About filing a T3 return

Until 2017, T3s were required to be paper filed, though slips and the summary could be transmitted by XML. starting with 2017 year ends, the T3 could be filed by way of XML filing. Starting in version 2021.3, you're able to to electronically file T3s with regular EFILE credentials.

Note: This article is for filing slips and returns from 2021 and later. If you are looking to file a return from before 2021, see this article.

- Available resources

- Paper file a T3 return in Profile

- Use the T3Efile worksheet

- File T3 slips via XML filing (2021 and later)

- EFILE a T3 return with CRA EFILE credentials

- Early file next year's T3

Available resources

The CRA's Where to file a T3 Return guide details where a T3 return can be filed.

The CRA's T3 Trust Guide provides information on how to complete the T3 Trust Income Tax and Information Return, the T3 slip, Statement of Trust Income Allocations and Designations, and the T3 Summary, Summary of Trust Income Allocations and Designations.

Paper file a T3 return in Profile

ProFile transfers information from the T3 schedules, slips, and forms to the T3 Trust Return Jacket. The final page of the jacket requires a signature from a trustee, executor or administrator for the trust.

Other forms you may need to file if they are used include:

- T3A: Request for loss carryback by a trust

- T1013: Consent form

- T1135: Foreign income verification statement

- T1141: Information return in respect of transfers or loans to a non-resident trust

- T2223: Election, under subsection 159(6.1) of the Income Tax Act, by a trust to defer payment of income tax

- TX19: Asking for a clearance certificate

- Election: Election to tax income in the trust

Use the T3Efile worksheet

T3Efile is a worksheet used to track exclusions stemming from the T3 return.

T3Efile automatically calculates eligibility and populates (using Yes or No values) based on the return information.

It displays all unmet criteria for filing the T3 return:

Any criteria for filing not being met prevents the "Internet file this return?" question in the return's Filing section from activating.

Preparers should review the T3Efile worksheet prior to EFILING and address any unmet criteria prior to filing. If Yes is selected for any of the T3Efile boxes, you may have to paper-file the return.

File T3 slips via XML filing (2021 and later)

| Note: Always print or retain a PDF copy of the CRA confirmation of an EFILE when completed. ProFile does not retain a report or record of which slips are transmitted. |

1. Prepare the T3 slip in ProFile.

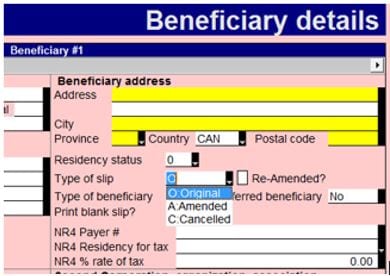

2. Open the Beneficiary details form and select the Type of slip being transmitted:

3. Select the Transmit option under the EFILE dropdown menu in the top toolbar.

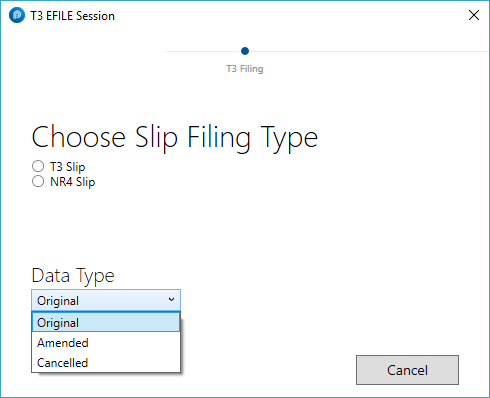

4. Select the appropriate option under the Data type dropdown menu and select the OK button:

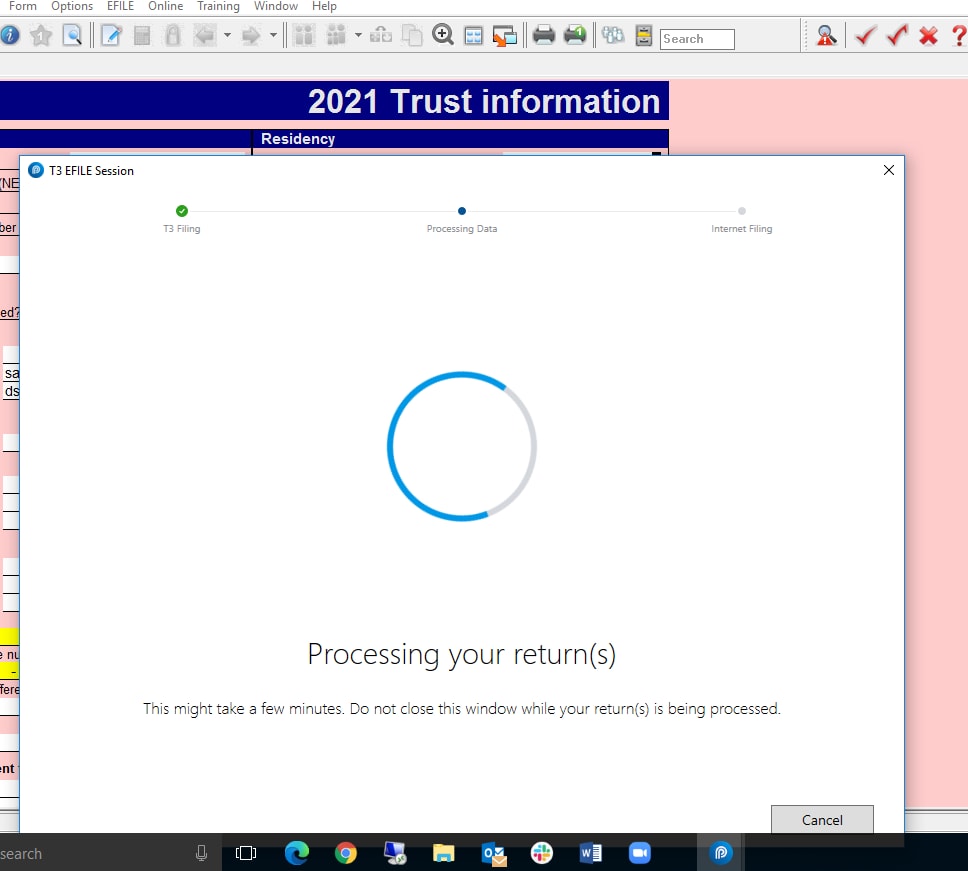

ProFile builds the XML file and automatically launches the CRA transmission window.

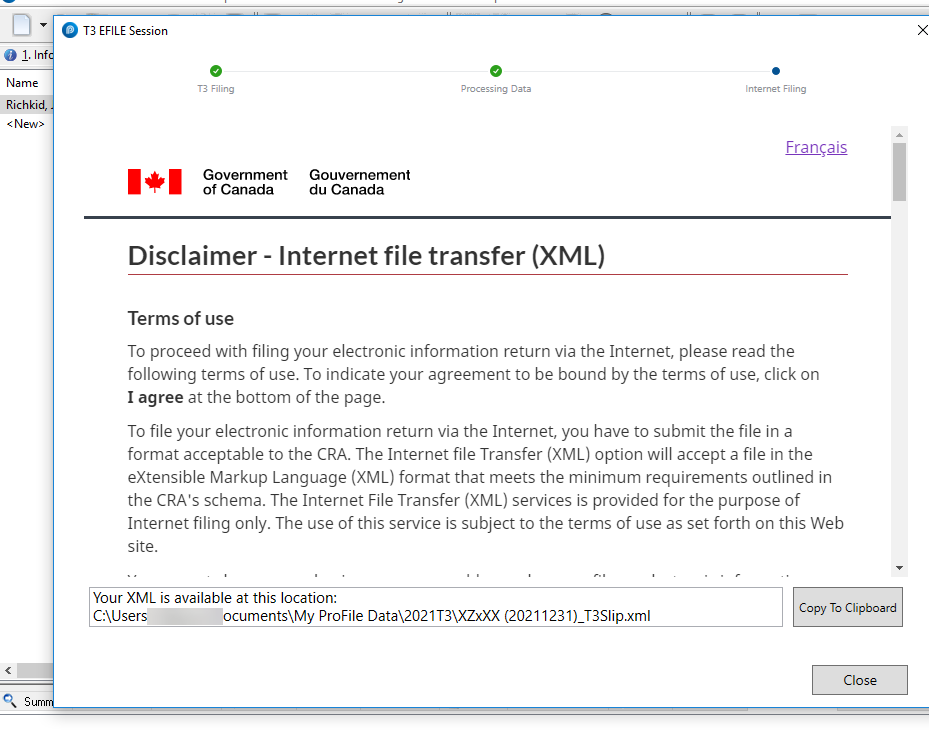

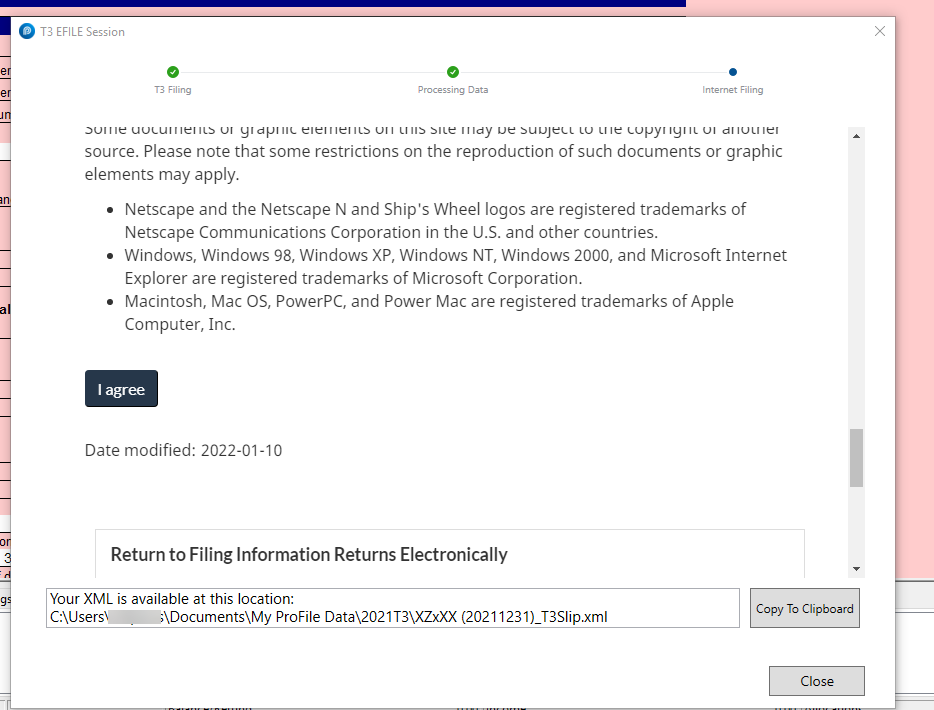

5. Locate the XML in the designated folder or select Copy to Clipboard to copy the XML location to the clipboard.

6. Review the CRA disclaimer and select the I agree button for consent to transmit the XML:

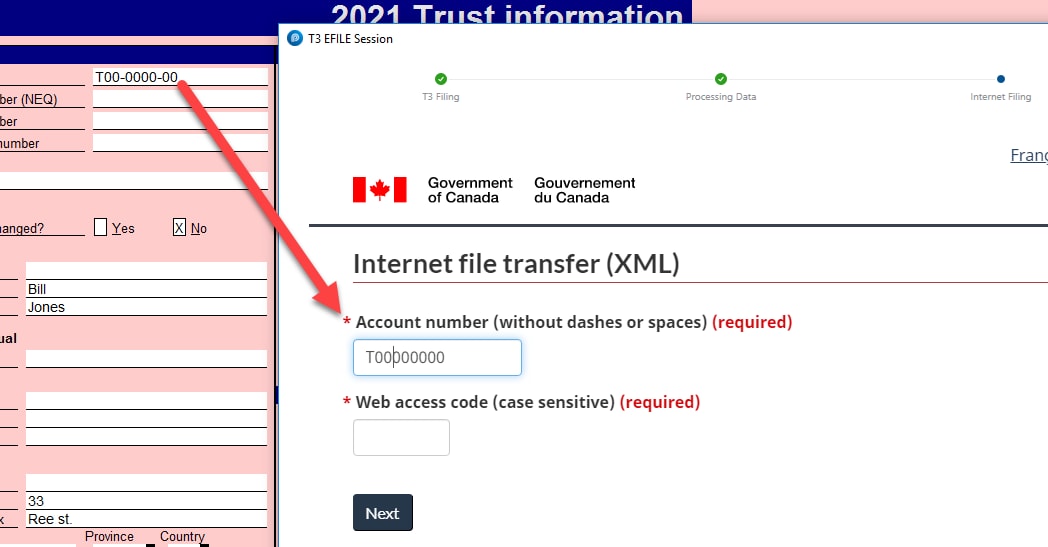

7. Enter the Account number, Web access code and then select Next. The XML transmits to the CRA.

Note: Due to changes in CRA requirements, the account number must be manually entered. It can be copied from the Trust account number line on the Info page:

