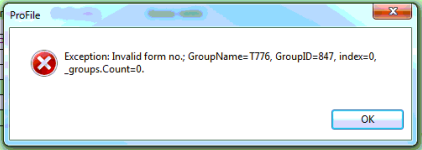

This error may be caused due to associated T776 forms (T776 CCA and T776 Asset) present in the return without a T776 form.

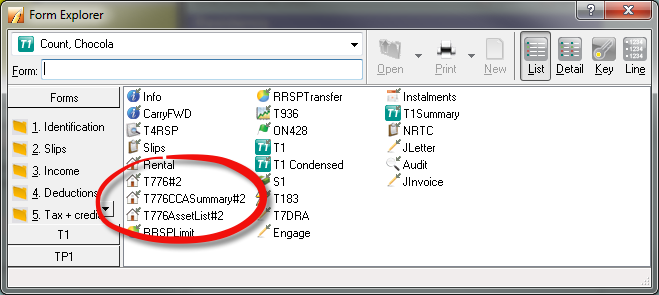

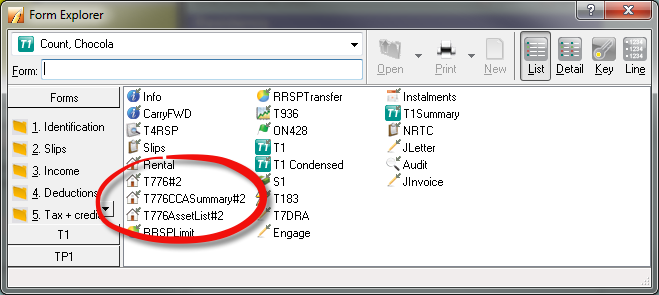

Spouse 1:

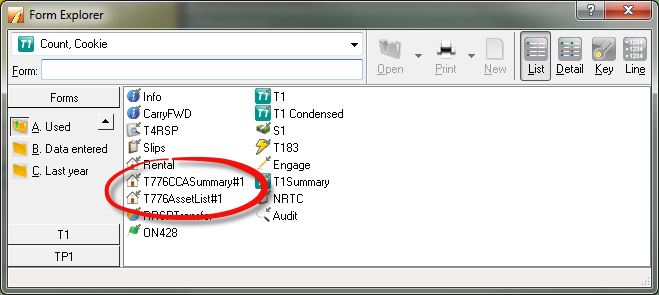

Spouse 2:

If this is a coupled return, review both returns.

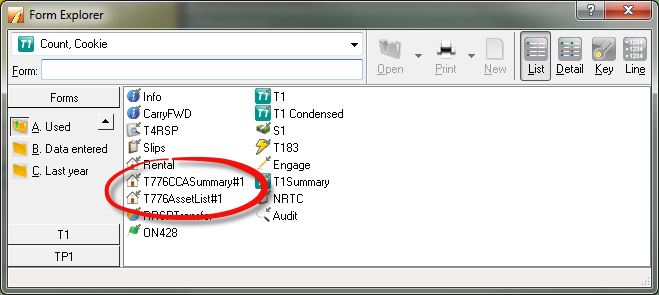

If one of the returns has a T776CCASummary#1 and/or T776AssetList#1 without a T776#1, as in the above example, the error will occur.

Note: The # following the T776 forms could range from 1 to 999+. The T776CCASummary and T776AssetList have to have a corresponding T776.

Those orphan forms must be deleted.

Delete orphan forms

Note: Do not delete the forms from the spouse, as it will delete them from both.

- Open the T776CCASummary.

- Select Clear Form from the Form drop-down menu in the top toolbar.

- Select Delete Form from the Form drop-down menu in the top toolbar.

- Open the T776AssetList.

- Select Clear Form from the Form drop-down menu in the top toolbar.

- Select Delete Form from the Form drop-down menu in the top toolbar.