Update settings for T4, T4A, and T5018 electronic filing to the CRA

by Intuit•120• Updated 4 months ago

Due to recent updates from the Canada Revenue Agency (CRA), you must include a Representative Identifier (RepID) when electronically filing 2024 T4, T4A, and T5018 slips. This applies to accountants who use a Represent a Client (RAC) login to upload slips for their clients.

You can review the information provided by the Government of Canada webpage for full details.

This article provides instructions on where to add your RepID in QuickBooks Online and QuickBooks Desktop to ensure your XML files are accepted by the CRA.

Add your Representative Identifier (RepID) in QuickBooks Online:

For T4 slips in QuickBooks Online, add your RepID in the Payroll Settings. This ensures all T4 XML files you generate include the necessary RepID tag. For T4A and T5018 slips, you can enter your RepID right before you download the XML file.

Add RepID for T4 slips:

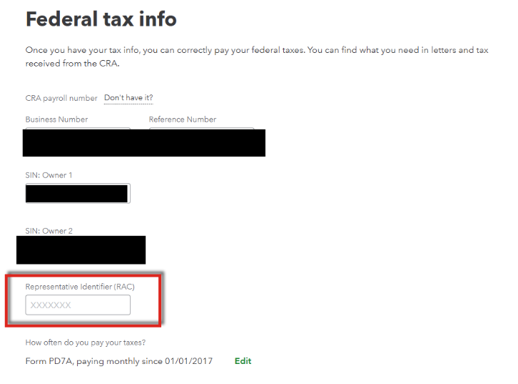

- Select the Gear icon, then select Payroll Settings.

- Go to the Federal Tax section.

- Next to the Business Number Field, select View/Edit and complete the multi-factor authentication steps.

- In the Representative Identifier (RAC) field, enter your 7-digit alphanumeric RepID.

- Select Save.

Note: If you generated T4 XMLs before adding your RepID, you must delete the employer T4s from the Archived Forms section and regenerate them. This ensures the updated XML file includes the RepID.

Add your Representative Identifier (RepID) in QuickBooks Desktop

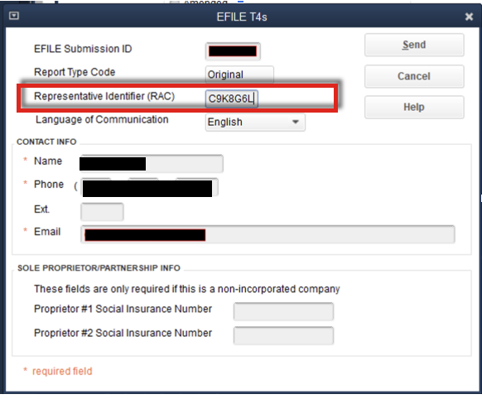

For T4 slips in QuickBooks Desktop, add your RepID in the EFILE T4s window when you are ready to file.

- From the top menu, go to Employees, then select Payroll Forms.

- Select Process T4s.

- Choose the Employees to include and select Review. After reviewing the forms, select EFILE. This opens the EFile T4s window.

- In the Representative Identifier (RAC) field, enter your 7-digit alphanumeric RepID.

- Select Send.

When using MyBA to upload slips you should ensure the number associated with the login matches the Business and Reference Number seen under the Federal Tax option within Payroll Settings. The 15-digit Business Number and Reference Number in QBO (for example, XXXXXXXXXRPXXXX) will flow to the new TransmitterAccountNumber tag line group in the XML. If the two do not match, the XML will be rejected during upload.

Note: This CRA change does not impact RL-1 XMLs for Québec. You can continue to upload RL-1 XMLs to Revenu Québec as usual.

More like this

- Using T4A and T5018 forms in QuickBooks Onlineby QuickBooks

- Invalid formatting error when transmitting T4, T4A, or T5018 slips to CRAby QuickBooks

- Use T5018 forms in QuickBooks Desktopby QuickBooks

- Using T4A forms in QuickBooks Desktopby QuickBooks