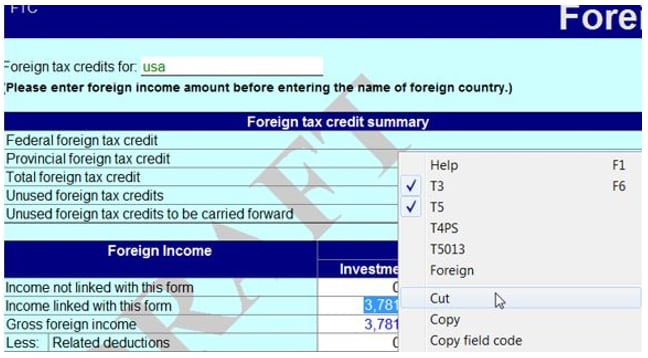

Right-click on the form to see which slips the amounts are originating from:

Understanding the Flow

- The user enters Slips into ProFile.

- The user navigates to the FTC form and enters the country.

- The user reviews the CRA FTC forms (T2209/T2036); they are already automatically populated, based on the FTC form in step 2 above.

- The credit flows automatically to the S1 (federal)/[provincial]428 form).

Frequently asked questions

Review the CRA’s support articles to learn more about tax-related questions: