ProFile's family-linking feature optimizes federal transfer credits - such as the tuition tax credit - between data files for members of a family.

By default, ProFile transfers a dependent's unused tuition/education amounts to the spouse with the higher income tax payable return.

It is necessary to override ProFile's default transfer setting in order to transfer the credits to the spouse with less income tax payable.

Resolution

Revise higher income tax payable return

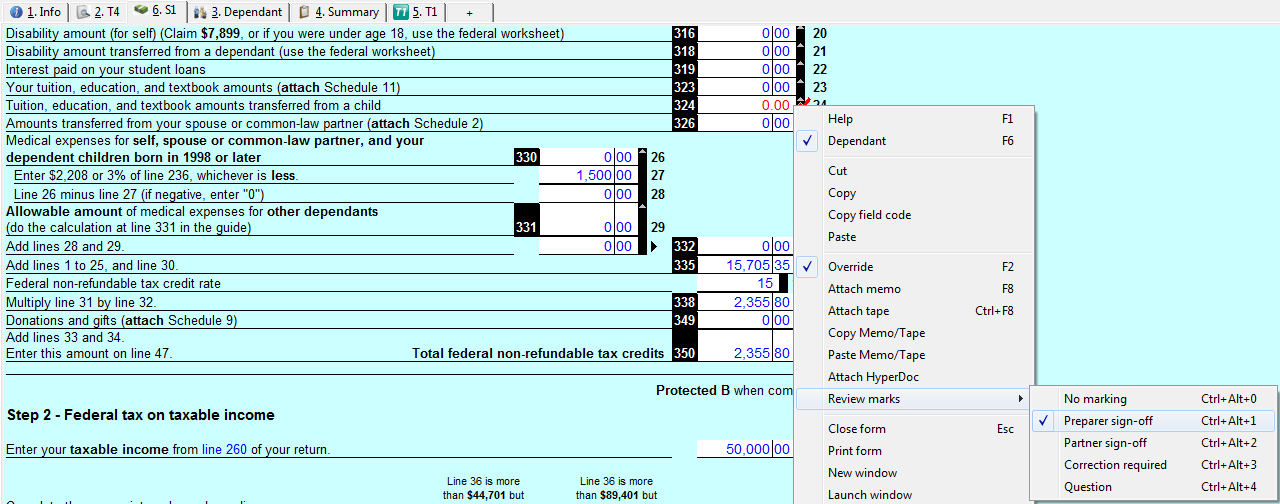

- Identify line 324 of Schedule 1 on the spouse with the higher income tax payable return.

- Set the number in this field to a value of $0; this overrides the default. The font displays in red text to indicate an override.

- Right-click on the red text. Select the Review marks option from the menu, then select the Preparer sign-off option.

The override is accepted and the text displays as normal in the line.

Revise lower income tax payable return

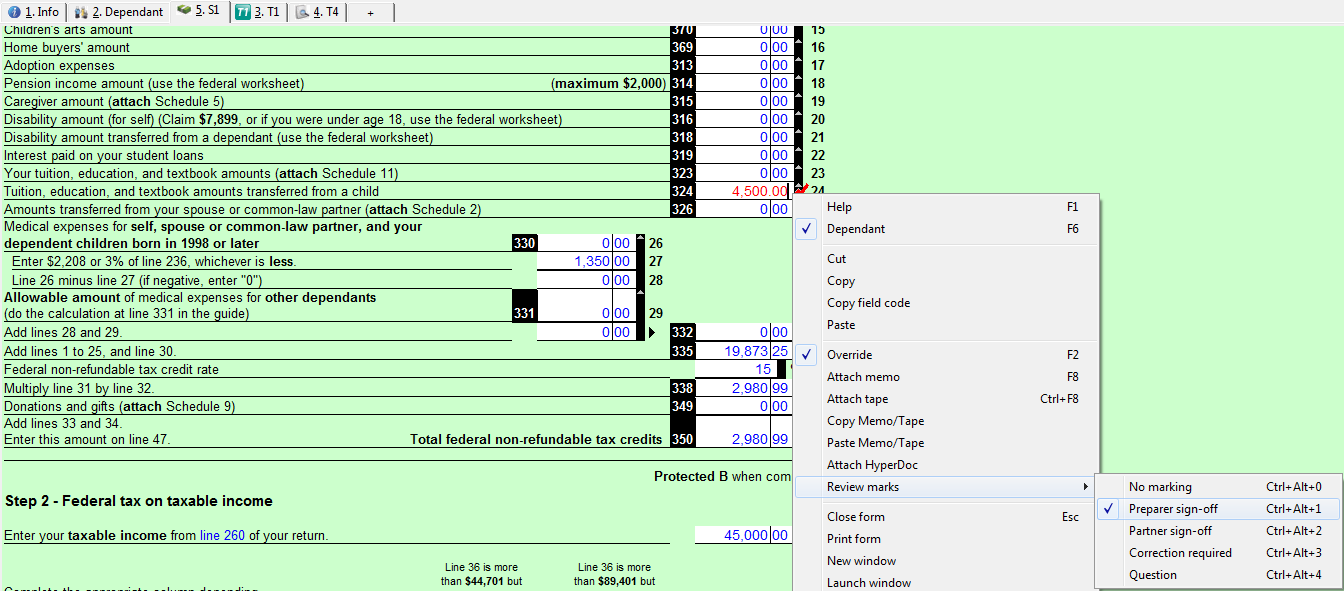

1. Identify line 324 of Schedule 1 on the spouse with the lower income tax payable's return.

2. Enter the eligible tuition/education amount that can be claimed in this field.

3. Right-click on the red text. Select the Review marks option from the menu, then select the Preparer sign-off option.

The override is accepted and the text displays as normal in the line.