Snapshot/variance is a feature used to identify significant changes on the T1/TP1, T2, and T3 jackets, schedules or T1Cs. Snapshot/variance allows experimentation with different scenarios and quickly identifies the impact of a change on many key fields. Variance calculates only for fields with CRA line numbers. As a result, some fields (e.g., on worksheets) will not be included in the variance comparison.

Previous year variance

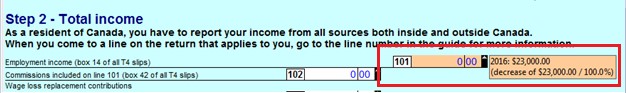

ProFile includes previous-year variance to identify significant differences between returns of different years.

For any files carried forward in ProFile T1/TP1, the variance feature can compare values in the current year’s tax return with values in the previous year.

When a return carries forward, ProFile automatically creates an entry for the previous year in the Snapshot/variance dialogue box.

Activate the previous year to see variance notices on the Variance tab of the Active Auditor and in fly-over messages when the cursor is hovered over orange variance fields.

Allow a variance

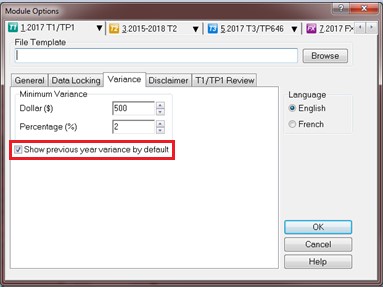

- Select Module... from the Options drop-down menu in the top toolbar.

- Select the year and module from the tab menu.

- Click the Variance tab; the variance menu displays.

- Select the Show previous year variance by default box.

5. Click the OK button.

Variance thresholds

Variance thresholds can be set to meet individual requirements:

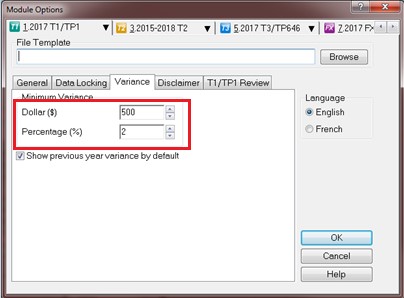

- Select the Module... option from the Options drop-down menu in the top toolbar.

- Select the year and module from the tab menu.

- Click the Variance tab.

- Set the minimum dollar value or percentage of change that will trigger a variance calculation.

5. Click the OK button.

If both a dollar and a percentage amount are set, ProFile calculates a variance only when the amount differs by more than the dollar value and the minimum percentage.

Set variance specifically for the T1/TP1

Variance thresholds can be set specifically for the T1/TP1 Review:

1. Select the Module... option from the Options drop-down menu in the top toolbar.

2. Click the T1/TP1 Review tab.

Use the variance function to automatically complete T1-ADJ forms:

1. Create a snapshot.

2. Enter the new data.

3. Right-click on the table on the T1-ADJ form.

Take a snapshot

ProFile can automatically take a snapshot when printing or creating a PDF file. Simply select the Take snapshot option on the print dialogue before clicking Print.

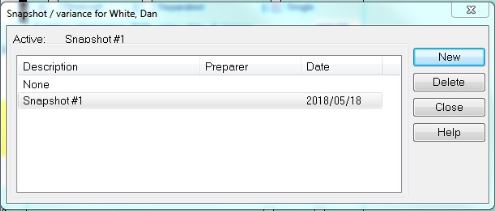

To take a snapshot of the current return:

1. Select the Snapshot/variance option from the Audit drop-down menu in the top toolbar.

2. Click the New button. This takes a picture of the current contents of the tax return.

3. Name the snapshot with a name that reminds you of the purpose of the scenario.

4. Select the Activate this snapshot checkbox; ProFile compares any changes you make in the file to this snapshot.

5. Click the OK button.

While making changes in the file, the variance analysis applies on the Variance tab of the Active Auditor and in fly-over messages when your cursor is over a yellow variance field. The Line number view of the Form Explorer lists all the fields that can display variance amounts.

Shelf life of a snapshot

Snapshots may have a short self-life. For example, a snapshot was created last week using a client RRSP contribution of $5,000. This week, it may be necessary to evaluate the impact of reducing that contribution to $3,000.

However, if a new T3 slip was added since taking the first snapshot, variance will detect the impact of both the T3 and the RRSP contribution change. To best use variance, carefully manage which data fields are changed since taking a snapshot that are needed for comparison.

Delete a snapshot

Snapshots may have a short shelf life. If other data is changed in the return (e.g., adding income from a forgotten contract job), it is necessary to delete the original snapshot and create a new one reflecting the extra income before comparing that scenario to current data.

To open the Snapshot Variance dialogue window:

1. Select the Snapshot/variance option from the Audit drop-down menu in the top toolbar.

2 .Select a snapshot to delete.

3. Click the Delete button; the snapshot deletes.