QuickBooks Ireland Temporary VAT Change

by Intuit• Updated 3 years ago

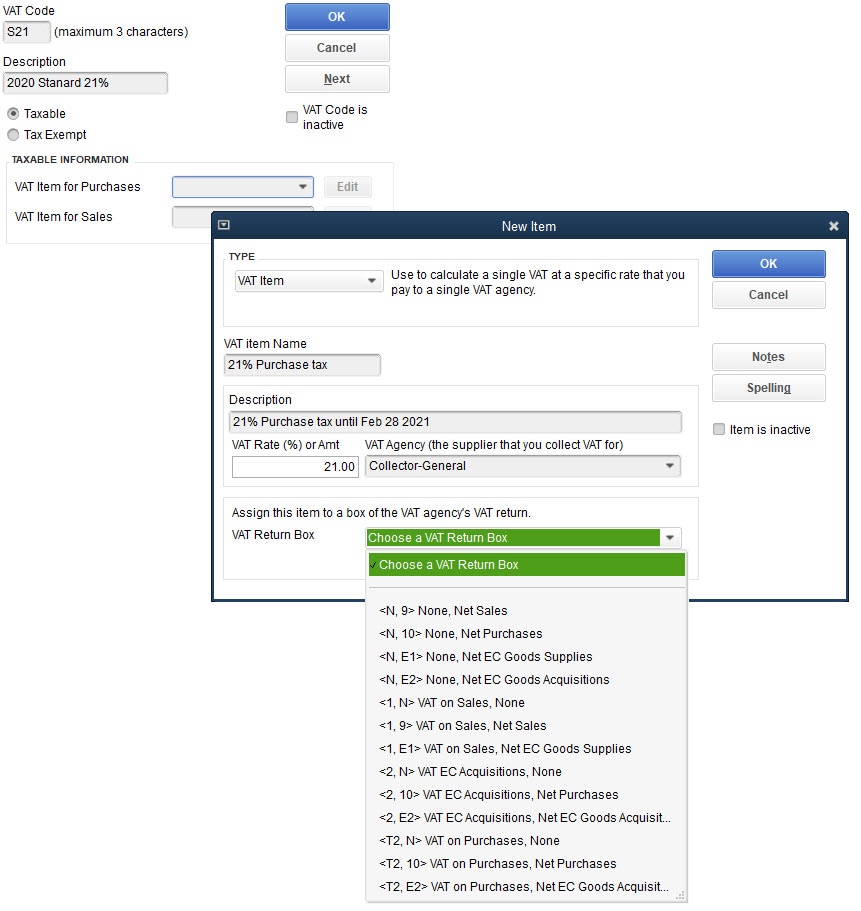

The VAT rate in Ireland is changing from 23% to 21%. QuickBooks sets the VAT items that are used most often where your business is located. However, for this VAT change, you will need to create a temporary VAT code and associated VAT items.

NOTE: You should check any reoccurring transactions to ensure the correct VAT code(s) are being used

More like this