T2 filers can link data from a related or associated corporation into the RAC Details form of another corporation using ProFile's Corporate Linking function. Any changes to the data of a related/associated corporation found within a RAC Details form is highlighted, and can be synchronized with only a few clicks.

Who can use Corporate Linking?

Any ProFile customer who has the T2 module is eligible to use Corporate Linking.

For which tax years is Corporate Linking applicable?

Corporate linking is available for T2 returns in the 2015-2018 module or later.

Will Corporate Linking work for OnePay and Trial licenses?

Yes.

Link a Related or Associated Corporation to a T2 Return

1. Open the T2 return.

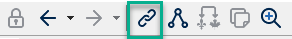

2. Select the Link icon on the ProFile top toolbar menu to link a related/associated corporation.

3. Navigate to the folder containing the return to be linked.

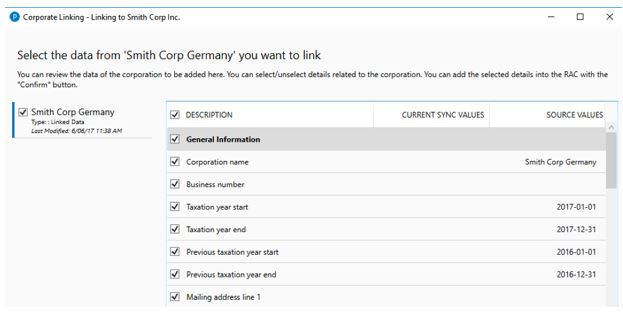

4. Select the T2 return file of the related/associated corporation to be linked. The details of the related/associated corporation display.

5. Select or unselect the related/associated corporation's data.

6. Click the Confirm button. All selected related/associated data is imported and linked.

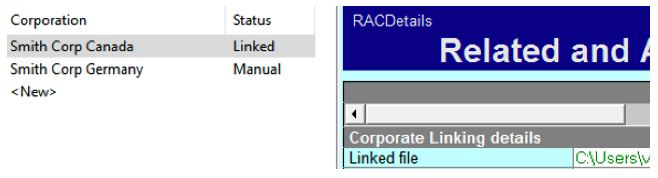

The RAC Details of the newly-linked corporation displays and the designation Linked is assigned for it in the left-side display menu.

Review Related/Associated Corporation status

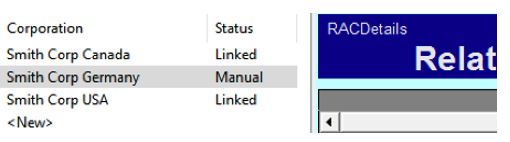

The status of related/associated corporations that are linked - or have been linked previously - to a corporation is displayed in the left-side menu of the linking window.

The following designations can apply to related/associated corporations:

- Linked: the related/associated corporation is linked.

- Manual: the related/associated corporation is not linked, but the RAC Details information exists and may be linked.

- Broken: the related/associated corporation was previously linked, but has since been renamed or moved from its former location (e.g. the original file folder or directory). To relink the related/associated corporation, locate the file and select the Confirm button or revert to the original file name.

Communications within Corporate Linking

The following messages may display when using the Corporate Linking function:

- You have selected the currently open file. Please choose another file to link.

- Cause: It is not possible to add a T2 return to itself as a related/association corporation.

- The selected file has already been linked to the current return. Please use review to unlink the file.

- Cause: It is not possible to link to the same related/associated corporation more than once.

- You are linking a Corporation to the current return. Please use the Review Linked Corporations function to update any existing RACDetails entry.

- Cause: User is linking to a related/association corporation for the first time.

- The selected file was prepared with a version of ProFile that is not supported by corporate linking.

- Cause: User is linking to a file whose tax year is not supported by Corporate Linking.