What are Bank Deposits in QuickBooks?

by Intuit• Updated 1 month ago

Learn how bank deposits work with the Undeposited Funds account in QuickBooks.

Let’s say you physically put several payments in the bank: you deposit a few checks and some cash for a total of EUR €100. Your bank may record everything as one single EUR €100 deposit. Or it may record the checks and cash separately.

When you should do it

In QuickBooks, you need to record your deposit to match your bank statements exactly. If your bank records multiple payments as a single deposit, you’ll do the same in QuickBooks. If your bank records payments separately, enter each one separately.

Learn how it works

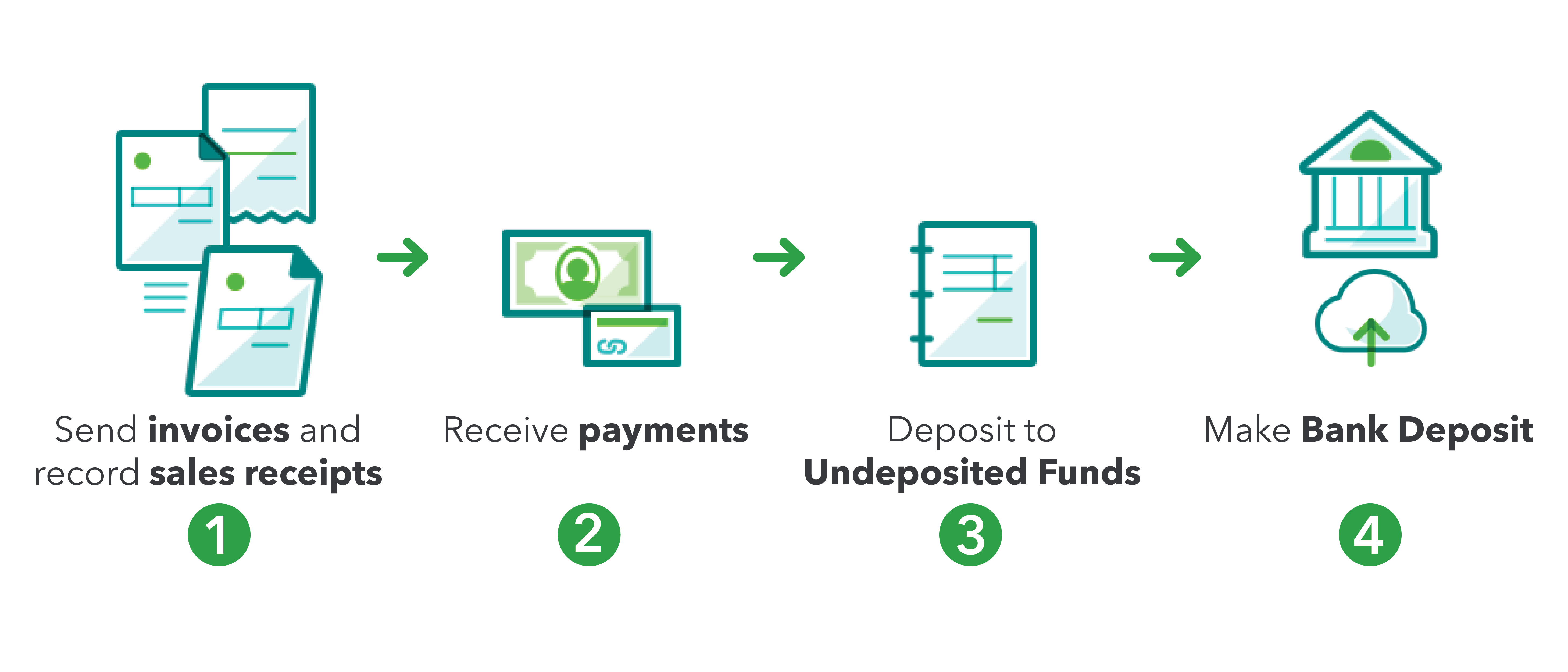

Use the Bank Deposits feature to group payments together into a single bank deposit record. First, put the invoice payments and sales receipts you need to combine into your Undeposited Funds account. Then group them together on the Bank Deposit screen and move the single bank deposit it into an account.

This process ensures QuickBooks always matches your bank records. (It also makes account reconciliations much easier).

Start making bank deposits

Learn how to make Bank Deposits in QuickBooks Online.

More like this

- Record and make bank deposits in QuickBooks Onlineby QuickBooks

- Find missing payments you want to deposit in the Bank Deposit windowby QuickBooks

- What’s the Undeposited Funds account?by QuickBooks

- Edit the customer name on a bank depositby QuickBooks