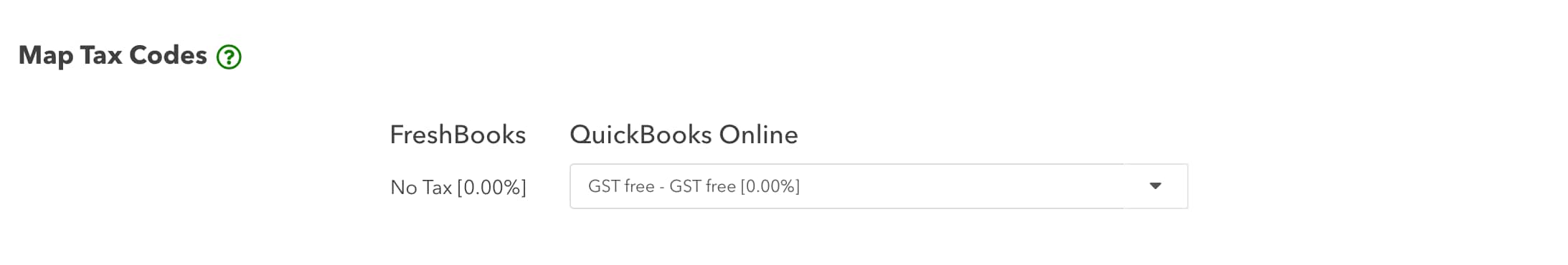

- Map Tax Codes: Here, for each tax created/defined in your FreshBooks, you must select its corresponding tax code in QuickBooks Online. Learn how to configure tax with QuickBooks Connector.

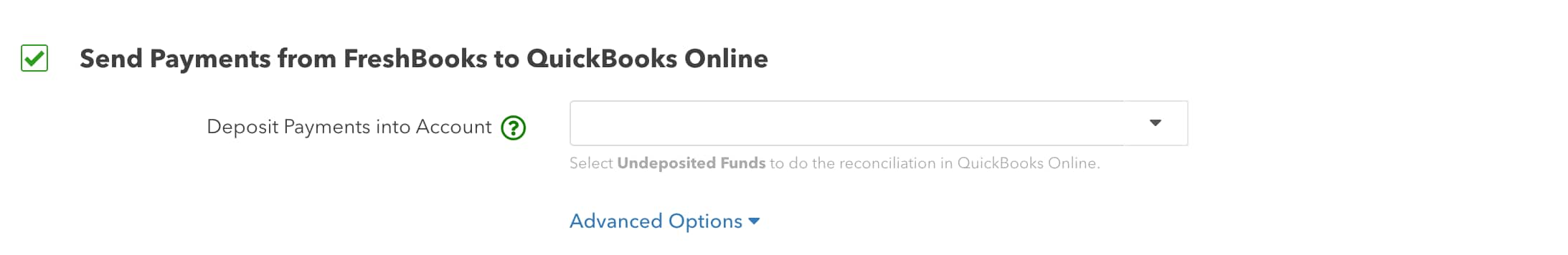

- Payment configuration settings will allow you to select whether you want payment data from FreshBooks to be registered against your sales within QuickBooks Online. If you want to map different payment methods to different clearing accounts, this can be done via Advanced Options. Then, select Save.

Note: If you are unsure of which clearing accounts to use, consult with your accountant.

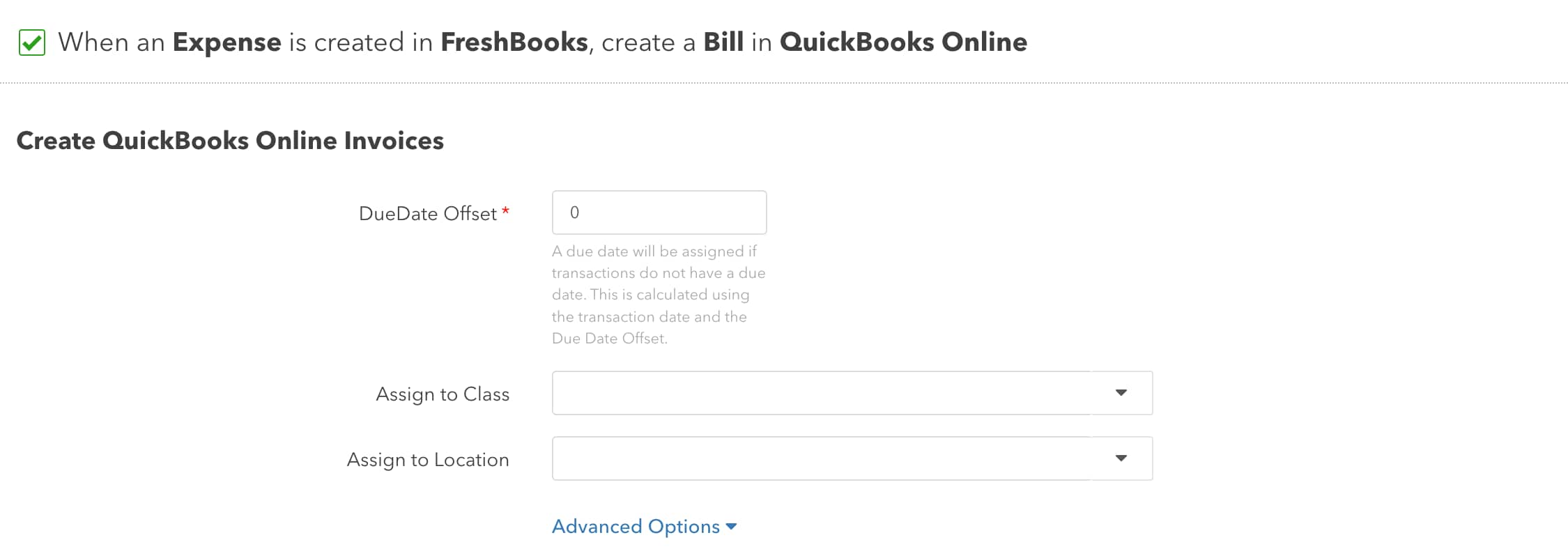

- The next workflow option will allow QuickBooks Connector to retrieve all of your FreshBooks expenses and create them as bills in your QuickBooks Online. Similar to your invoice setting, you can assign DueDate offset days and assign expenses to class and location under your Expense settings.

- Select the Advanced options to allow you to add a Purchase Number Prefix.

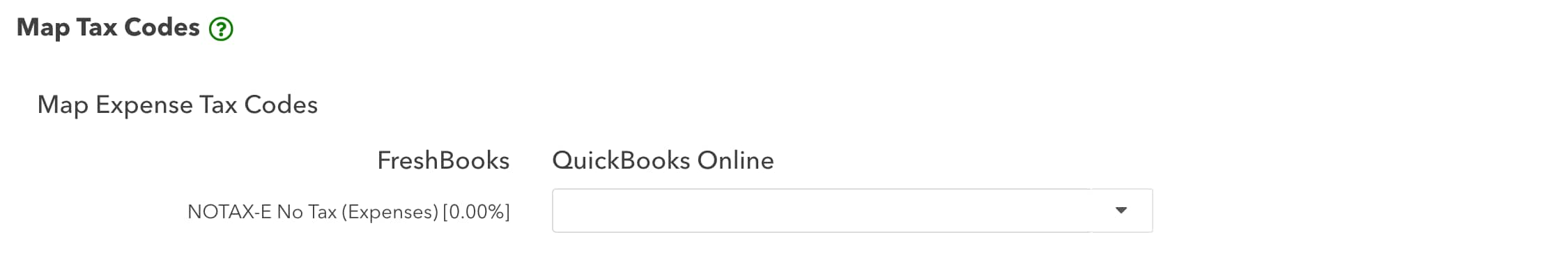

- Map Tax Codes for your expenses. Here, for each tax created/defined in your FreshBooks, you must select its corresponding tax code in QuickBooks Online. Learn how to configure tax with QuickBooks Connector.

