How to give an employee cash advance pay on their paycheque

by Intuit•42• Updated 7 months ago

This article explains how to set up a cash advance to be deducted from an employee's next pay cheque and how to assign the cash advance deduction to an employee.

| Note: | We recommend that you consult with your accountant or tax adviser before setting up a cash advance repayment deduction. |

Set up a cash advance payment deduction

The following steps show you how to set up a cash advance payment deduction:

- Go to Payroll and select Employees (Take me there).

- Select the employee you're making a deduction for.

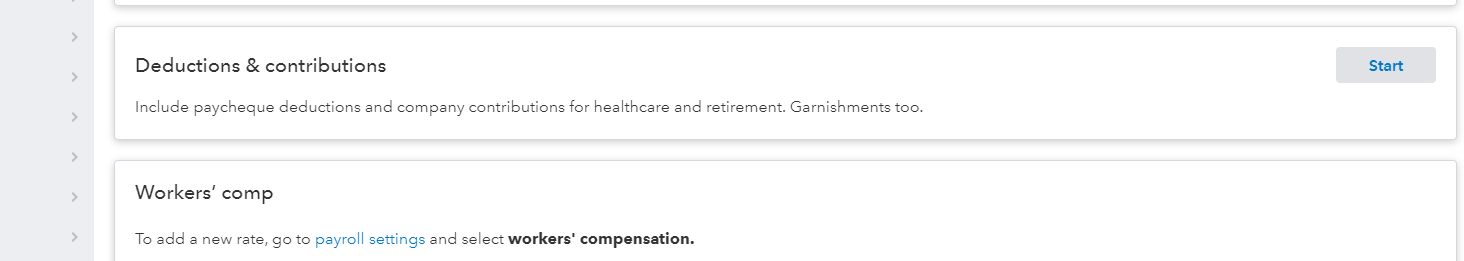

- Under the Profile tab, select the Start button of the section Deductions & contributions.

- Select Add a new Deduction/Contribution.

- From the Deduction/contribution type drop down menu, select Other deductions.

- From the Type dropdown, select Cash Advance Repayment.

- Enter an appropriate description in the Description field.

- Select Ok.

- A pop-up will appear asking if you want to assign the saved deduction to an employee.

- Select Yes or No. Yes will take you directly to the Employees page to apply the deduction.

Assign the cash advance deduction to an employee

- Go to Payroll and select Employees (Take me there).

- Select the employee by choosing their name.

- Select the edit pencil next to question #5.

- In the Deduction/contribution dropdown menu, select the cash advance deduction you created above.

- In the Amount per pay period dropdown menu, select either $ Amount or % of Gross Pay.

- Enter the amount or percentage.

- (Optional) Enter the annual maximum amount.

- Select Ok.

- Select Done.

In your Payroll Settings, you can select an asset account to track this deduction.

| Note: | Because the pay and deduction report to two different types of accounts, they will show separately on reports. To balance these amounts, you can create a journal entry debiting the Repayment asset account and crediting the Reimbursement expense account. |

Sign in now for personalized help

See articles customized for your product and join our large community of QuickBooks users.

More like this

- Pay and report tipsby QuickBooks

- Vacation pay for bonuses in QuickBooks Online Payrollby QuickBooks

- Understand gross pay and net payby QuickBooks

- Set up your payroll service in QuickBooks Desktopby QuickBooks