Note: For tax year 2019 and forward, preparers should use the Consent Authorization request or Business Consent Cancellation request form for EFILE. Review the current method of EFILE, or read about the change on the CRA website.

This article is being preserved for reference purposes. The Authorize a Representative or Cancel a Representative forms must be transmitted from the most recent T1 tax year module.

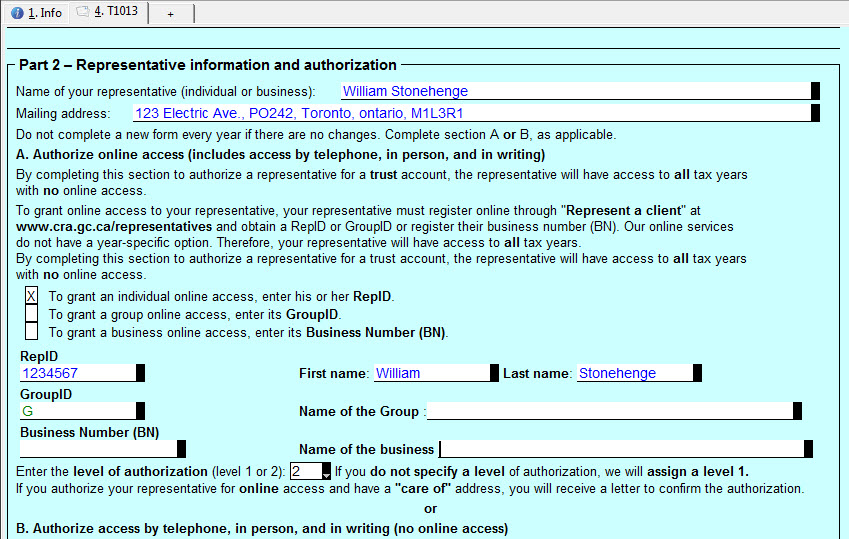

The T1013 Authorizing or Cancelling a Representative form is used to authorize a representative to access a taxpayer's tax information through the CRA. The taxpayer can grant access to a person, a group or a business. To grant a group online access, the GroupID number must appear correctly in Part 2 of T1013.

The T1013 can be completed either manually or automatically by ProFile for the purpose of authorizing a representative for the tax payer with the CRA. The T1013 is submitted to the Government of Canada separately from the T1 return; the option is provided under the EFILE menu as EFILE the T1013 for this tax payer?

ProFile allows you to enter the preparer's credentials under Options > Environment > Preparer, which then populates in Part 2 (both sections A and B) of the form.

The T1013 also has two levels of authorization: Level 1 allows the CRA to disclose information to the representative, while Level 2 allows the CRA to disclose information to the representative and the representative to request change.

For more details, see page 2 of the T1013.

Manually populate the information

1. Choose the purpose of the form. The Tax Payer information in Part 1 is automatically populated from the Info page.

2. Select one of the following options:

- Part 2, A: The preparer can choose who is granted authorization

- Part 2, B: The preparer can choose to authorize by phone, in person, or in writing

3. Complete parts 3, 4, and 5 manually.

Set defaults through the software options

Most of the T1013 can be automatically filled from Options > Module. Under Carry Forward and New Files, there are options which automatically fill out the purpose of the form, representative information, and authorization, including the level of authorization.

Complete parts 3, 4, and 5 manually.

EFILE the T1013

1. Ensure the form is complete.

2. Select the EFILE the T1013 for this taxpayer option under the EFILE menu in ProFile.

Note: The form can only be transmitted if Part 2 A has been selected.