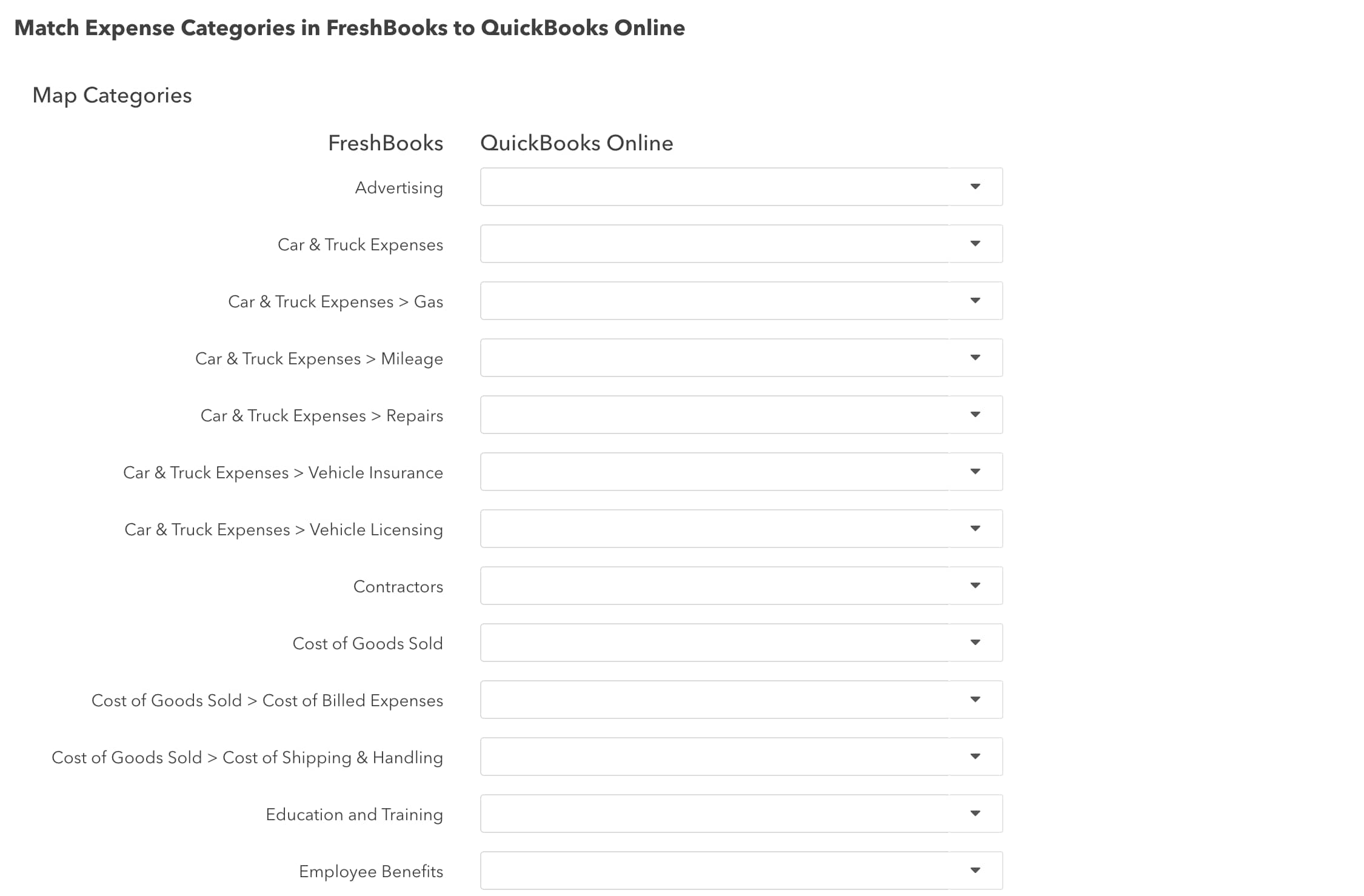

- You will also need to map your FreshBooks expense categories to corresponding expense accounts in your QuickBooks Online.

- If you'd like QuickBooks Connector to create new items in QuickBooks Online, you can enable this option. In the items settings configuration section, select the Income accounts and Expense accounts to be used for your inventoried and non-inventoried items from Use Income Account and Use Expense Account dropdowns respectively. Learn about the integration of items. Then, select Save.

Sync

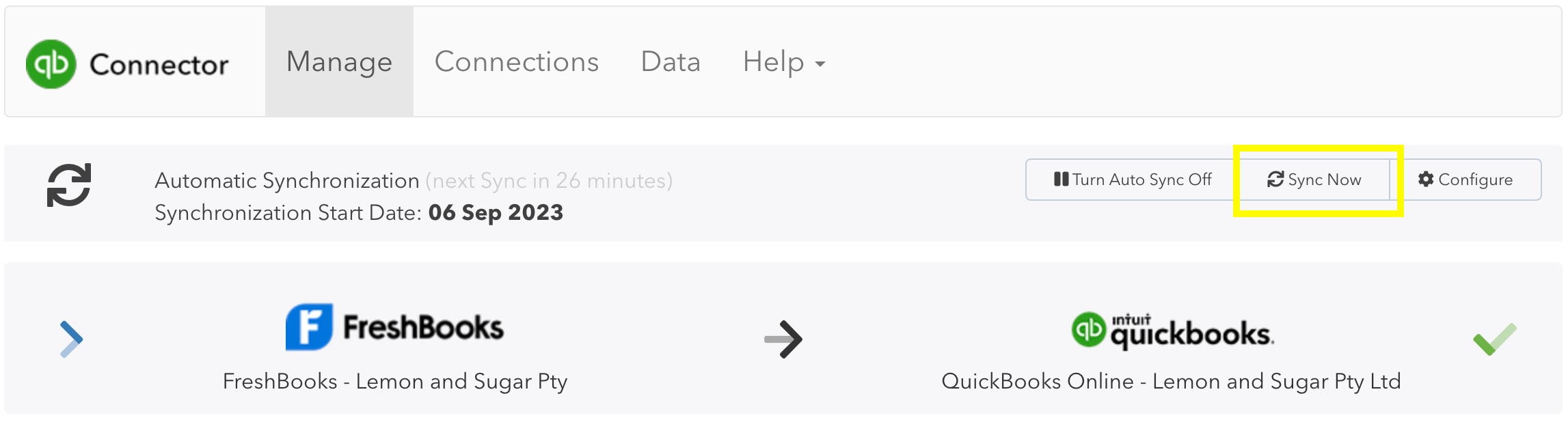

Once you are finished configuring your integration setup, you can proceed with setting up your sync settings.

The Integration starting date setting specifies a filter against your FreshBooks invoice date. This means that any invoices dated before the specified date will not sync. Once you have agreed to the QuickBooks Connector user terms and conditions, you can turn on the automated hourly sync.

More like this