About filing slips early

The Canada Revenue Agency requires a corporation to file T4/T4A slips within 30 days after a corporation closes or ceases to operate.

An issue arises when a filing is required before the FX module is released for the appropriate year. ProFile can handle this situation.

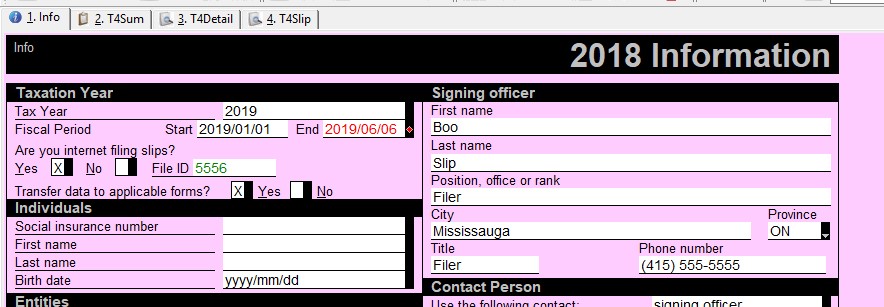

This following example illustrates the set up for a corporation that closed on 2019/06/06.

The 2019 module was not available at the time this file was created in the 2018 module. Although users cannot carry forward a return to a year where the module is not available, they can create the following year’s slips in the most current module.

Two steps are required to set up the return properly; they are both located on the Info tab.

1. Enter Tax year and Fiscal Period:

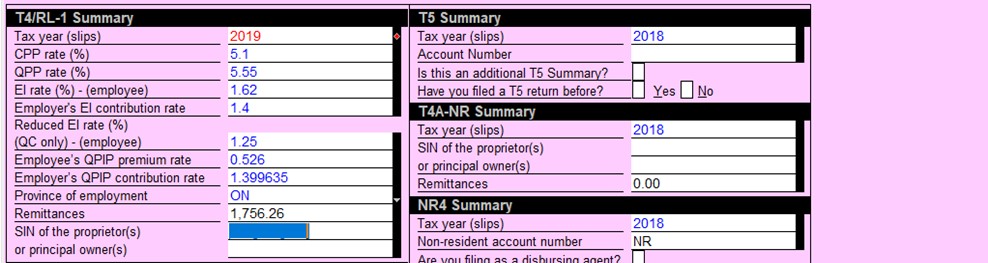

2. Change the T4/RL-1 Summary section of the Info tab to indicate the Tax year:

This step indicates the tax year for the slips is 2019 and changes the rates to those available at the time of the last FX update for the tax year entered:

Entries in steps 1 and 2 will change the Tax year on the T4 slip, T4summary, and the XML file sent to the Canada Revenue Agency to the year entered on the Info tab.

After these changes, the slips can be prepared and filed as usual.