This article details the method to acquire the optimum retirement transfer amount for a TP1s client.

1. Complete form T1032 on the federal side.

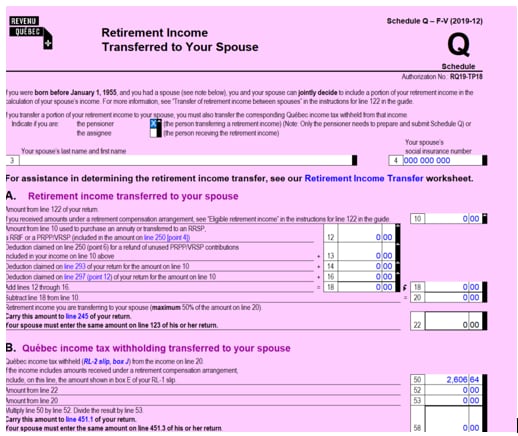

2. Open form TP1Q – Retirement Income Transferred to your spouse for 20[YY] in the return of the person receiving the pension:

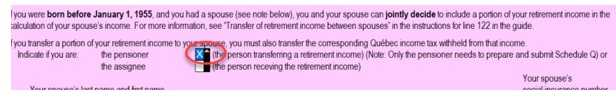

3. Confirm the checkbox indicating the person is the Pensioner is checked by the T1032 form:

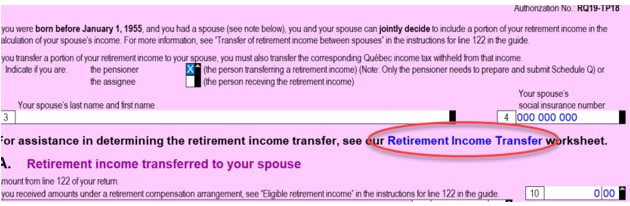

4. Select the Retirement Income Transfer link:

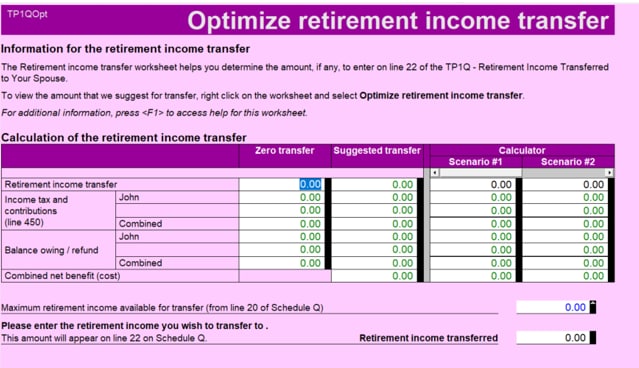

5. The TP1QOpt - Optimize Retirement Income Transfer form opens.

5. The TP1QOpt - Optimize Retirement Income Transfer form opens.

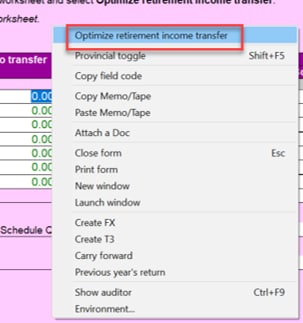

6. Right-click anywhere on the TP1QOpt - Optimize Retirement Income Transfer form; the selection menu displays.

7. Select Optimize retirement income transfer from the selection menu.

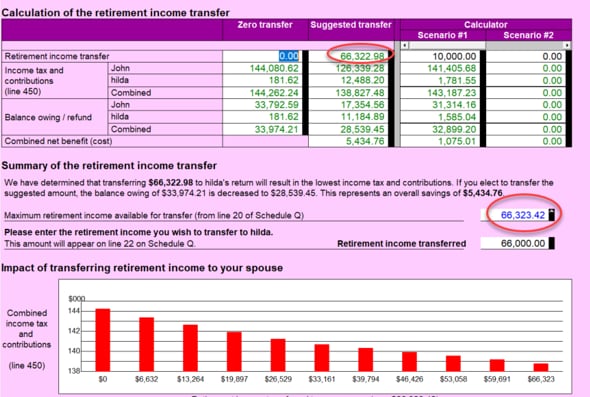

The TP1QOpt form populates with the optimum suggested split-pension information. At the bottom of the form, a graph displays various impacts on the combined income tax/balance dues at various pension income split dollar values.

8. Enter the amount desired in field Retirement income transferred. The amount displays on line 22 of the TP1QOpt.

Use the scenarios in the Calculator section

- Select the Retirement income transfer box under Scenario #1.

- Enter the amount of pension income to be transferred.

- Press Enter.

The calculator displays the Income tax contribution and Balance Owing for each individual, as well as combined net benefit for the couple.

Note: To transfer income on a TP1Q, the transferrer must have turned at least 65 in the tax year. The recipient of the split pension can be any age. If pension income is not being split on TP1Q, make sure Age is 65 or older on Info.