The information provided here is intended to provide general guidance only ProFile and its support agents cannot provide any tax-related advice or opinion.

We recommend reviewing the CRA website and contacting their tax inquiries line or consulting an accredited CPA firm for information regarding current tax laws.

We also recommend having any return prepared or reviewed by a professional accountant before filing.

In-product T1 training module

ProFile includes an in-product training module that walks users through the basic process of creating a T1 return. You can access the training by selecting the applicable module from the Training tab in the top toolbar.

As you proceed through the training, you’ll see examples of how to fill out a return and the requirements for the basic forms.

Online community

Visit our online community to review hundreds of support articles, how-to questions, and questions from other ProFile users.

CRA guides and resources for T1 creation

Before getting into your tax workflow, we recommend reviewing the guides below to have a better understanding of Canadian income tax rules. This will allow you to take on the right clients and assist you in growing both your tax knowledge and practice.

CRA T1 guide

Start with reviewing the CRA Federal T1 guide. The guide covers topics including, but not limited to:

- What’s new for this tax year

- Who needs to file a return

- Due dates, penalties, and interest fees

- Gathering required documents

- Which tax package to use

- Step by-step guides on how to complete each section of the jacket, with details on the meaning and tax rules for each line

- How to send the return

- Assistance with completing a return via phone or in person

More can be found here, listed by number.

Remember that the federal and provincial governments each have their own tax rules, and may differ in the application of the same tax credit. We recommend reviewing the income tax package for the province you live in and others if you plan on working on tax returns for residents of different provinces.

Sample information for Residents of Ontario guide covers topics such as:

- What’s new for Ontario

- Ontario credits

- Ontario Trillium benefit

About the tax workflow

As you acquire clients, a tax workflow will help you better organize the workload during tax season. We recommend a basic seven-step tax preparation process to help you manage your practice:

- Gather client data via Hub.

- Organizing client data.

- Data input.

- Initial review of input.

- Tax analysis and planning.

- Final review.

- Transmission to the CRA.

Gathering client data via Hub

The most-effective way to gather client data is through an engagement package that includes an engagement letter, a checklist, and questionnaire. This package will serve to provide the majority of client information that you’ll need to file with the CRA.

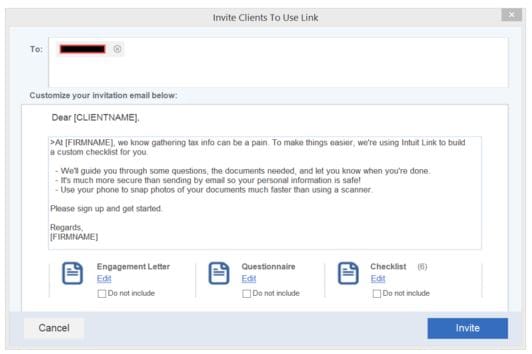

ProFile offers this engagement package via Hub, its in-product engagement service that streamlines client communication and tracks interactions and submissions.

An engagement letter will outline the scope of your services for your clients. ProFile provides a sample engagement letter you can use on the Engage form. It can be customized to your needs.

A questionnaire and checklist will answer many questions for you, especially if it’s a new client. ProFile provides a default questionnaire and checklist that can be adjusted to your practice. Using a checklist and questionnaire will save you and your client time and reduce back-and-forth communication. The questionnaire will help you find about any changes for the client in the most recent tax year.

T1 engagement letter in Hub

The engagement letter is the initial communication sent from ProFile via email. It provides the opportunity to explain your expectations to the client, as well as explain the process of gathering their data. The engagement letter can be customized to each client as needed.

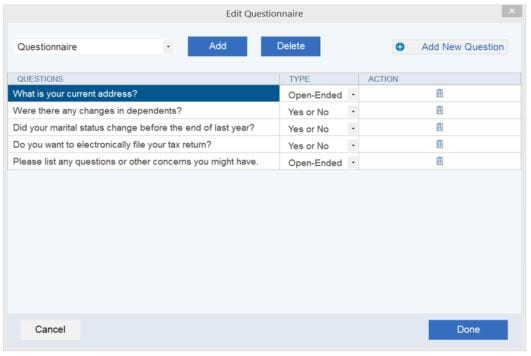

Questionnaire in Hub

The questionnaire gives you the ability to create unique and customized questions for your client. In addition, you can pre-set answer options to streamline incoming client data.

