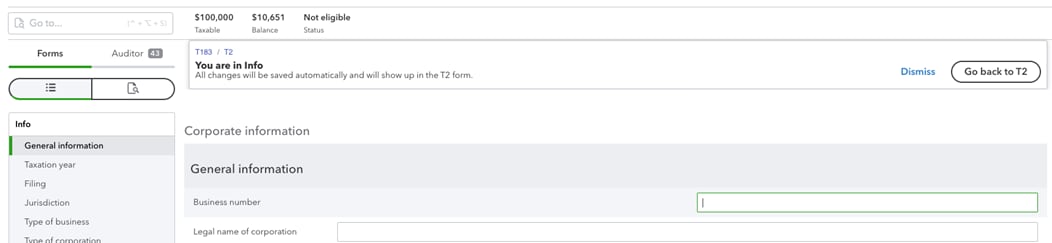

About Pro Tax Data Entry Fields

by Intuit•1• Updated 3 months ago

What do different fields mean in Pro Tax?

Fields can contain the following types of data:

- Currency amount

- Percentage

- Date

- Yes or No

- Radio Buttons: Select a single option from a list of mutually-exclusive options, like Male or Female.

- Checkboxes: Set listed options "on" or "off".

- Dropdown lists: Select a single item from a list of items, such as the province name from all of the province and territory names.

Types of fields

Pro Tax has several types of data fields that allow you to enter different kinds of information:

- Text fields: Text fields allow you to enter any combination of numbers, letters and other characters.

- Numeric fields: Numeric fields contain dollar amounts, percentages and other numbers.

- Option groups: Option groups allow you to select a single item from a group of choices.

- Date fields: Date fields allow you to enter dates (for example, yyyy/dd/mm or dd/mm/yyyy). You do not need to enter the separator (/) characters. Pro Tax formats dates automatically.

Fields colours

The colour of a field can tell you a lot.

Here's a key to the range of colours for field text and background:

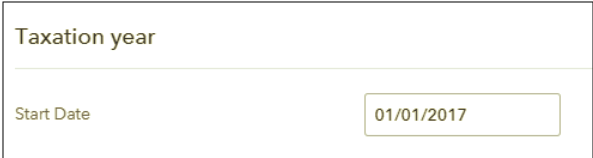

Manual entry Fields - an amount or value that you enter. It has no tab or colour on the side. For example, entering start date of the tax year:

Blue bar fields: A calculated amount or value, or a value that is carried from another field. These can be overridden at the tax preparers discretion

For example, Schedule 1 has the blue fields below displaying that the amount comes from Schedule 125 for line 300 and schedule 2 for line 311

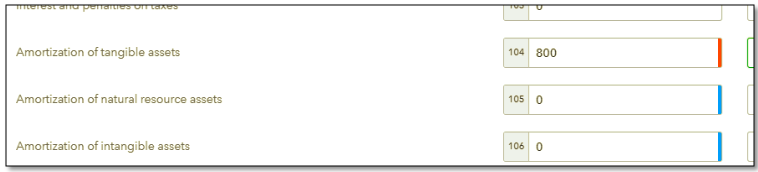

Red bar Fields: A calculated amount that is currently overridden

For example, on schedule 1, I have overridden line 104, amortization of tangible assets with flows from schedule 125 with another amount.

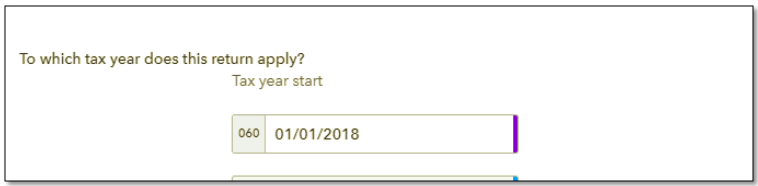

Purple bar Fields: Information that was carried forward from a previous year's tax return, or was imported.

For example, I have carried forward a tax return with tax year ending 12/31/2017. The carried forward tax return shows a purple bar with the new tax year starting the next day, 01/01/2018

Greyed out fields: A calculated amount that cannot be overridden. Locked fields.

For example, I cannot enter an amount on 8089 below. The amount is calculated based on schedule 125 based on the prior entries above it and the line is locked.

Field background prompts

Orange text prompt: The field’s content caused a passive audit message

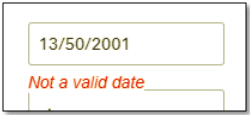

Red text prompt: You entered invalid information in the field and Pro Tax cannot accept the information (for example, an invalid date).

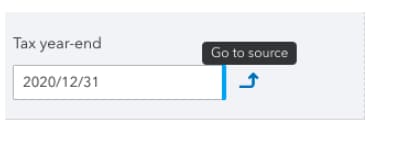

Jump links

Each field contains a Jump link, which allows you to quickly jump from a form to a related field, and easily go back to the form you were working on.

More like this

- Troubleshooting EFILE errors in Pro Taxby QuickBooks

- T1 Express Data Entryby QuickBooks

- QuickBooks Online Accountant left navigation panel changes for Pro Taxby QuickBooks

- QuickBooks Online Accountant Pro Tax Billing FAQby QuickBooks