The following are known issues in the current release of ProFile.

Don't see your issue listed below? Search for other issues and errors on our ProFile Community and Support site.

TP1 248 not properly calculating amount from RL29

Issue

If your only self-employment income is on RL29, you may be incorrectly categorized as having employment income rather than self-employment income when determining the deduction for QPP contribution on line 248 of TP1.

Workaround

If this scenario occurs, please override the amount on line 248 of TP1 by using the amount from line 50 of QPP form.

Resolution

This issue will be fixed in a future release.

Amount of credit reduction on Line 431 of TP1 is incorrect

Issue

If your spouse is transferring an amount of credit on line 431 of your TP1 and is also transferring to their father or mother an amount as a child 18 or over enrolled in post-secondary studies, your amount on line 431 is being reduced by 15% of this amount transferred to their father or mother (line 20 of your spouse’s Schedule S).

This rate should be 14%.

Workaround

Under this scenario, deduct 14% of the amount transferred to their father or mother on line 20 of your spouse’s Schedule S from the amount transferred on your spouse’s TP1 line 430 and enter the result on line 431 of your TP1 return.

Resolution

This issue will be fixed in a future release.

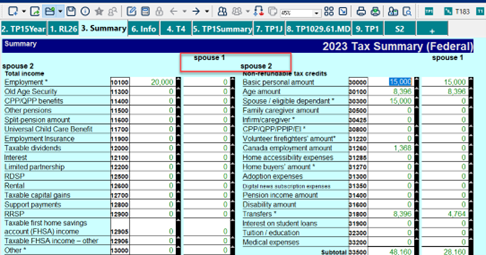

Names in T1 Tax Summary form aren't aligned properly

Issue

The names in the T1 Tax Summary form are not aligning properly.

Resolution

This issue will be fixed in a future release.

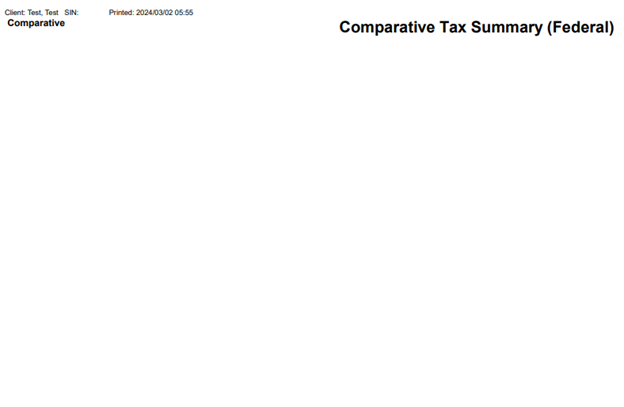

First page of T1 Comparative Tax Summary prints only the title of the form

Issue

The first page of the T1 Comparative Tax Summary is only printing the title of the form:

Workaround

You can follow the instructions in this support article to adjust ProFile’s print settings and fix the issue.

Resolution

This issue will be fixed in a future release.

Top menu bar distortion occurrs when switching between different monitors

Issue

Some users who drag the ProFile application between different monitors are encountering screen distortions in the top menu bar.

Cause

This issue is a result of different text size scale settings between the monitors.

For example, if one monitor's text size scaling is set to 100 percent, and the second monitor's text size scaling is set to 125 percent, the distortion in the top menu bar may occur.

Workaround

Navigate to the Windows display settings of each monitor being used and set the text size to the same scale setting (for example, 100 percent) and restart ProFile.

We are enabling monitor settings logging to determine the frequency of this issue. There is no experience change when logging is enabled.

Resolution

This issue will be resolved in an upcoming ProFile release.

ProFile freezes for some Backup to Cloud users with “Unable to validate your online credentials” message

Issue

ProFile freezes for some Backup to Cloud users; an “Unable to validate your online credentials” message displays after a period of time.

Resolution

ProFile recommends logging out of Backup to Cloud and refraining from using the service while our product team investigates this issue.

ProFile does not carry forward TaxCycle data for more than one S125 form

Issue

When carrying forward T2 returns, forms subsequent to the first S125 are not populated with TaxCycle data; only the initial form populates.

Workaround

Review the equivalent S125 forms in TaxCycle and enter the additional statements manually in ProFile.

Resolution

This issue will be fixed in a future ProFile release.

Icons and check marks in Windows Explorer don't display as expected

Issue

Customers encounter this issue when trying to verify the status of a return through Windows Explorer.

Click here to review the full issue description and workaround.