How ProFile calculates non-refundable tax credits for immigrants to Canada

Via the 2013 CRA manual (page 75, Appendix L for Proration of credit for new comers):

"In order for an immigrant to be allowed full non-refundable tax credits in the year of immigration, the taxpayer must meet the 90% rule for the period of non-residency. A taxpayer will meet the 90% rule if the Canadian-source income reported by the taxpayer for the part of the year that they were not a resident of Canada is 90% or more of their net world income for that part of the year. A taxpayer will also meet the 90% rule if they had no foreign or Canadian-source income in the period that they were not a resident of Canada. If a taxpayer does not meet the 90% rule, the non-refundable tax credits will be prorated based on the immigration date."

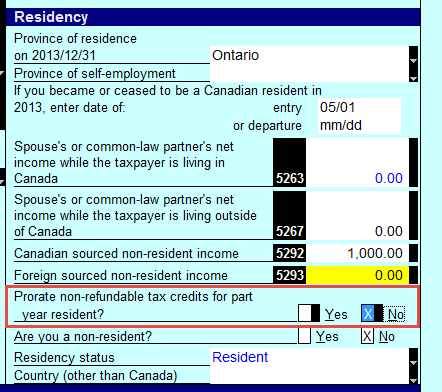

Based on amounts entered on line 5293 and 5292 as well as income reported on tax return, Profile automatically selected Yes or No for Proration: