1. Create a new T1 return.

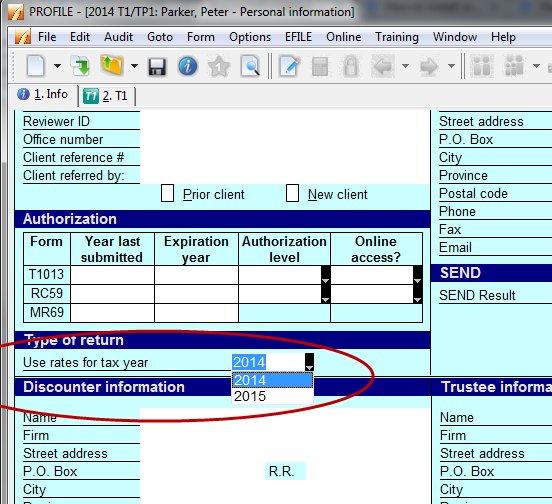

2. Navigate to the Info page.

3. Select the tax rates for the following tax year in the Type of return section.

4. Enter the date of death.

5. Select the Yes option for the question Is this an Early Filed or Elective deceased return? in the Filing section.

6. Complete the return, entering any carry forward amounts (e.g. capital or non-capital losses, UCC, etc.).

7. Enter the income and expenses for the deceased taxpayer.

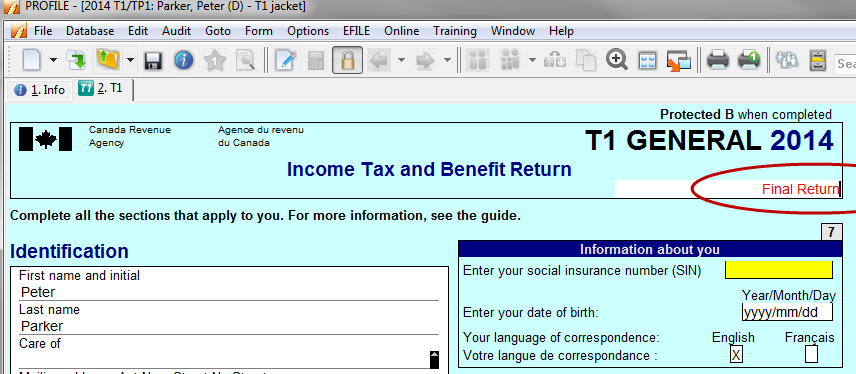

8. Navigate to the T1 jacket.

9. Override the For planning purposes only entry with Final return.

10. Print the return.

11. Navigate to the T1 jacket; enter the following tax year in place of the current one.

12. Mail the return to the CRA for processing (see CRA article related to mailing returns).

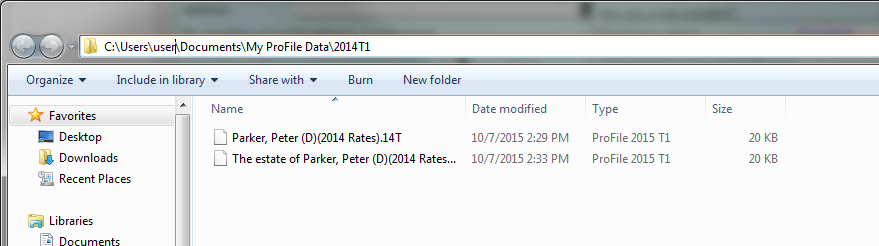

Saving two returns with the same Social Insurance Number

Two returns can be saved with the same social insurance number by using The estate of the late client option.

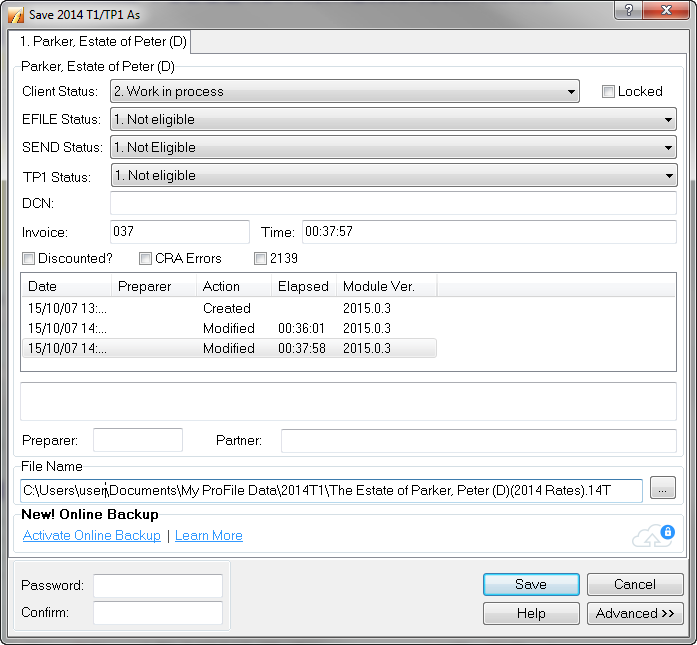

1. Select the Save As... option from the File drop-down menu in the top toolbar. The Save As window displays.

2. Add The estate of designation to the name.