ProFile can automatically calculate the T1-ADJ form in the event that an adjustment is required.

The following video outlines the process:

Use form T1-ADJ

- Open a T1 client data file that you created and have previously filed.

- To retain the original tax return, select Save As from the File drop-down menu in the top toolbar, and save the return with a modified name.

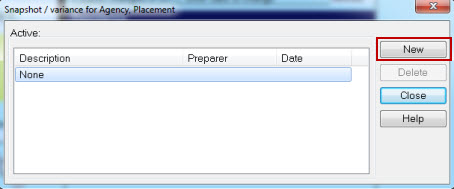

- Select the Snapshot/variance the Audit drop-down menu in the top toolbar. The Snapshot/variance for Agency Placement window displays:

- Select the New button. A new entry displays in the Active: list.

- Name the snapshot something that identifies why the return is being adjusted (for example, Additional T3 slip) and select OK. This records amounts in key fields that ProFile will check for variance after the return is adjusted.

- Navigate to the form or slip that requires adjustment and key in the new values.

- Use the Form Explorer (or press F4) to open a copy of the T1ADJ. ProFile allows unlimited copies of this form to be made, so additional adjustments to the return can be filed as necessary.

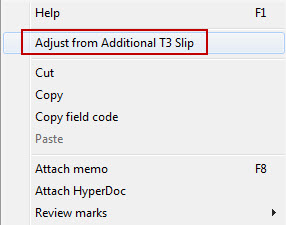

- Right-click on the T1-ADJ form and select the Adjust from (snapshot name) option with the name of the snapshot.

In the example below, there would be only Adjust from Additional T3 slip from the context-sensitive menu:

ProFile compares the original return to the revised data. The software automatically detects the impact on all relevant fields, and completes the table with line numbers, names and changed amounts. This only applies to fields with CRA line numbers.

- There is a free-form area on the T1-ADJ where other details or explanations can be provided. To create separate paragraphs in this section, use Shift and Enter to start each new paragraph.

- Print a copy of the T1-ADJ and mail it to the CRA; there is no need to submit the full return.

Note: A T1-ADJ form cannot be electronically filed.

Mail the T1-ADJ form

The CRA maintains an up-to-date list of all tax centres where T1-ADJs can be mailed.

Find a CRA address list here.