Hello @Tyee ,

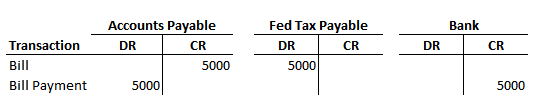

My answer is assuming that you are talking about Corporate Income Tax payable, as that is the only tax that you might enter in this way. In your example below, you posted a liability to a liability. (A/P is already a liability account, and your Fed Tax Liability account is also a liability account.) See T-account example below following the steps you have taken.

Note that you are left with a DR to the Fed Tax Payable as you have described.

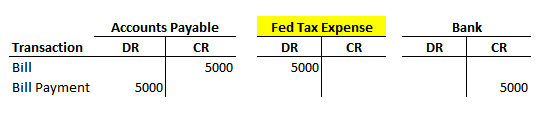

I don't recommend using a Bill for any kind of taxes in QB, other than arrears and interest, but If you are going to use a Bill, the entry should look like this:

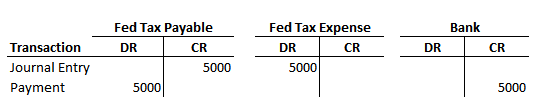

Normally, you wouldn't enter corporate tax payable as a bill. Rather, you would book a Journal Entry to DR Income Tax Expense and CR Corporate Tax Payable. When you pay the tax, you would write a cheque and post it to Corporate Tax Payable, which will DR Corporate Tax Payable and CR the Bank. See below:

If, however, you are talking about the GST/HST federal tax, then I would have a completely different answer because it sounds like you aren't using the built-in tax module to handle the GST/HST. If that is true, I can give you an illustrated link from this forum which explains how to set up GST/HST and PST (if applicable) in QB Desktop, how to file returns and make payments. Let me know if this is the situation and I will respond further.

Good luck!