Certain error messages may prevent a successful EFILE of a T1 or T2 return. These issues must be resolved before transmission can be successfully completed.

Resolve EFILE errors

- Double-click the error message.

- The return opens with the auditor tab selected. Review the error(s) indicated in red text.

- Click each error; the source of the error opens in the return. For example, clicking on an error related to an incorrect SIN number takes you to the Info page where the SIN is entered.

- Resolve all outstanding errors in the auditor.

- Save the return.

- Attempt the electronic transmission again.

About EFILE exclusions

In certain cases, an EFILE rejection can be a result of an exclusion that requires a paper filing.

Click here to learn about EFILE exclusions for T1 returns.

Click here to learn about EFILE exclusions for T2 returns.

Pro Tax data entry fields

Upon EFILE you may receive a notification that the return was rejected. In some cases, it may be a result of overrides where the correct tax flow was not followed.

Click here to learn about entry types and overrides in Pro Tax.

List of T1 EFILE errors

Click here to review an updated list of T1 EFILE errors from CRA.

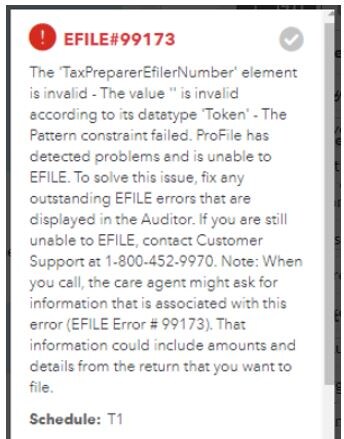

EFILE error #99173

This error is generally due to a missing or invalid element in the return.

The cause of the error will be listed in the first line of the error message:

Causes may include:

- SIN not entered of invalid, including non-resident spouses. In this instance, enter SIN # 000000000 for the non-resident spouse.

- preparer information has been entered incorrectly

- missing EFILE Number and/or invalid password

What the Pro Tax support group can help with

The Pro Tax Care team can assist in troubleshooting rejected returns due to some EFILE error codes.

However, the Care team will not be able to assist with EFILE errors that relate to information or balances available on the CRA's record (for example, EFILE errors regarding HBP balance). Pro Tax customers will need to contact CRA for the correct amounts in these cases, otherwise the return will be rejected by CRA if it does not match their records.

Examples of these errors include:

| EFILE error | Description |

| 2130 | There is a current year immigration date recorded with the Canada Revenue Agency, but one was not entered on this return. |

| 2250 | The claim made for Home Buyers Plan repayment at field 246 of Schedule 7 and/or field 5883 of RC 383 exceeds the maximum repayable. |

| 2252 | The claim made for Home Buyers Plan (HBP) repayment at field 246 of Schedule 7 and/or field 5883 of RC 383 is less than the required repayment, or there is an entry at field 129 for HBP repayment, but no entry was made at field 5508. |

| 2302 | The claim for the Home Buyers tax credit at field 369 of Schedule 1 exceeds the maximum allowable. Confirm that all data has been entered correctly. If the return is correct, contact CRA and confirm that the data they have on file matches the information received by the tax preparer. |

What the CRA EFILE Helpdesk can help with

Some error codes must be addressed with the CRA. For the following error codes, contact the CRA EFILE Helpdesk for assistance:

- 40

- 43

- 57

- 72

- 2197

- 2250

- 2252

- 70127