Thank you for reaching out to us, Miguel. I'm here to assist you in making a valid sales tax entry on your Invoice. To get started, I've outlined some essential steps for you.

First, we'll need to set up your sales tax to ensure they can be applied accurately to your invoices. QuickBooks keeps track of your province's sales tax laws to accurately calculate sales tax and returns. You can also add tax agencies for sales outside your province.

Here's how we can do this:

- Go to Sales tax and select Set up sales tax.

- If you have payroll or any other taxes, go to Taxes, select Sales tax, then click Set up sales tax.

- Choose a Province or territory from the dropdown, then hit Save.

- Select the Start of tax period and Filing frequency from their respective dropdowns.

- Select your Reporting method (usually it'll be Accrual, but if in doubt, please consult your accountant).

- Enter GST/HST number (optional).

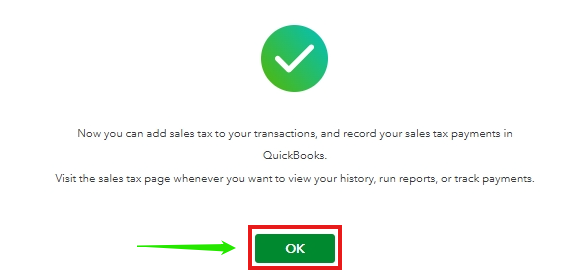

- Select Next, then select OK.

After setting up your sales tax, you can now make a valid entry in the sales tax column on your invoice. You can follow the steps below:

- Select + New, then Invoice.

- Choose a customer from the Customer dropdown.

- Ensure that all of their information is accurate.

- Select a sales tax from the SALES TAX column.

- Complete all other details needed.

- Once done, hit Save.

I suggest seeking guidance from your accountant to determine the most appropriate sales tax rate to apply. This is important to ensure you are meeting the legal requirements specific to your province or territory.

I'll share this article to assist you in maintaining accurate financial records, ensuring that payments are processed smoothly: Record invoice payments.

Feel free to revisit this thread if you have any additional questions about making a valid sales tax entry on your invoices, Miguel. It's my pleasure to help you. Have a great day!