This article details the method to complete a tax return when a spouse is a non-resident.

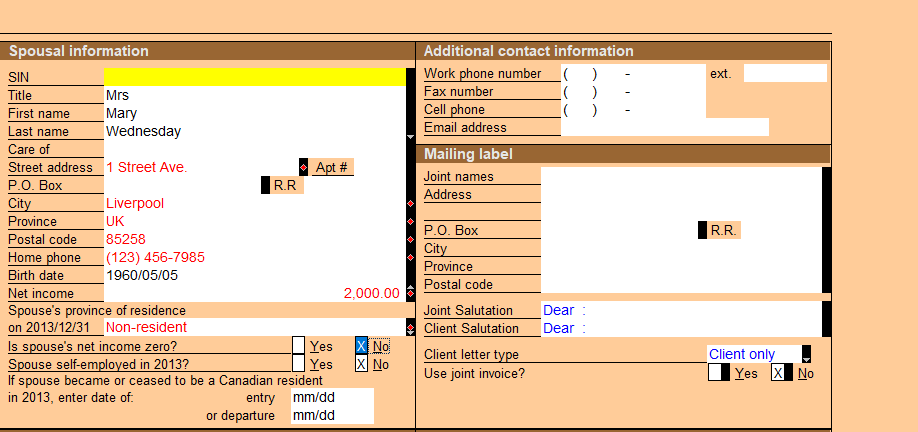

Complete spousal information in the Info page

When preparing a tax return for a married taxpayer, the information for the address and province of return automatically flows to the spousal section in the Info page.

If the spouse is a non-resident, override the address with the correct foreign address in the Spousal information section. Select Non-Resident as the province of residence and sign-off on all the warnings.

Note: To enter the foreign postal code in its correct format, right-click in the field Postal code and select Format Override.

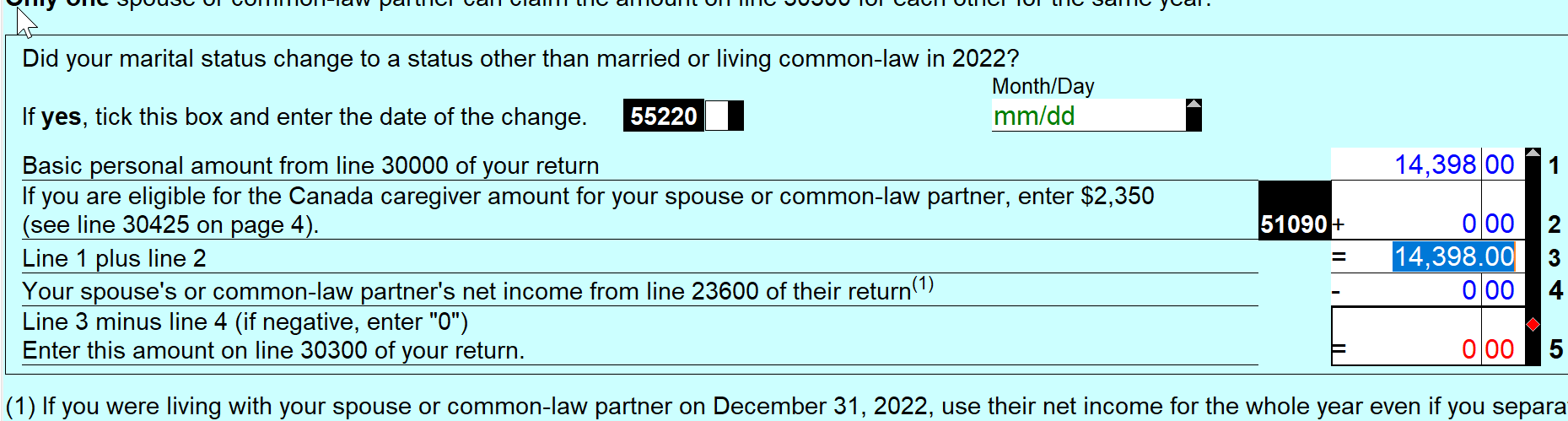

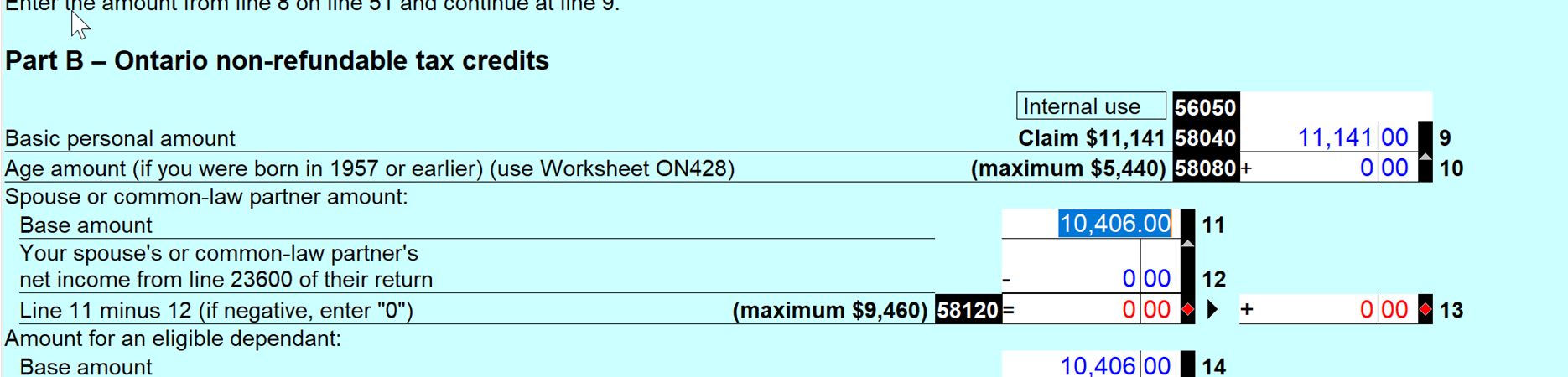

Override spousal amount for the non-resident spouse

When the province of return is selected as non-resident, ProFile assumes that the taxpayer is financially supporting the non-resident spouse and claims the spousal amount in line 303 of S1 and line 5812 of the appropriate provincial 428.

Override the fields indicated below if the taxpayer is not eligible to claim this amount:

If you're not sure that whether the customer can claim spousal amount for the non-resident spouse, contact the CRA EFILE Helpdesk.