Run a Return of Trading Details (RTD) report

by Intuit• Updated 5 months ago

Learn how to run a Return of Trading Details (RTD) report in QuickBooks Online.

All Irish businesses registered for VAT must file a Return of Trading Details (RTD) on an annual basis, following the end of their respective accounting period.

The RTD is a summary of supplies of goods and services, imports and purchases giving rise to deductible input VAT at the various VAT rates. The return includes all Irish, intra-EU, and overseas trades carried out by Irish businesses.

You must file the annual return within 23 days of your accounting end of year. The RTD is a statistics return which means you don’t have to pay any VAT liability. It is meant to assist Revenue in verifying the accuracy of your VAT returns.

Create a Return of Trading Details (RTD) report

- Go to Reports (Take me there).

- Enter Return of Trading Details Report in the search field. You can also browse for reports in the list on the Reports page.

- Select the Report period and Accounting method. Note: Mixed mode reporting will be the default option for all new customers who choose Cash from 2021.

- Select Run report.

Note: In the Mixed Mode RTD Report, QuickBooks will use the Cash basis for sales transactions and Accrual basis for purchase transactions. Learn more about the accounting methods in QuickBooks Online.

The RTD report is broken into 4 sections:

- Sales Data - the total value of supplies sold for each VAT rate for a year (the normal RTD period). This is for SALES ONLY.

- Acquisitions from EU - the total value of supplies purchased from EU countries (including VAT free purchases).

- Purchases for Resale - the total value of ALL purchases (IE and EU and Non-EU) of stock purchased for resale net of VAT.

- Other Deductible Goods & Services - the total value of supplies purchases where input tax could be claimed and is not purchases for resale.

QuickBooks automatically maps all the tax rates for you in the report to the correct headings. These amounts are only shown in euros and as VAT exclusive.

Note: The report is mapped to tax rates and tax agencies that QuickBooks created automatically. The report does not include any transactions that use tax rates you manually created.

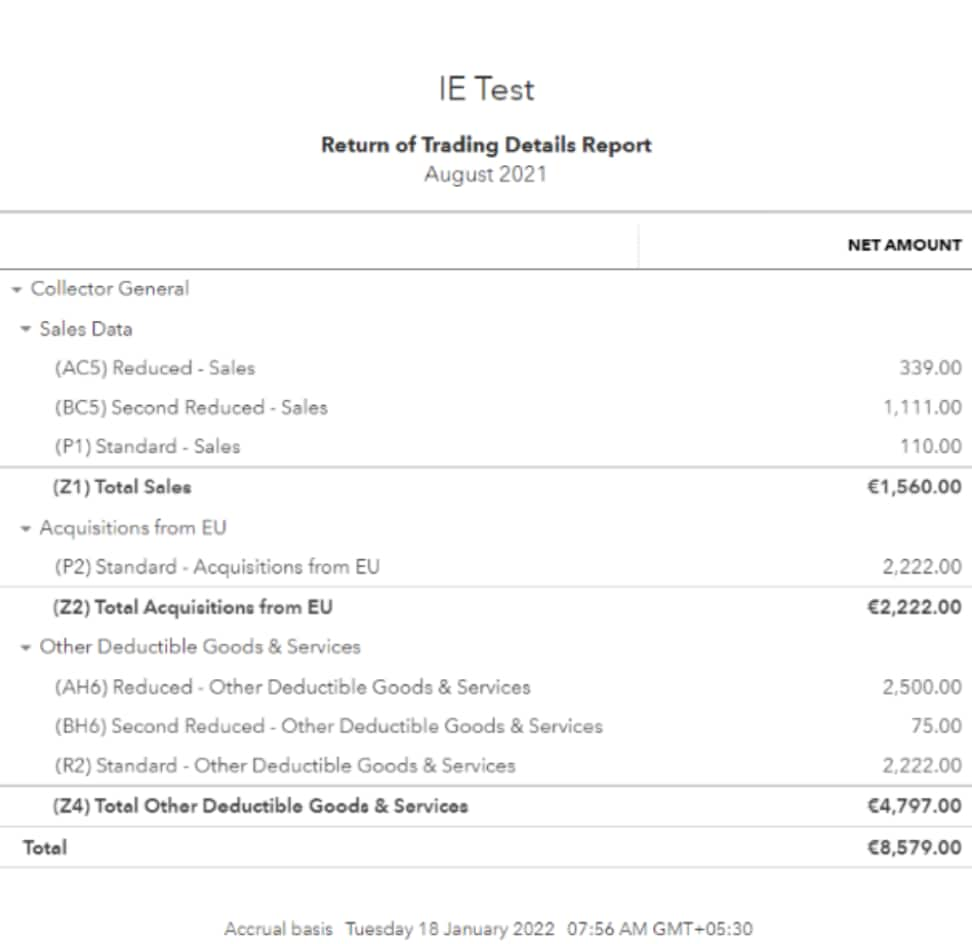

Return of Trading Details Report - Accrual Accounting Example:

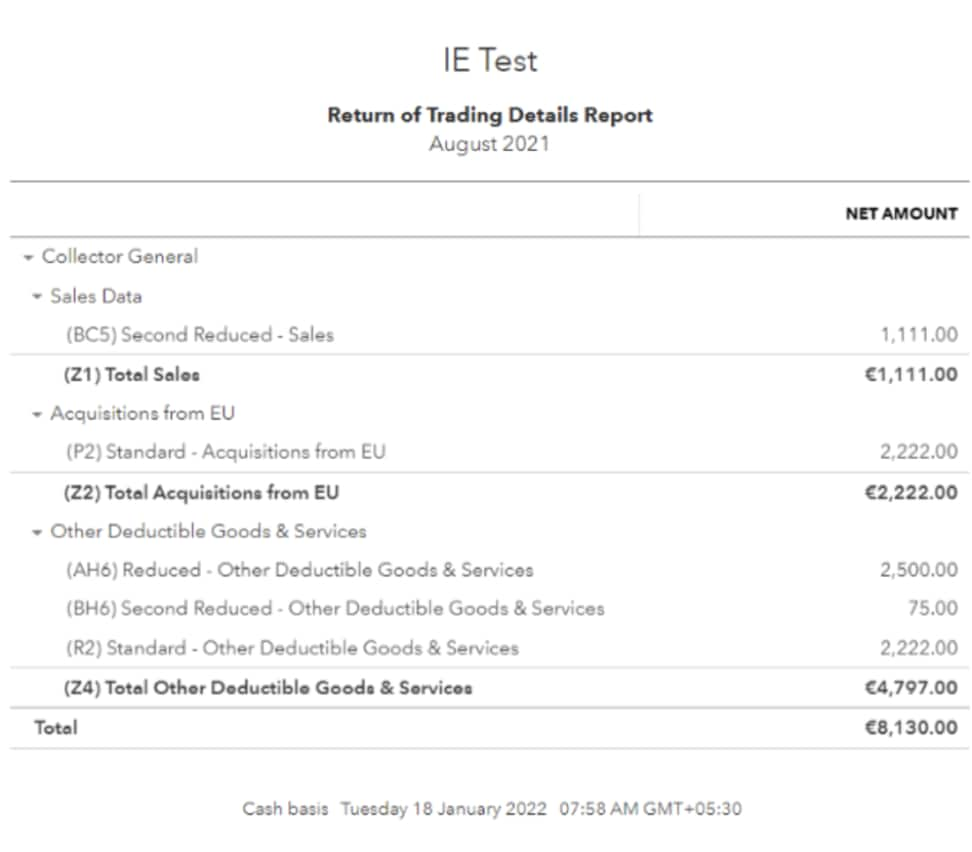

Return of Trading Details Report - Mixed Mode Accounting Example:

