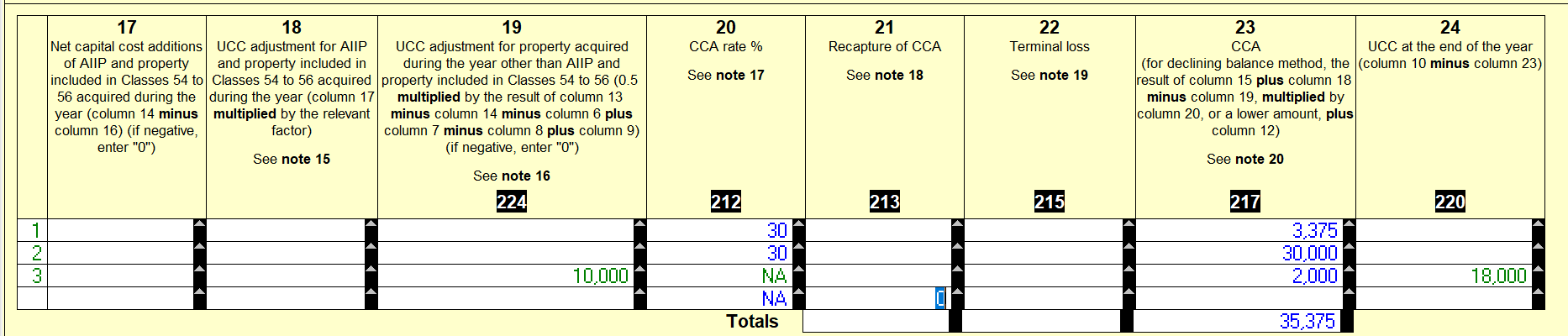

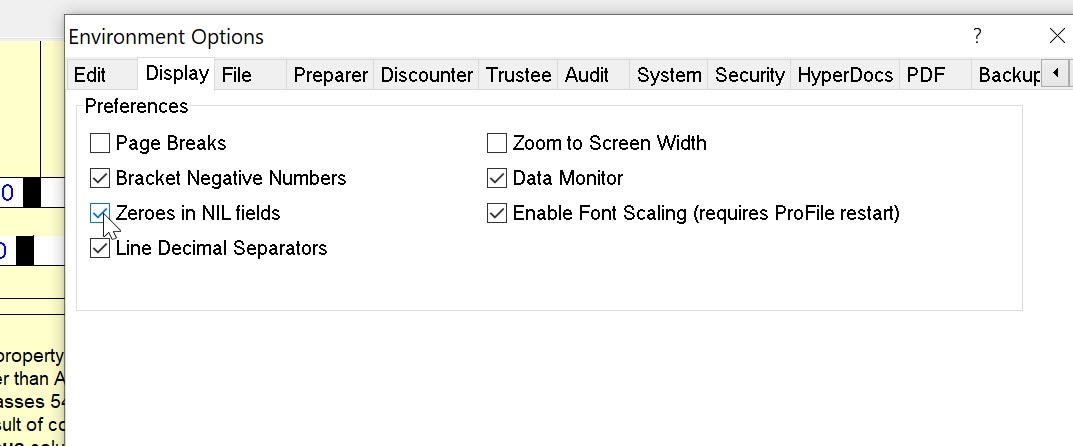

If the return has an asset classified in Class 13, CCA is calculated as straight-line. As stated in Note 17, straight-line calculations should have NA entered in column 20 of the applicable row. If the field is green and cannot be edited, go to Options > Environment... > Display and uncheck Zeroes in NIL fields.

If Zeroes in NIL fields is unchecked, it displays as blank in column 20 of the applicable row.

The straight line CCA for the year is reported in column 23: