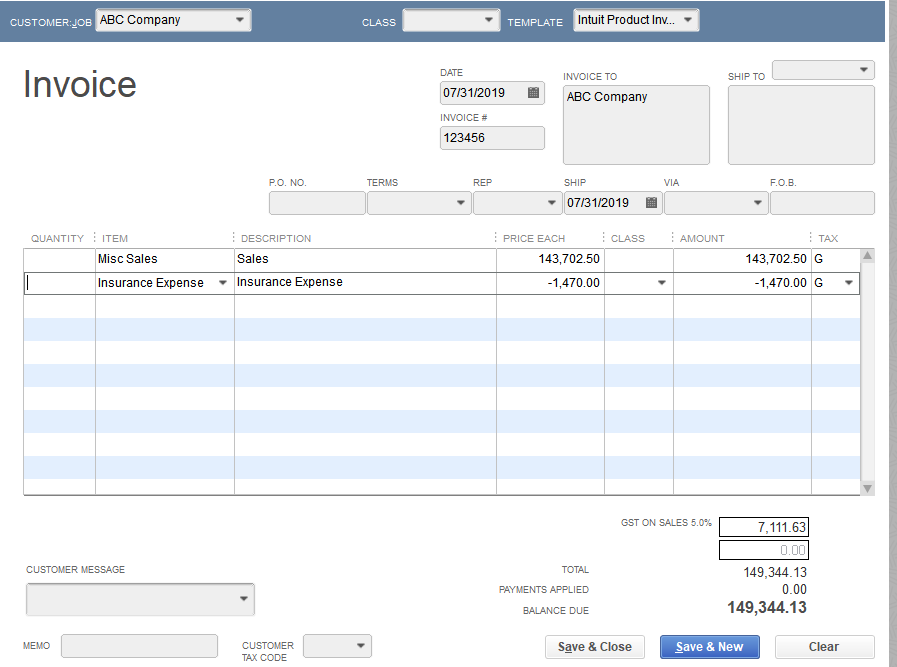

You can do this by creating an Item for your Insurance Expense which is linked to the G/L account of your choice. For this purpose, I always use the Item Type 'Other Charge'. You will get a warning that 'This item is associated with an expense account. Do you want to continue?'. Click OK. Then enter your expense amount on the invoice with a negative sign.

Your GST nets out to the correct amount. If you want to check the GST ledger, you'll note that you have the correct amount going to GST collected, and also the correct amount to the GST ITC's.

Good luck!