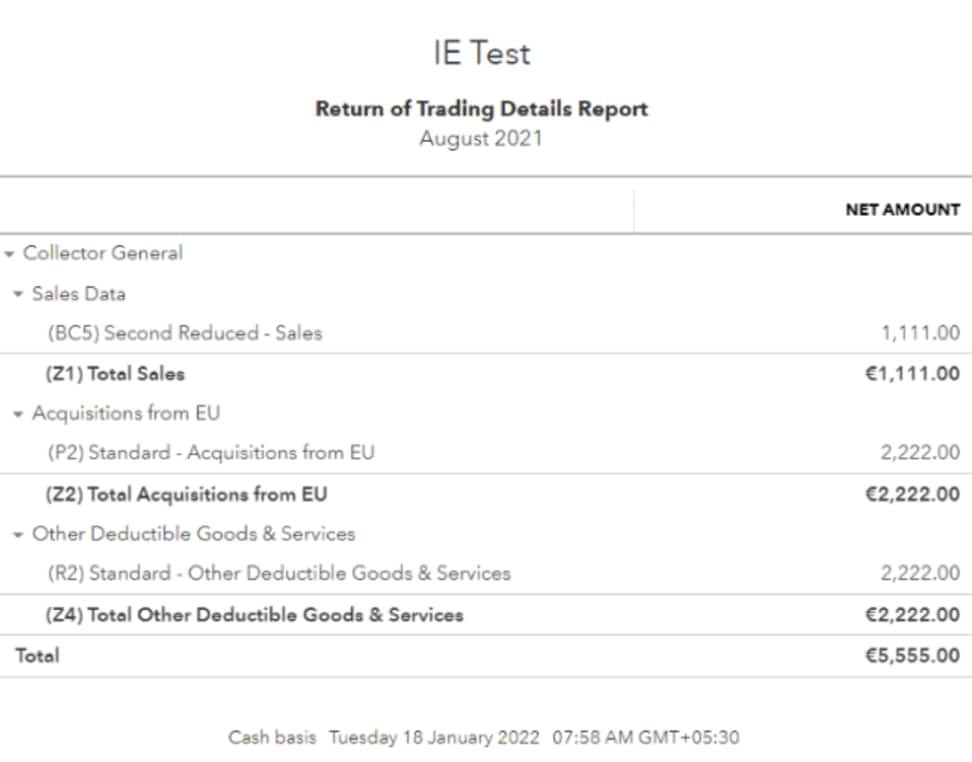

Return of Trading Details Report - Cash Mode Accounting Example:

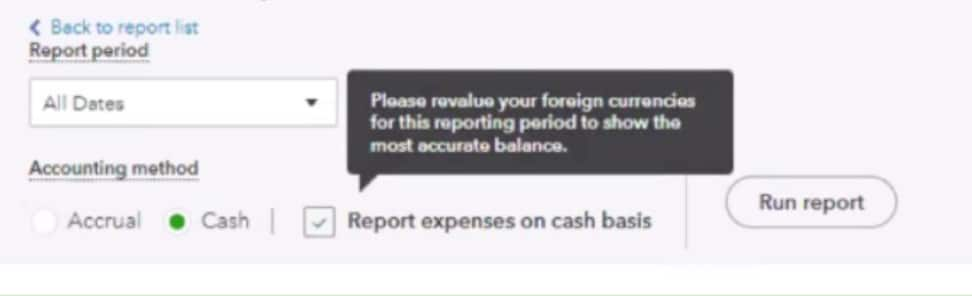

If you wish to run your Return of Trading Details Report by Cash only, make sure you have selected Report expenses on cash basis.

To view more details about a section, select the dropdown arrow ▼ beside the section.

Note: If a transaction doesn't post correctly, edit the tax rate for the transaction. If you have already completed a tax return that includes the transaction in question, speak with your accountant before making any updates.

More like this

- File your VAT return and record VAT payments in QuickBooks Onlineby QuickBooks

- VAT Detail Reportby QuickBooks

- Check how much VAT you owe in QuickBooks Onlineby QuickBooks

- Use reports to track cash flowby QuickBooks