Malaysia Sales and Service Tax (SST) FAQs

by Intuit•1• Updated 1 year ago

This article is for customers using the QuickBooks Online Malaysia product.

Sales and Service Tax (SST) in Malaysia starts soon, and we know you probably have a lot of questions for how QuickBooks can help you remain compliant. These are the answers to the questions you may have regarding the SST in QuickBooks Online:

What is Sales and Service Tax?

Sales and Service tax is a new tax regime in Malaysia where certain manufacturing businesses are required to start charging sales tax on goods they produce, and certain service businesses are required to charge service tax on the services they provide.

Where can I learn out more about Sales and Service Tax?

We recommend consulting the Malaysia Sales and Service Tax website which is being updated almost every day, and includes detailed guides for taxable goods and services under this new regime.

How does QuickBooks support Sales and Service Tax?

You can easily configure QuickBooks to charge and track Sales and Service Tax.

To do this, you will simply need to add the applicable Sales or Service tax rates for your business manually

Why do I have to set up new rates?

Not all of our customers are required to set up Sales and Service tax, nor will they necessarily have to charge both sales and service tax to their customers.

By setting it up manually based on your business needs, you get a solution right for you.

How do I set up a new tax rate?

Setting up a new rate takes just a minute, and we’ve created a short video to show you how.

Which rates should I set up?

We recommend consulting with Malaysia Customs or a tax professional directly to answer this question. Whichever rates you are required to use for your business can easily be set-up in QuickBooks when you are ready.

What do I do when it’s time to file my first return?

Once you’ve set up the new rates, you can run tax reports to find out how much you’ve sold and how much tax you may owe.

Why haven't you updated QuickBooks yet?

We are waiting for Malaysia Customs to publish and clarify guidance around implementing Sales and Service tax before we make any changes to our product.

I’m not required to register for Sales and Service tax. What about me?

Based on this new regime, we realise there will be many customers who may no longer need to track GST in QuickBooks. We are investigating how to make that transition seamless, and hope to have more information soon.

Where can I find out more about sales and service tax?

We recommend consulting the Malaysia Sales and Service Tax website - https://mysst.customs.gov.my/ or a tax professional to learn more.

How do I update my Invoice to not say Tax Invoice?

You can update the name of most QuickBooks transactions using Custom Form Styles, accessible in the Gear Icon in your QuickBooks file. Simply update your template and you will be good to go.

How can I do a bi-monthly filing in QBO?

Bi-monthly filing is not an option in QBO but we can change the end date of the filing period to show tax amount due on a bi-monthly basis:

- Sign in to your QuickBooks Online account, and go to Taxes.

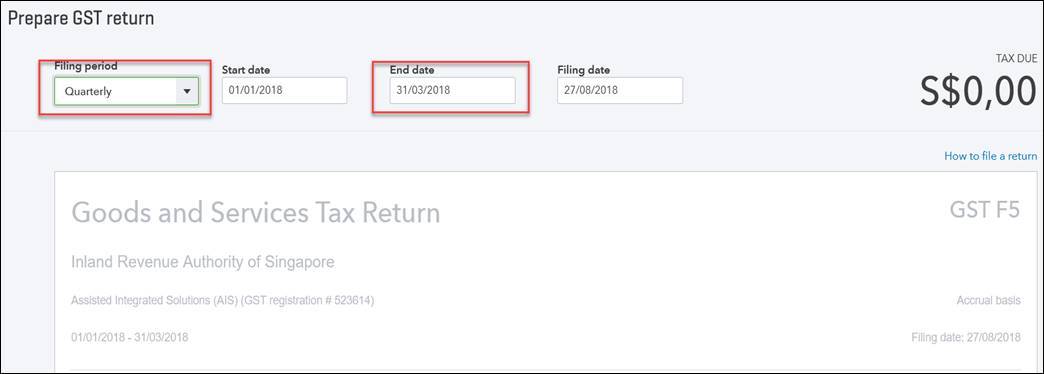

- Select the period you want to file the return, then select Prepare Return. On the return form, the system will set the end date depending on the frequency chosen (ex. if the quarterly option is chosen, the end date will be set on 31st March for Q1.)

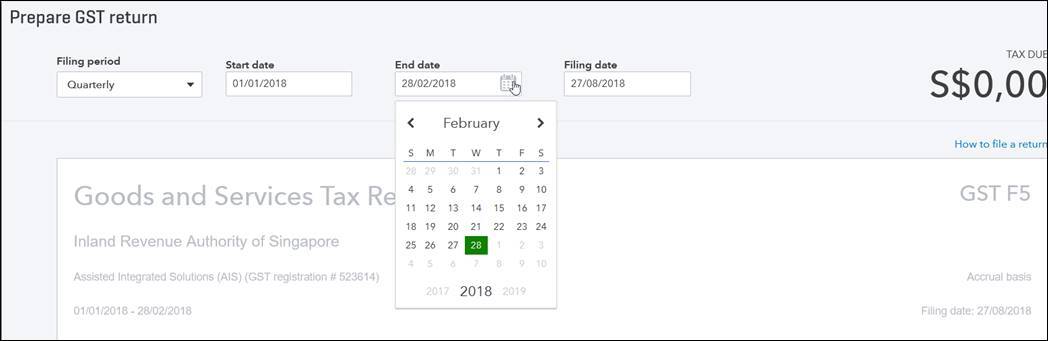

- Change the end date to the bi-monthly date (ex. instead of ending on March 31, change the date to February 28).

- Complete the return.

Sign in now for personalized help

See articles customized for your product and join our large community of QuickBooks users.