The CRA will process individual income tax returns that you file early. This means you can promptly file year-of-death returns for the interval from January 1 to the date of death.

Create a return for a taxpayer with a upcoming taxation year date of death

- Create a new T1 current year return.

- Enter the taxpayer's personal information on the Info form. Do not save the return yet.

- Enter the taxpayer's date of death on the Info form. Do not save the return yet.

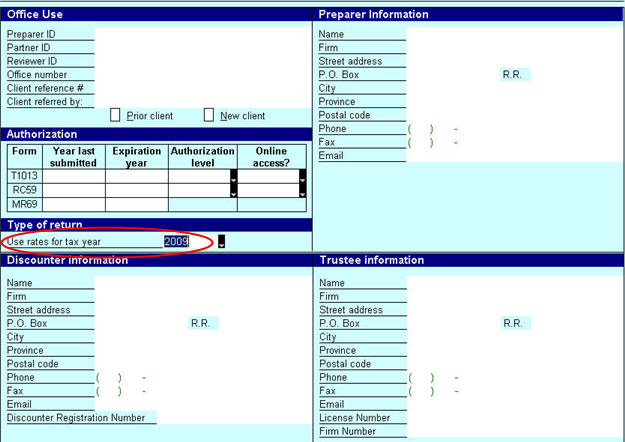

- Select the upcoming taxation year rates in the Use rates for tax year drop-down list in the Type of return section of the Info form.

- Save the return.

As with current year deceased returns, ProFile automatically adds (D) to the file name to help you distinguish between deceased and regular tax returns. When you use the upcoming year rates, ProFile also adds YYYY rates to the file name.

For example, if you create an early-file deceased return for Thomas Peterson who passed away on March 13, 2009, the default file name would be Peterson, Thomas (D) (2009 rates).09T.

If forms for the year of death are not yet available

The CRA requires that you indicate the year for the return that you are filing at the top of the T1 jacket. Either enter the taxation year in the description field at the top of the jacket before you print the return, or print the return then cross out the current year and write the following year.

Thoroughly review the return before filing.