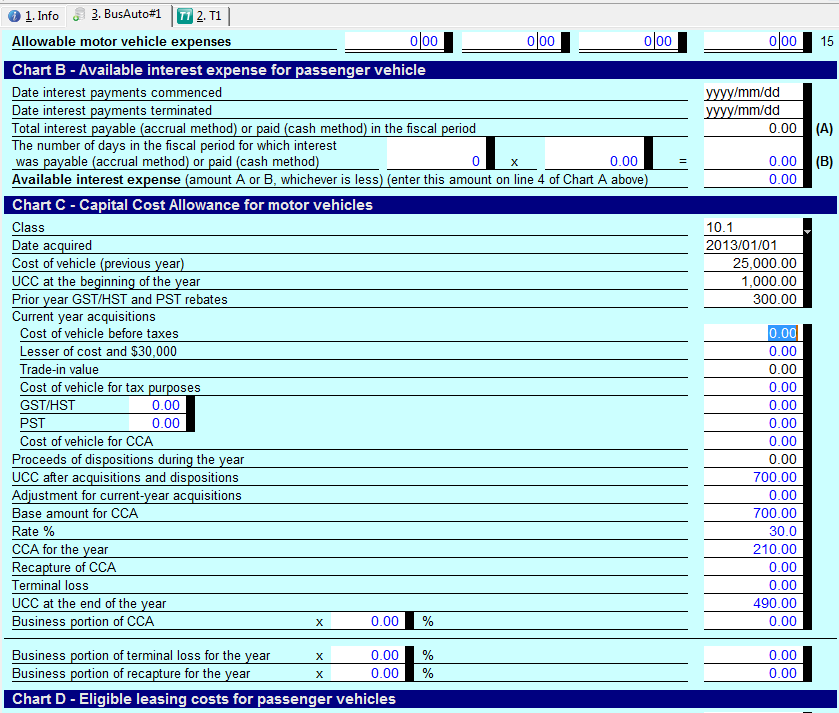

1. Enter the CCA information for vehicles used for self-employment in Chart C of the Business Auto form.

2. Use the drop-down arrow next to the line pertaining to Class to select the applicable class: 10 or 10.1.

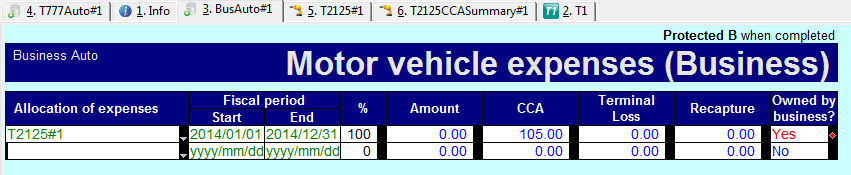

3. If the taxpayer owns less than 100% of the partnership as indicated in the Details of other partners section of the business statement, fill in the Owned by business column in the Allocation of expenses table on the Business Auto form.

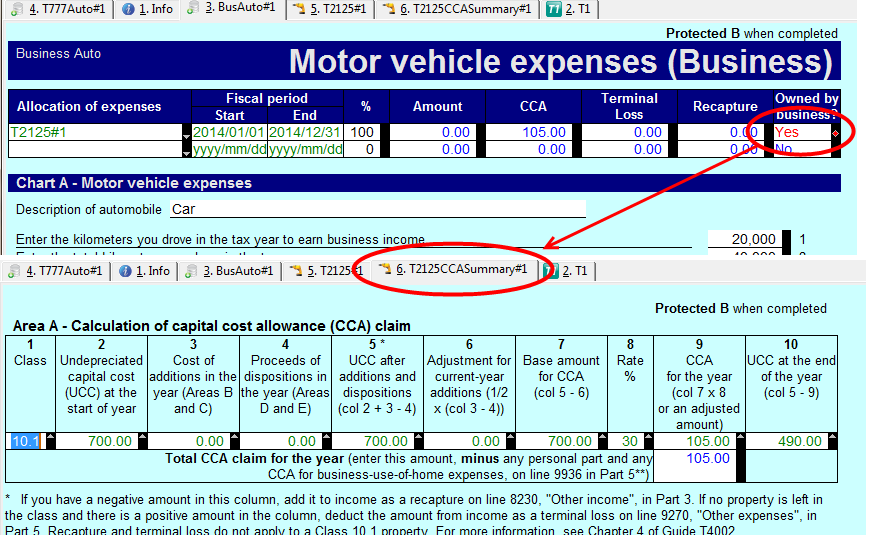

If Yes is selected, the asset will transfer to the business statement's CCASummary.

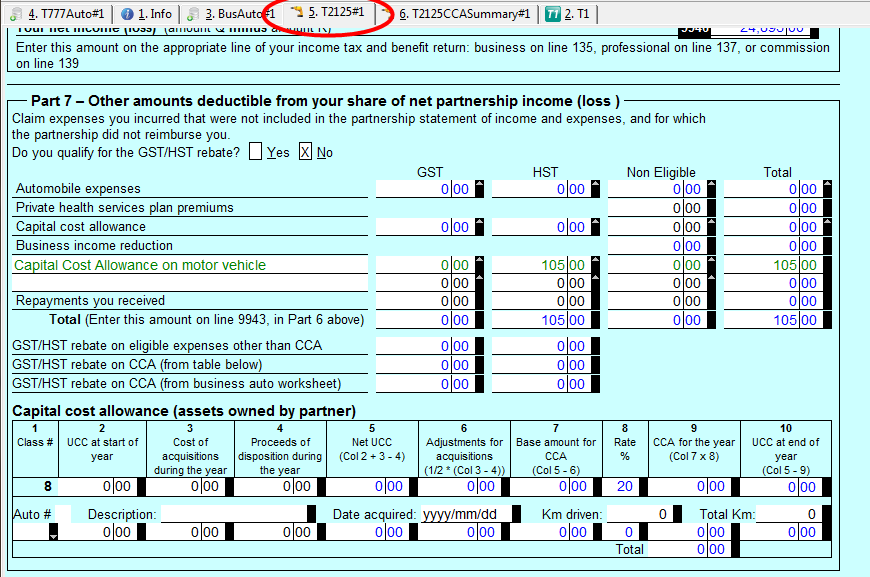

If No is selected, the asset will transfer to the CCA (assets owned by partner) table of the relevant business statement.

5. ProFile prorates the CCA for class 10 and class 10.1 if the automobile is allocated 100% to a business with a short fiscal year.