Hello @jamil1 ,

In order to avoid this situation, you must use your forms (i.e. sales forms and bill forms) and tax codes for the numbers to hit the Sales Tax reports correctly.

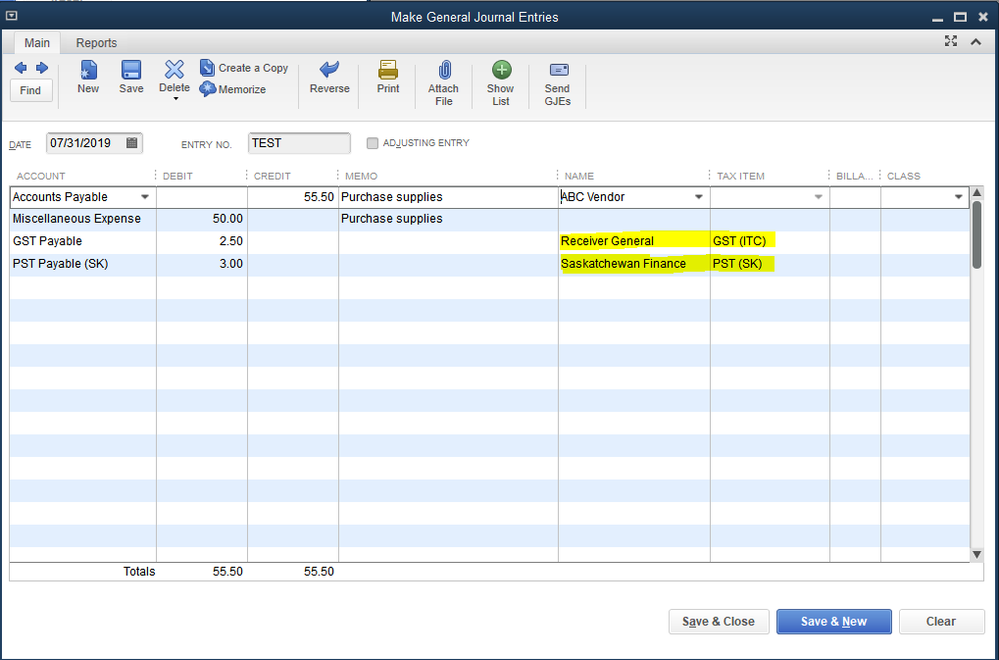

If you must make a JE with a Sales Tax line in it, you must use your tax liability account(s), then tab over to TAX ITEM and enter the appropriate Tax codes. This will ensure your entries will show up on the sales tax reports and not as unassigned.

See example below:

I'm not sure if this is relevant to you or not, but if you make any kind of A/P or A/R entry in a JE, the first line must always be the A/P or A/R account, and you must tab over and enter the name of the vendor/customer. Then you can apply the transaction in the Pay Bills or Receive Payments window.