I can guide you in handling the SEISS grant in QuickBooks Online (QBO), scottp777.

Since this is taxable, you'll want to create the Other income account from your Chart of Accounts.

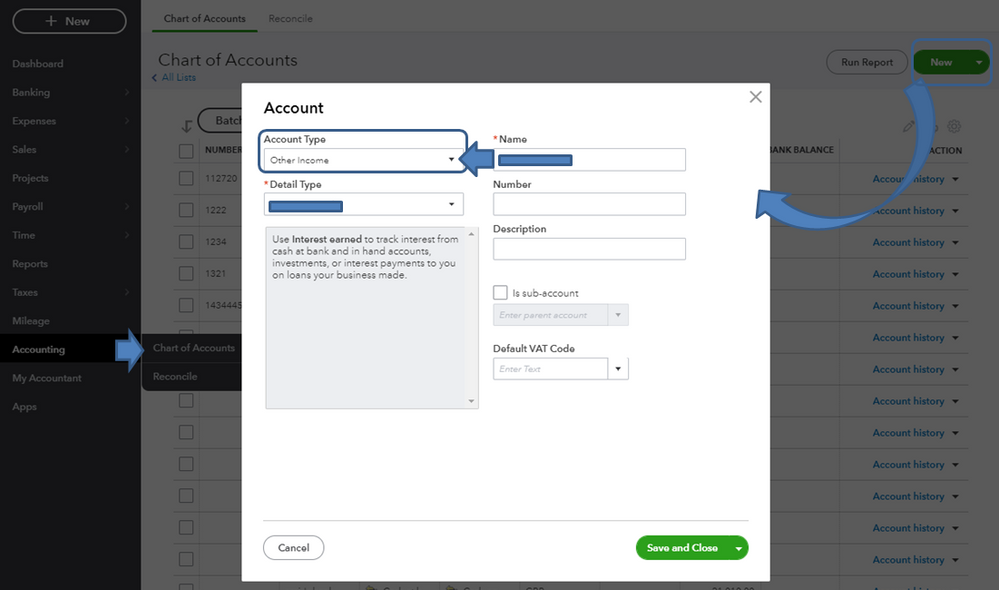

To do that:

- Go to Accounting and choose Chart of Accounts.

- Click New.

- Fill in the account information and choose Other Income as your Account Type. If you're not sure what Detail Type to use, you can ask your accountant.

- Click Save and close.

![]()

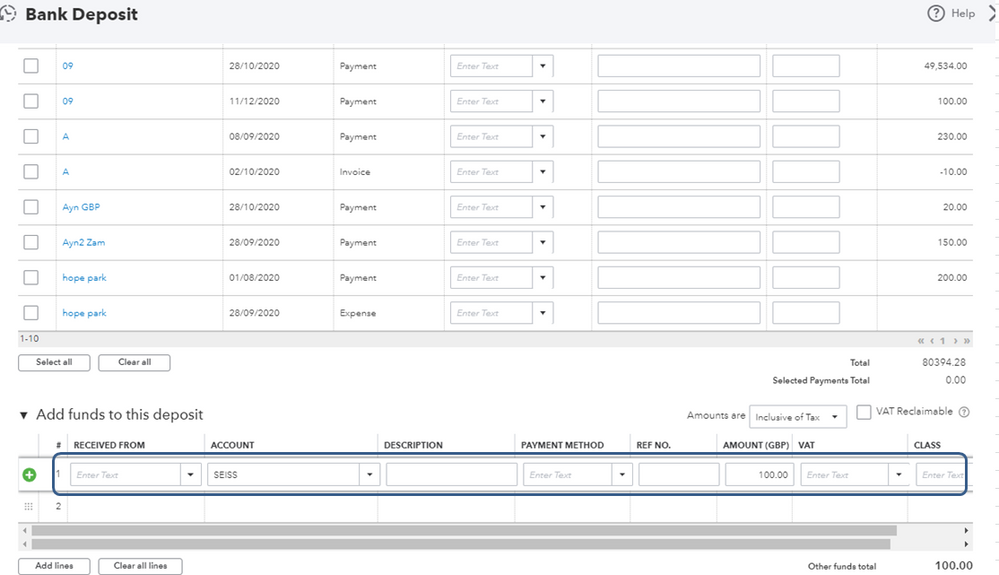

Then, you can create a bank deposit to record and use the Income account for SEISS that you've recently created.

Here's how:

- Go to the +New icon.

- Choose Bank deposit.

- Fill in the necessary information and add the Income account under Add funds to this deposit section.

![]()

- Click Save and close.

You can run the Profit and Loss report by bank account to review that deposits and other transactions made.

If you have other questions on future tasks, feel free to access our Help Articles.

The Community is always open if you have other questions while recording transactions in QBO. I'll be around to help. Wishing you a great day ahead.