The VAT rate in Ireland is changing from 23% to 21%. QuickBooks sets the VAT items that are used most often where your business is located. However, for this VAT change, you will need to create a temporary VAT code and associated VAT items.

Create a new VAT Code and VAT Items

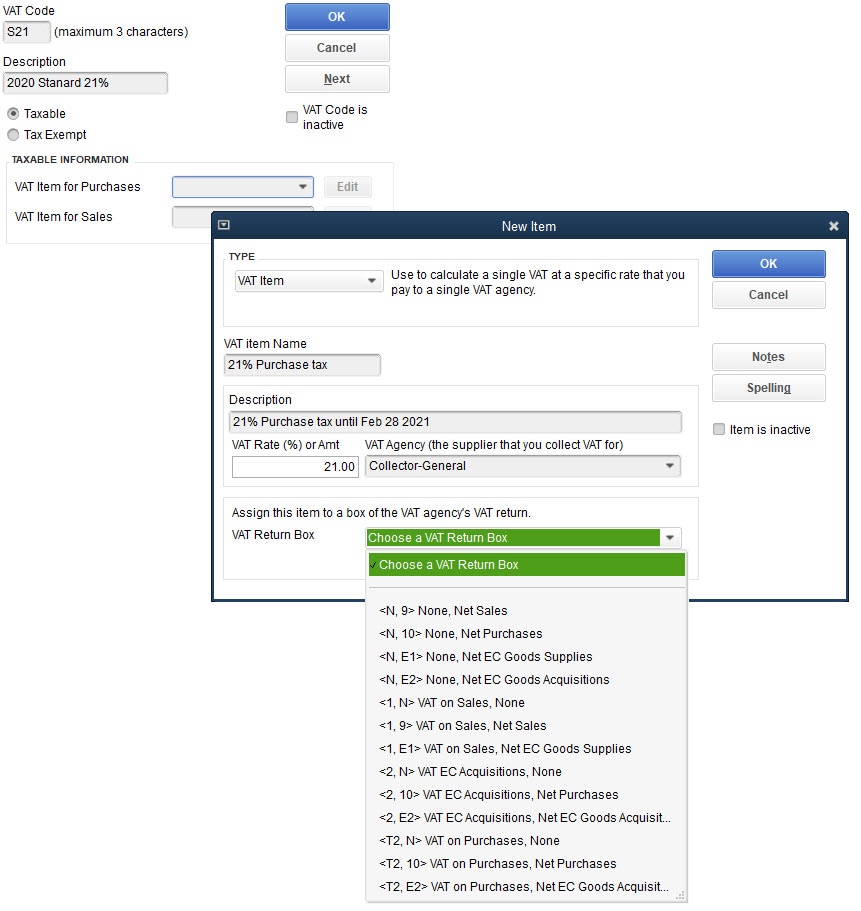

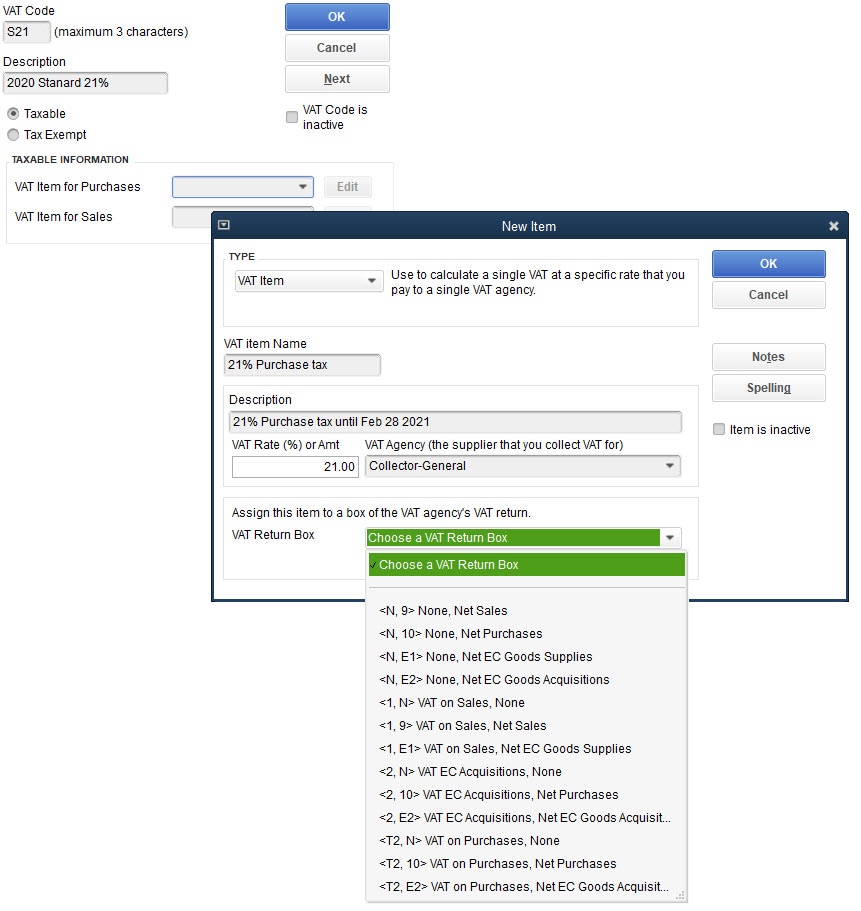

To create a new VAT code:

- From the toolbar select VAT and VAT Code List

- Next select VAT Code and New

- Enter the new VAT code ID, eg S21

- Next, enter a description and make sure tax is enabled

Before we select OK we need to create the new VAT items. Follow this process for both your purchase and sales VAT items:

- Select the purchase/sales drop-down and ensure VAT Item is selected

- Enter a VAT name. This name appears as one of the choices in the Tax field on your sales forms. The name may be seen by your customers on invoices or other forms. It's helpful for the name to indicate the VAT return line

- (Optional) Enter a description. The description is for your own use, so use a description that reminds you of whether the item is for sales or purchases

- Enter the VAT rate, eg 21%

- From the VAT Agency drop-down list, choose the agency that collects this tax

- Choose the box of the VAT Return on which to report this VAT item. Note, the VAT Return Box options are based on the information in the VAT agency record.

- Click OK. Do this for both purchase and sales VAT items

- Finally, click OK in the VAT code window to save your new VAT code and newly created and associated purchase and sales VAT items.

How do I change the default VAT codes that are assigned to all new items?

When you first create an item, such as a service or stock item, QuickBooks assigns default VAT codes to that item. You need to review your stock and service items.

To change the VAT code assigned to a particular item:

- Go to the Lists menu and click Item List

- Double-click the item on the list

- Click the Sales VAT Code drop-down list and choose the appropriate VAT code to use when you sell the item. If applicable, click the Purch VAT Code drop-down list and choose the appropriate VAT code to use when you purchase the item

- Click OK

NOTE: You should check any reoccurring transactions to ensure the correct VAT code(s) are being used