You may encounter the following errors:

- Error code 2168 - The claim for the federal amount for an eligible dependant at field 305 of Schedule 1 differs from the maximum allowable

- Error code 2229 - The claim for the amount for an eligible dependant at field 5816 of provincial or territorial Form 428 exceeds the maximum allowable

Resolution

First, check the following eligibility requirements.

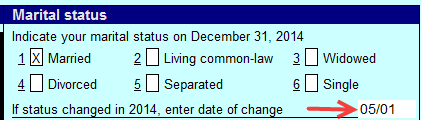

Marital status should be Single, Separated, Divorced, Widowed, or Married/Common-law.

For Married or Common-law status, there should be a date of marital status change on the Info form.

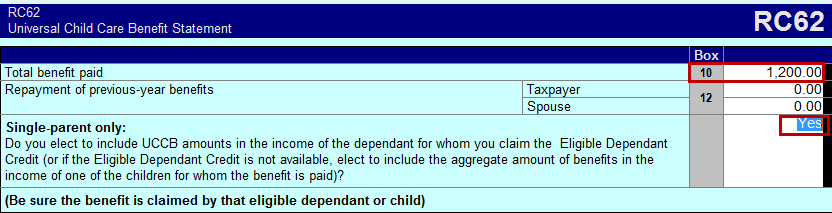

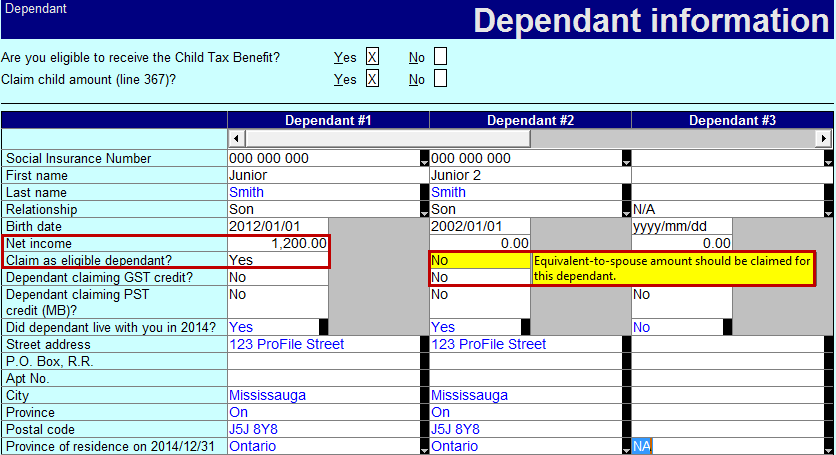

After reporting the UCCB income on RC62, it must be designated to the same dependent that is being claimed for the Eligible Dependent credit.

The warning shown above can be signed off.