Note:

- This article applies only for T1 filings in tax year 2016 and onwards.

- This article applies only to spouses disposing of a shared principal residence property.

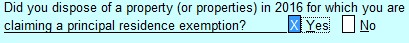

Preparers might receive an error when answering yes to the question Did you dispose of a property (or properties) in [year] for which you are claiming a Principal residence exemption?

The cause of the error is entering unnecessary information in a spouse's S3 Principal Residence Detail form. The necessary information is provided under the taxpayers T1 return.

This article illustrates the method to correct the error, answer in the affirmative, and populate the necessary forms correctly.

Resolution

To resolve an existing error, delete the unnecessary information and populated columns in the spouse's S3 Principal Residence Detail form.

- Delete the unnecessary information from the populated fields.

- Right-click on the field.

- Select Delete column; the column deletes.

The error should now be resolved.

Correctly complete the disposal of a principal residence property

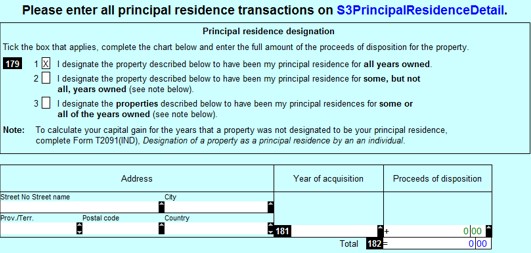

On a T1 form, preparers see this option for a taxpayer ("Spouse 1"):

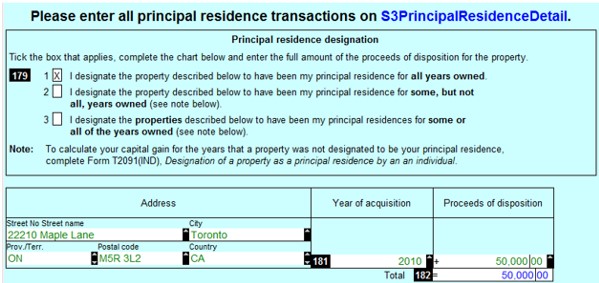

When answering in the affirmative, preparers complete the principal residence detail section of Form S3, Capital Gains (or Losses) for Spouse 1 by selecting one of the three options related to the sale of the property:

Note: For assistance in determining what constitutes a principal residence, see Chapter 6 of the CRA document, located here on the Capital Gains 2020 website.

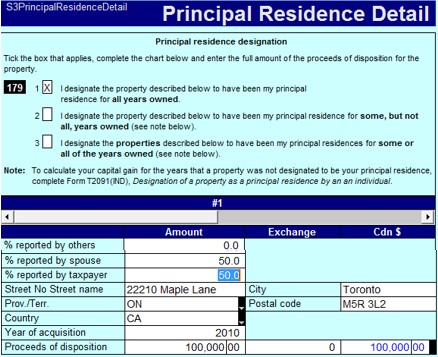

After the appropriate selection is made, the preparer completes the S3 Principal Residence Detail form for Spouse 1, entering the required information under the Amount column, including the percentages of the sale reported by Spouse 1 and Spouse 2, as well as property information such as street name, year of acquisition, and more.

In this example, the preparer has assigned the percentage of the sale reported by Spouse 1 and Spouse 2 at 50% each:

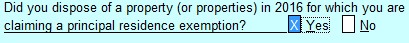

The preparer opens the T1 for Spouse 2 and selects the Yes option in the question, Did you dispose of a property (or properties) in [year] for which you are claiming a principal residence exemption?.

The preparer completes Form S3, Capital Gains (or Losses) for Spouse 2, selecting the same designation for the property as Spouse 1 did:

The Proceeds of disposition fields populate according to the percentages determined in the Principal Residence Detail form for Spouse 1 and Spouse 2.

The preparer does not complete a Principal Residence Detail form for Spouse 2; the necessary information has been provided under Spouse 1.