8. Select the print icon on the browser window to print the confirmation number.

9. Select the Close button.

EFILE a T3 return with CRA EFILE credentials

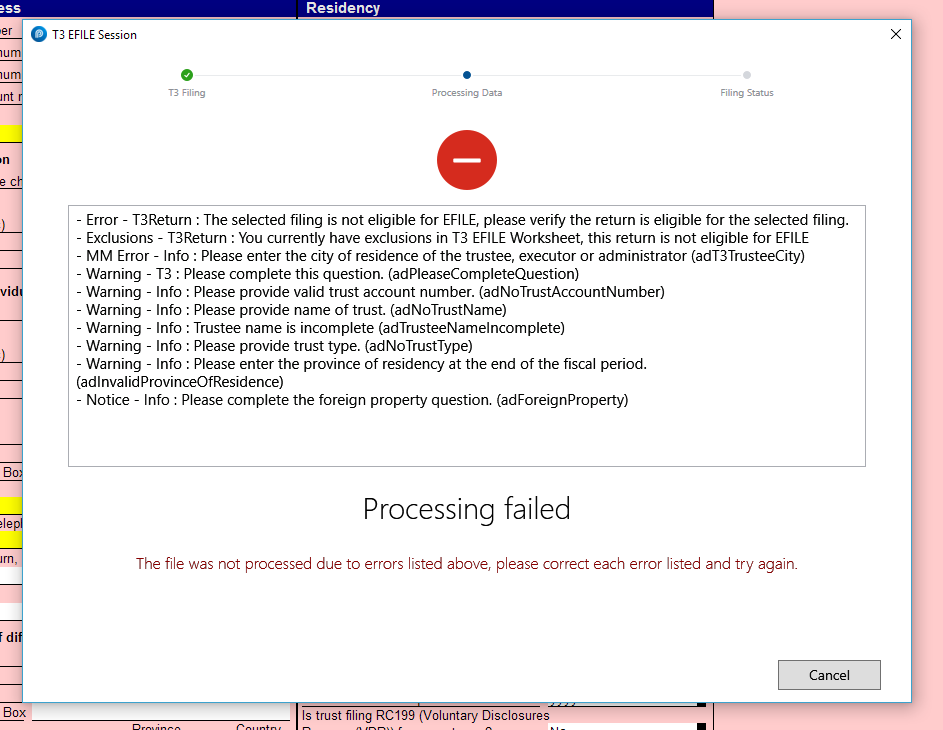

Beginning with the release of 2021.3.0, returns with a year end of 2021 or later will be able to be electronically filed using CRA EFILE credentials. Returns are still required to not have any exclusions on the T3Efile worksheet.

A newer section on the Info page under Filing will default to Yes if a T3 is eligible for EFILE and No if not:

Slips and summaries must still be transmitted via XML filing.

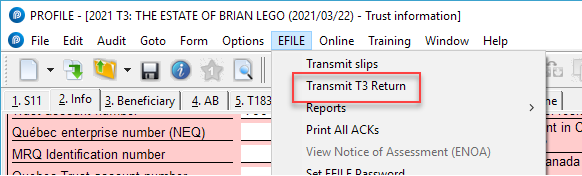

To EFILE the return, select EFILE in the top toolbar menu and then Transmit T3 return:

The interface displays as illustrated below. Select the type of T3 you are filing and select Next:

If your T3 file has EFILE errors you'll see a rejection box outlining what needs to be corrected:

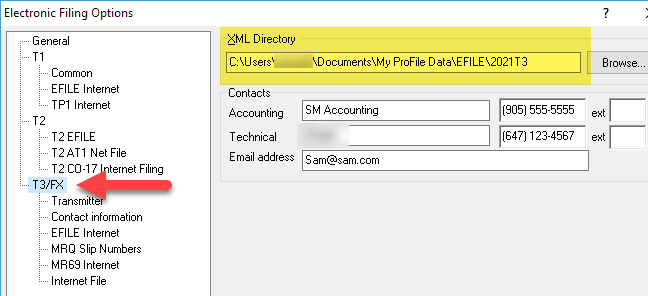

Returns are submitted to CRA in JSON format. The JSON along with the acceptance or rejection message will be stored in the folder selected in the T3 EFILE -> Options directory:

The confirmation number will appear on the Info page if successfully transmitted:

Early file next year's T3

The next year’s T3 module in ProFile is not available until the year after: for example, when the 2018 T3 module is the last one released and you need to prepare a T3 return with 2019 year-end, the 2019 T3 module is not available until January of 2019. In this situation, the previous year’s T3 module is used for preparing next year’s T3 return.

New tax rate implementation

New tax rates are implemented in the previous year’s T3 module to handle preparation of next year’s T3 returns. Entering the appropriate year-end on the Info page initiates the applicable tax rates for that year. T3 returns filed using the previous year’s tax forms are acceptable to the CRA, and they will reassess the return if required.

Prepare next year’s T3 return using the previous year’s T3 module

- Save a duplicate copy of the previous year’s T3 return to be used as the next year’s T3 return.

- Open the previous year-end T3 return in ProFile.

- Enter the appropriate year-end for the trust return T3 to be prepared; this initiates the applicable tax rates for next year.

- Delete the information pertaining to the previous year-end, keeping what is required for the next year-end.

- Enter the T3 data required for filing the next year’s trust return, allocate income to beneficiaries, and create the T3 slips.

- Print the T3 trust return using File -> Print and print T3 slips using File -> Print Slips.

- Save the T3 trust return with a different file name to identify the tax rates for that year.