ProFile makes it easy to file T2 returns electronically.

What can undergo EFILE

- T2 corporate returns from 2007 to current year (returns must be created in the correct module)

- T2 adjustments

- CO-17 NETFILE

- AT1 NETFILE

- T106

- T1134

- T1135

- T1135 Amended

Review our support article for tax years supported on the above EFILE feature.

Review existing or acquire new EFILE credentials

Review this article to acquire, enter, or update an EFILE number and password in ProFile.

Making files eligible for EFILE

A tax return file changes to eligible status when all outstanding EFILE messages are resolved/addressed in the Active Auditor.

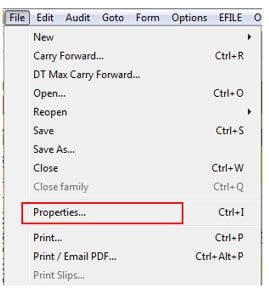

To review a file’s status, select the Properties… option from the File option in the top toolbar menu.

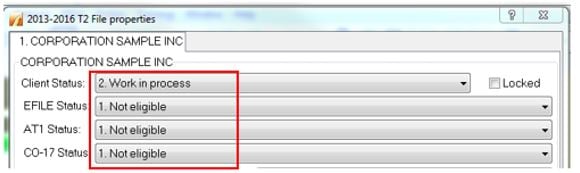

The eligibility status of the return displays.

See section Clearing Active Auditor messages below to resolve any outstanding Active Auditor messages and make the return eligible.

Clearing Active Auditor messages

ProFile’s Active Auditor displays messages that relate to the data file. These include passive audit messages, notices, processing errors, overridden fields, fields that have memos attached, fields with review marks, and EFILE-related messages.

Error messages or errors that may restrict processing the return display in red text.

Accessing the Active Auditor

The Active Auditor is accessed two ways:

- Select the Active Auditor icon in the top toolbar menu, or

- Right-click on any form and select the option Show Auditor from the menu

Selecting Active Auditor options

Note: Setting the Active Auditor options in one location applies the settings for all modules.

- Open ProFile.

- Select Environment… from the Options drop-down menu in the top toolbar.

- Select the Audit tab; the Audit Options window displays.

Each section of the audit options window has pre-set default selections.

Note: Modules may display different tabs in the Active Auditor based on the nature of the module itself, rather than settings.

Preferences settings

The Preferences section of the Audit tab includes settings that affect the display of warnings.

Note: ProFile recommends the Show Auditor Tabs option be selected to provide the clearest feedback and indication of errors on forms.

Summary Tab Includes settings

The Summary Tab Includes section of the Audit tab includes options that display in the auditor toolbar. Each of the selected options displays related errors in the corresponding Active Auditor tab.

Prevent Filing settings

The Prevent Filing section of the Audit tab includes options that halt the filing of the form. Errors created by the violation of these options must be cleared before filing can take place.

Remove Audit Messages settings

The Remove Audit Messages section of the Audit tab includes options as to who can remove errors in the Active Auditor for a form.

Note: ProFile recommends one or both options be selected. Otherwise, error messages in the Active Auditor cannot be cleared to allow filing.

Clearing Active Auditor messages

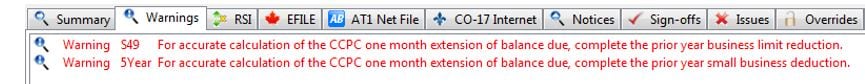

Error messages display as red text in the Active Auditor tabs.

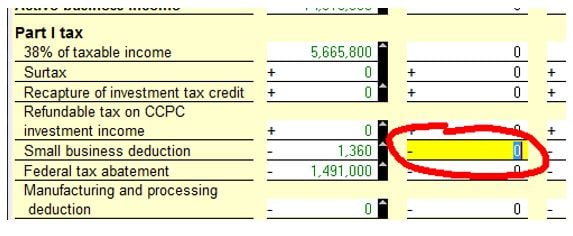

1. Double-click on an error warning in the tab. The error circles in red on the form.

2. Resolve the error; the specific error in the tab details the issue.

In some cases, the error, as identified by ProFile, may actually be acceptable to the preparer and/or the client.

In such cases, the individual selected in the Remove Audit Messages section of the Audit tab can sign-off, or approve, the error.

Attaching documents for EFILE of T2 returns

Review this article on attachment types and limitations.

Acquire client signoff

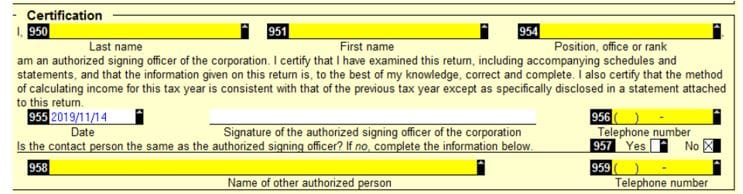

A T2 client must sign a paper copy of Form T183 and T2 jacket to grant consent for the EFILE to occur.

EFILE the T2 return

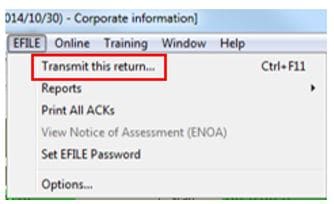

When the return is eligible, select the Transmit this return… option from the EFILE menu in the top toolbar menu.

The return transmits to the CRA.

Additional EFILE materials

It may be necessary to EFILE some or all of the following, depending on the return:

- T1134 - Information Return Relating to Controlled and Not-Controlled Foreign Affiliate

- T1135 - Foreign Income Verification Statement has to be filed separately, but can be efiled. Users can get fillable copy of T1135 from CRA's website.

- T106 - Information Return of Non-arm’s Length Transactions with Non-Residents

- CO-17 NETFILE

- AT1 NETFILE

- Attach a Doc

Troubleshooting EFILE errors

Errors may occur during the EFILE of a T2 return for a variety of reason. These may include, but are not limited to, the following:

| Error | Action |

| EFILE prevented due to auditor not being clear of errors | Clear any outstanding auditor errors and resubmit the T2 return. |

| CRA returns EFILE error number | Contact the CRA T2 Helpdesk |

| Connection and/or connectivity errors or timeouts |

|

Making an amendment or adjustmet to a T2 or CO17 return

It may be necessary to submit an amendment or adjustment to a T2, AT1, or CO17 return that has already undergone EFILE.

Review this article to submit an amendment or adjustment.