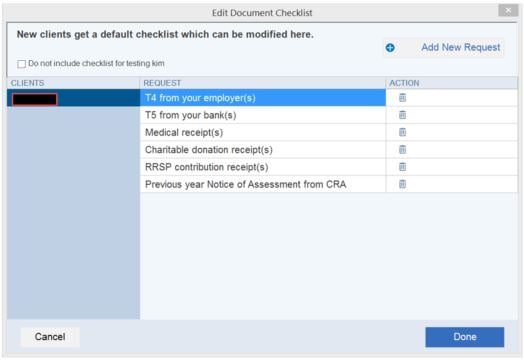

Checklists in Hub

A checklist allows you to create a list of items that the client needs to provide you in the course of your completing their return. This is a convenient way to explain exactly what you require from them all at one time.

Organize client data

At this point, you will have a great deal of client information at hand, which means that it’s time to get organized. The task now is to take all the paperwork, separate the tax information, and make organized piles for input.

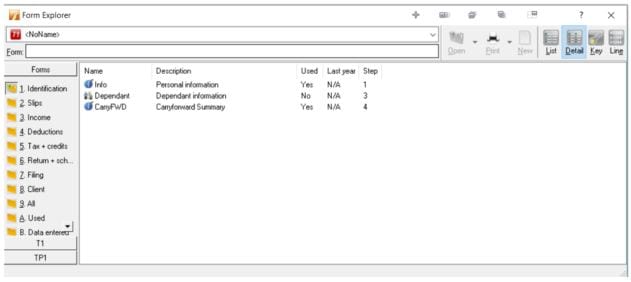

We recommend taking the information a client provides and organizing it into more manageable sections. You'll want to organize all slips by individuals, and make a pile for each spouse and dependents. While you are separating the paperwork, also organize them so that it’s easy for entry. You'll want the identification first, followed by slips, income, and so on, matching the form explorer in ProFile for easy entry.

Tip: Use the memo feature in ProFile to keep track of pending communication with clients. Use the calculator field to add slips like medical slips.

Now that you have organized the income and deductions for all members of the family, create a joint pile. These are items the can potentially go into any spouse, and you will need to determine which one they belong in as you start entering into ProFile. These include items such as medical, donation, tuition, childcare, and so on. The child care will be determined by lower income, which you will find out as you start inputting into the software. The client pay also provides organized piles to you for various credits such as public transit, caregiver, or disability credits.

Do not assume that clients qualify for any credit. Always review the eligibility requirements for these credits on the CRA website.

Data input

We recommend getting the T1013 printed and signed in order to automatically import information using the CRA's Auto-fill my Return (AFR) feature. AFR quickly pulls in the slips and carry forward information into the return for you.

Continue with other information the client not captured by the AFR feature. Use the Form Explorer in ProFile to work your way down in different sections of the tax return:

Initial review

It’s always a good idea to have someone else review the return once all data has been entered, in order to ensure accuracy and good practices. Use the Preparer sign off feature in ProFile on amounts entered, and review the internal auditor for any outstanding issues.

Tax analysis and planning

Tax analysis and planning is rarely simple; it requires experimentation and undertaking different scenarios to determine the best option for clients.

Review the Comparative form and the Business Comparative form in ProFile and deep-dive into optimizations between family members for the best options. In addition, plan with clients for the next tax year using the Planner.

Final review

Time for the final review of the return prior to transmission to the CRA. Have someone review return after tax planning for any issues, and review the auditor tabs for any lingering errors.

In preparation for a client discussion, print any slips and the Comparative form to assist in explanations and to assist with client questions.

Gather the necessary elements of client consent, including the following:

- Signature

- T183 printed and signed prior to transmission via EFILE

- T1 Jacket

- An additional signature for pre-authorized debit (PAD)

- T1135 printed and signed, if required

- Any additional forms signed, if required

Transmission to CRA

Transmission of the completed return can either be electronically (via EFILE) or paper, by mailing the return or form to one of the CRA offices. In addition, ensure the T1135 form is transmitted.

As final pieces of housekeeping, print the return for the client and mark it as completed in ProFile.

Send the client your invoice, and confirm with them when payment is received.