Review the transmitter number requirements before undertaking a filing of T5013 schedules and slips.

Eligible T5013 schedules and slips can be filed (current year only)

Select the Transmit Federal Slips or T5013 return option from the EFILE drop-down menu in the top toolbar.

On the T5013FIN and the T5013 Summary, there are two options at the top of the form to either:

- EFILE T5013 slip and summary via internet

- EFILE T5013Fin and schedules via internet

If only one of these file options is selected, it will show as an override:

Due to expectations that both the summary and schedules should be received together, the fields are selected together by default. However, either can be deselected and only the selected field will be transmitted. Sign off on the warning. Otherwise, both options will automatically checked by default if Yes is selected to Are you internet filing slips? on the Info page.

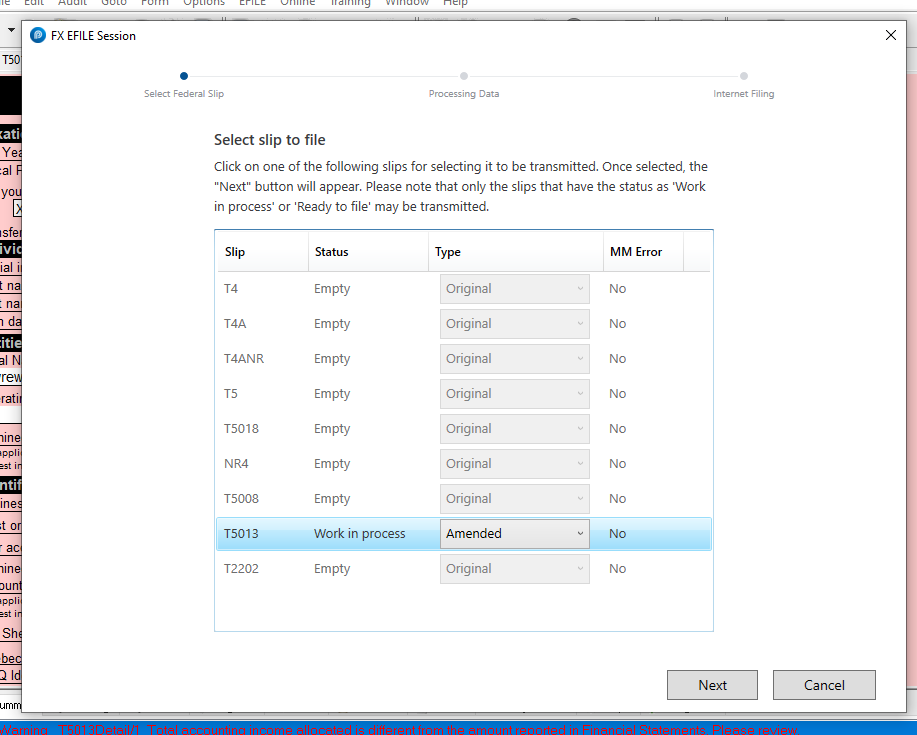

Amend a T5013FIN

To amend the T5013FIN, click on line 040 to amend the schedule(s). This has no impact on the slips. Ensure that when transmitting, select Amended under Data type. Click the line of the box for T5013 and then click Next.

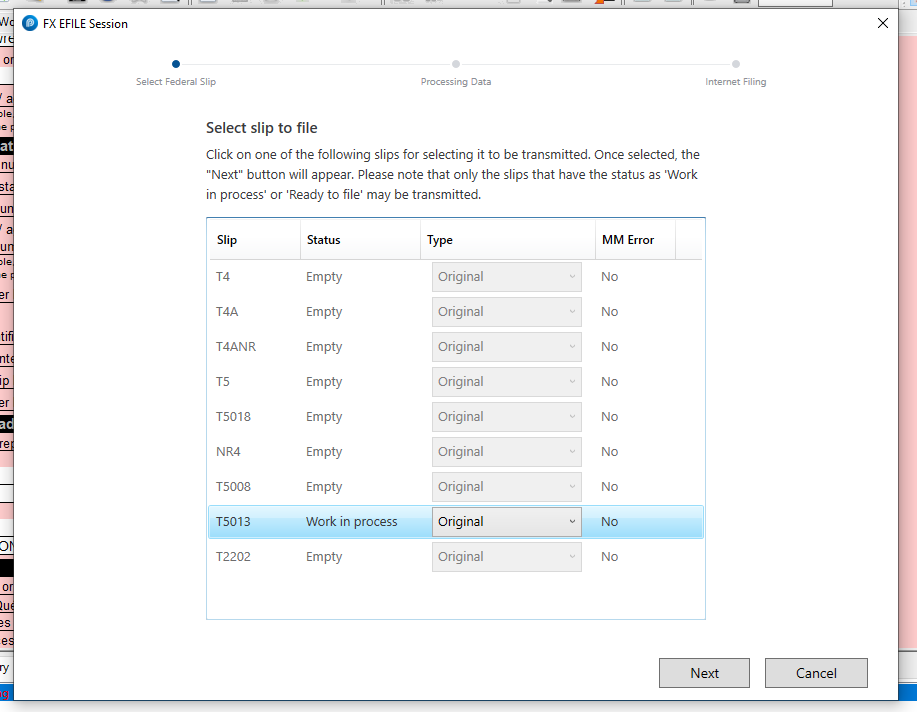

Transmit the T5013FIN

1. Navigate to File > Properties and choose T5013 Work in Process or Ready to file option.

2. Navigate to EFILE > Transmit Federal Slips or T5013 return and click on the line for T5013. If this is the first time filing for this return, select Original, then click Next to transmit:

Note: There is no option to EFILE through the Client Explorer database.

3. In the CRA window, ensure that the 2nd box is selected.