What is Express NOA?

ENOA is a CRA service that allows individuals and authorized representatives to view the basic result of an assessment immediately after filing a return and to receive the full notice of assessment the next day.

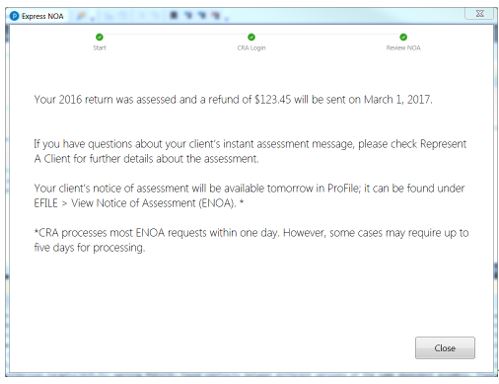

The instant assessment results provide the status of the return with a summary of the refund, amount owing, or a zero balance and deposit information, if applicable.

The full notice of assessment provides an account summary with the result of the assessed return showing a refund, a zero balance, or a balance owing, tax assessment summary, explanation of changes and other information, and RRSP/PRPP deduction limit statement. It may also contain the Home Buyers' Plan statement and Lifelong Learning Plan statement.

Note: The CRA processes most ENOA requests within one day. However, some cases may require up to 5 days for processing.

Who can use ENOA?

- Individuals

- Authorized representatives

What is required to make an ENOA request?

Preparers using the ENOA feature require:

- A completed and EFILED return

- A CRA assessment of the EFILED return

- A completed Authorize a Representative form, or a completed (pre-2020) T1013 form

How does someone get authorized to submit ENOA requests?

To use the Express NOA service, you must:

- Be a registered electronic filer

- Be registered in Represent a Client and have a RepID, GroupID, or business number

- Have a valid Authorize a Representative form or a pre-2020 T1013 with Level 1 (or higher) authorization for online access on file with the CRA

- Have a valid form T183 and have completed Part C for the Express NOA function

Please see the Frequently asked questions section at the bottom of this article for more information.

Select the ENOA option on the Info form

1. Identify the query Do you want preparer to get Electronic Notice of Assessment? on the Info form.

2. Select the Yes option.

Update Form T183

It is necessary to update the Form T183 - Information Return for Electronic Filing of an Individual's Income Tax and Benefit Return prior to submitting an ENOA request.

- Open the T183 form attached to the initial EFILE request.

- Navigate to Part F – Delivery of your notices of assessment and reassessment of the T183 form.

- Confirm that option #3 has been automatically selected from the available options.

Option #3 informs the CRA that the electronic filer will receive notices of assessment and reassessment and will provide the client with a copy.

Note: Option #2 can also be selected in addition to selecting option #3; in this event, notices of assessment and reassessment are provided and are made available online.

Failure to select option #3 will result in an error during the ENOA submission.

Start Express NOA

The ENOA process is undertaken twice:

- The first generates a short summary/assessment of the return

- The second generates a full summary/assessment of the return

The second iteration can usually be undertaken 24 hours after the first, although there may be delays from the CRA of up to 5 days.

Both ENOA undertakings are done in the same manner in ProFile.

Make the initial ENOA request

- Open ProFile.

- Open the return that ENOA is being sought for.

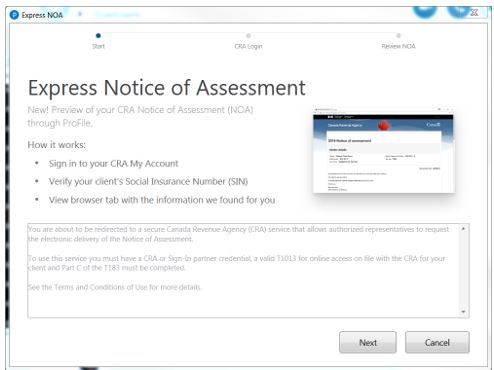

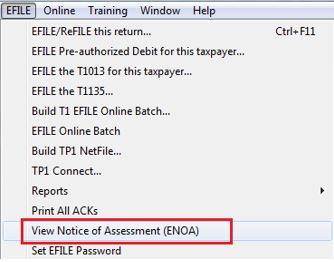

- Select the View Notice of Assessment (ENOA) option from the EFILE drop-down menu in the top toolbar. The ENOA wizard displays in ProFile.

4. Review the wizard content and click the Next button.

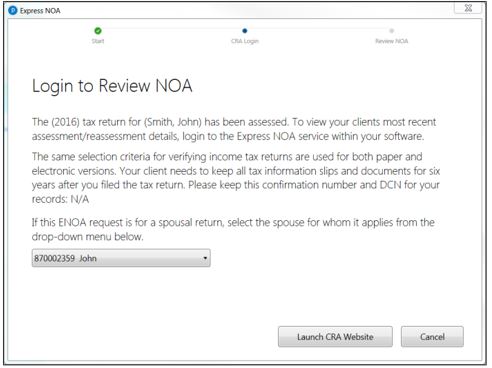

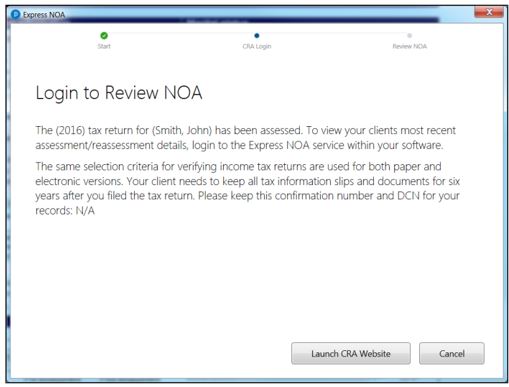

If this is a coupled return, select a specific spouse from the drop-down menu, then click the Launch CRA Website button.

5. If this is a single return, click the Launch CRA Website button.

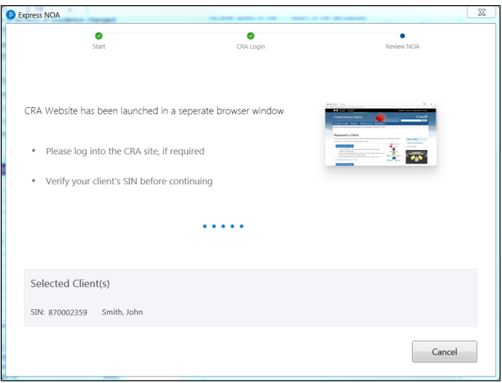

The ENOA wizard indicates that the CRA website has been launched in a separate browser window.

6. Navigate to the CRA Login browser window that was launched; enter the user ID and password information and click the Login button.

In the CRA web browser, the ENOA request processing status displays.

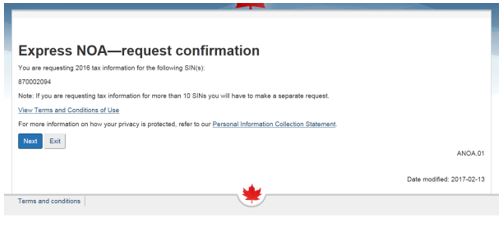

7. The CRA web browser displays the SIN of the client for whom the ENOA request is being made. If the number correctly corresponds to the client, click the Next button.

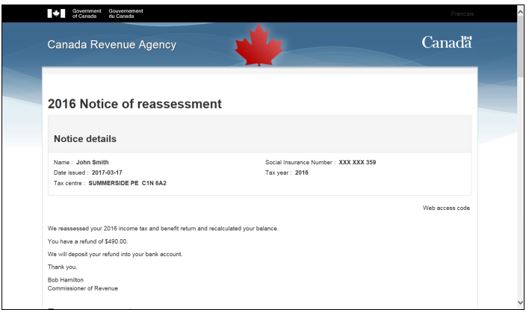

A new browser displays the details of the successful ENOA request. This page can be saved or printed.

8. Click the Close button; it is now necessary to wait a minimum of 24 hours to repeat the request and acquire the full ENOA summary.

