ProFile makes it easy to file T1 returns electronically.

Review existing or acquire new EFILE credentials

Review this article to acquire, enter, or update an EFILE number and password in ProFile.

Make files eligible for EFILE

A tax return file changes to eligible status when all outstanding EFILE messages are resolved/addressed in the Active Auditor.

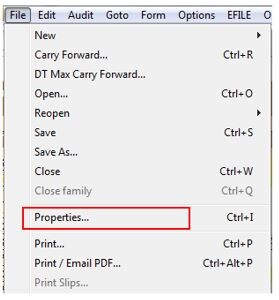

To review a file’s status, select Properties… from the File option in the top toolbar menu.

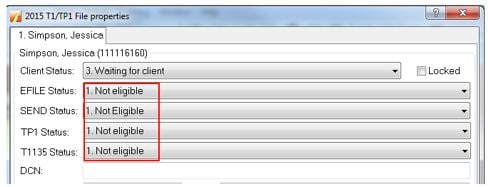

The eligibility status of the return displays.

See the section Clearing Active Auditor message below to resolve any outstanding Active Auditor messages and make the return eligible.

Clear Active Auditor messages

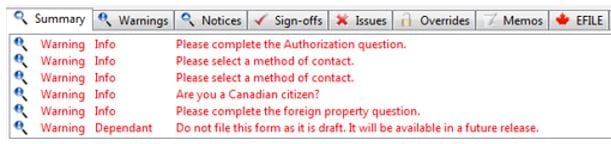

ProFile’s Active Auditor displays messages that relate to the data file. These include passive audit messages, notices, processing errors, overridden fields, fields that have memos attached, fields with review marks, and EFILE-related messages.

Error messages or errors that may restrict processing the return display in red text.

Access the Active Auditor

The Active Auditor is accessed two ways:

- Select the Active Auditor icon in the top toolbar menu:

- Right-click on any form and select the option Show Auditor from the menu

Select Active Auditor options

Note: Setting the Active Auditor options in one location applies the settings for all modules.

- Open ProFile.

- Select Environment… from the Options drop-down menu in the top toolbar.

- Select the Audit tab; the audit options window displays.

Each section of the audit options window has pre-set default selections.

Note: Modules may display different tabs in the Active Auditor based on the nature of the module itself, rather than settings.

Preferences settings

The Preferences section of the Audit tab includes settings that affect the display of warnings.

Note: ProFile recommends the Show Auditor Tabs option be selected to provide the clearest feedback and indication of errors on forms.

Summary Tab Includes settings

The Summary Tab Includes section of the Audit tab includes options that display in the auditor toolbar. Each of the selected options displays related errors in the corresponding Active Auditor tab.

Prevent Filing settings

The Prevent Filing section of the Audit tab includes options that halt the filing of the form. Errors created by the violation of these options must be cleared before filing can take place.

Remove Audit Messages settings

The Remove Audit Messages section of the Audit tab includes options as to who can remove errors in the Active Auditor for a form.

Note: Profile recommends one or both options be selected; otherwise error messages in the Active Auditor cannot be cleared to allow filing.-

Clear Active Auditor messages

Error messages display as red text in the Active Auditor tabs.

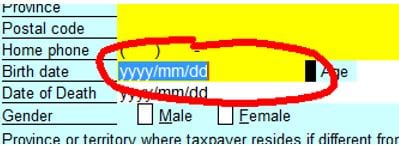

1. Double-click on an error warning in the tab. The error circles in red on the form.

2. Resolve the error; the specific error in the tab details the issue.

In some cases, the error – as identified by ProFile – may actually be acceptable to the preparer and/or the client. For example, an RRSP amount may be acceptable but ProFile suggests the amount is outside the range expected by CRA and determines it to be an “error”.

In such cases the individual selected in the Remove Audit Messages section of the Audit tab can sign-off, or approve, the error.

EFILE the T1 return

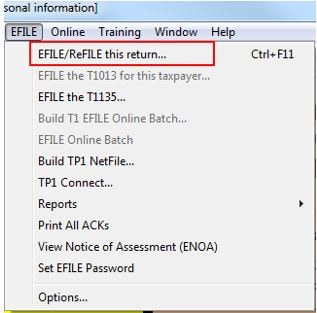

When the return is eligible, select the EFILE/ReFILE this return… option from the EFILE menu in the top toolbar menu.

The return transmits to the CRA.

Additional EFILE materials

It may be necessary to EFILE some or all of the following, depending on the return:

Troubleshoot EFILE errors

Errors may occur during the EFILE of a T1 return for a variety of reasons. These may include, but are not limited to, the following:

| Error | Action |

| EFILE prevented due to auditor not being clear of errors | Clear any outstanding auditor errors and resubmit the T1 return. |

| CRA returns EFILE error number (for example, #99173) | · review the CRA EFILE error guide on the CRA website · contact the CRA T1 EFILE helpdesk |

| Connection and/or connectivity errors or timeouts | · review our support article for creating a firewall exception for ProFile · review our support article for revising Internet options |

Resubmit the T1 return (if required)

It may be necessary to refile the T1 return, or provide the CRA with a T1 Adjustment.

Review the How to ReFILE a T1 Return article.

Review the Completing a T1 Adjustment article.