How to give an employee cash advance pay on their paycheque

by Intuit•75• Updated 2 weeks ago

This article explains how to set up a cash advance to be deducted from an employee's next pay cheque and how to assign the cash advance deduction to an employee.

| Note: | We recommend that you consult with your accountant or tax adviser before setting up a cash advance repayment deduction. |

Set up a cash advance payment deduction

The following steps show you how to set up a cash advance payment deduction:

Follow this link to complete the steps in product

- Go to Payroll and select Employees (Take me there).

- Select the employee you're making a deduction for.

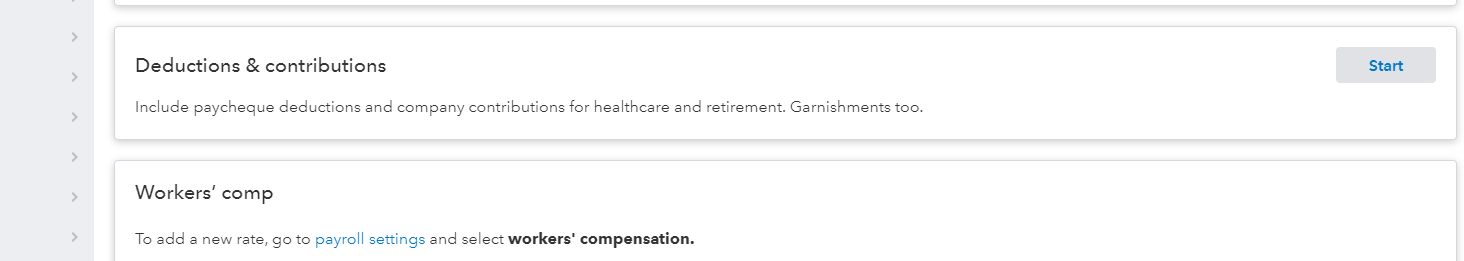

- Under the Profile tab, select the Start button of the section Deductions & contributions.

- Select Add a new Deduction/Contribution.

- From the Deduction/contribution type drop down menu, select Other deductions.

- From the Type dropdown, select Cash Advance Repayment.

- Enter an appropriate description in the Description field.

- Select Ok.

- A pop-up will appear asking if you want to assign the saved deduction to an employee.

- Select Yes or No. Yes will take you directly to the Employees page to apply the deduction.

Assign the cash advance deduction to an employee

Follow this link to complete the steps in product

- Select the employee by choosing their name.

- Select the edit pencil next to question #5.

- In the Deduction/contribution dropdown menu, select the cash advance deduction you created above.

- In the Amount per pay period dropdown menu, select either $ Amount or % of Gross Pay.

- Enter the amount or percentage.

- (Optional) Enter the annual maximum amount.

- Select Ok.

- Select Done.

In your Payroll Settings, you can select an asset account to track this deduction.

| Note: | Because the pay and deduction report to two different types of accounts, they will show separately on reports. To balance these amounts, you can create a journal entry debiting the Repayment asset account and crediting the Reimbursement expense account. |

More like this

- Pay and report tipsby QuickBooks

- Vacation pay for bonuses in QuickBooks Online Payrollby QuickBooks

- Understand gross pay and net payby QuickBooks

- Give an employee a refund for a payroll deduction in QuickBooks Online Payrollby QuickBooks