Make the ENOA follow-up request

The CRA processes most ENOA requests within 24 hours of the initial request. It is necessary to repeat the ENOA process to acquire the full summary.

- Open ProFile.

- Open the return that ENOA is being sought for.

- Select the View Notice of Assessment (ENOA) option from the EFILE drop-down menu in the top toolbar.

4. Repeat the previous steps in the ENOA wizard; you will again be prompted to login to the CRA.

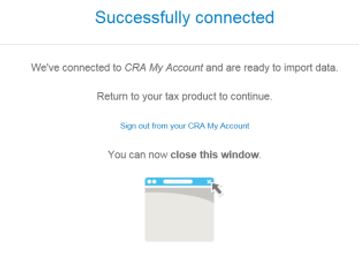

The a Successfully connected message is displayed in the CRA browser during the second request.

5. Close the Successfully connected window; the full ENOA summary displays in the browser window.

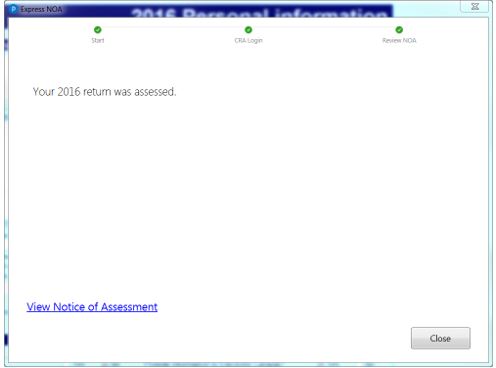

6. The Express NOA wizard in ProFile displays a link to the full ENOA. Click View Notice of Assessment to see the assessment.

7. Click the Close button; the ENOA is complete.

Review the ENOA

Note: ProFile stores a local copy of the ENOA for record-keeping purposes upon the second iteration of ENOA being completed. This is after 24 hours has passed.

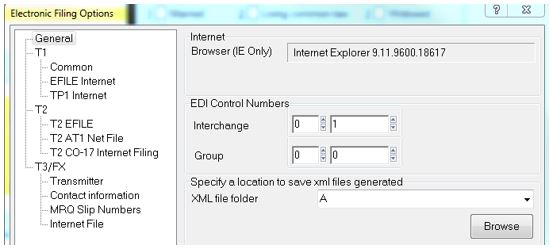

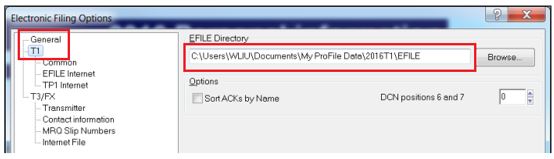

1. Select Options from the EFILE menu in the top toolbar in ProFile. The Electronic Filing Options menu displays.

2. Select the option T1 under the General tab.

The location of the ENOA file is listed in the EFILE Directory field.

3. Navigate to this directory; the ENOA file is saved with the following format:

pfnoa_LastName_FirstName_MaskedSIN_timestamp.html

Frequently asked questions

I received an error relating to a T183 form. Has the ENOA process stopped?

If Part C of the T183 form is not completed as required prior to ENOA, an ERR.108 error displays. The ENOA process seems to continue but has stopped. Select Cancel. Correct the information missing and attempt to run ENOA again.

Can I use ENOA for a friend or family member's return?

Yes, if you have acquired the necessary authorization.

Can I still have a Notice of Assessment mailed if I use the ENOA feature?

A notice of assessment is no longer mailed to the individual when ENOA is used.

Why was my ENOA request rejected by the CRA?

It is possible the initial filing has not yet been assessed. It is a requirement that a return be assessed by the CRA prior to making an ENOA request.

Preparers can check their My Account with the CRA to see the status of any returns.

Why did my ENOA connection fail?

A connection will most likely fail due to an internet issue. Ensure your internet or Wi-Fi is connected properly.

Is ENOA available for TP1 returns?

No, not at this time.

Where can I learn more about ENOA?

You can review the CRA's About Express NOA page for more details here.