Use the Workpapers lock feature

by Intuit•1• Updated 7 months ago

Learn how to lock and unlock Workpapers in QuickBooks Online Accountant.

One of the main benefits of working in the cloud is the ability to collaborate with clients and colleagues within a firm.

During the year-end workflow, accounting professionals like to have even more line-of-sight into the transactions that are being added to QuickBooks Online.

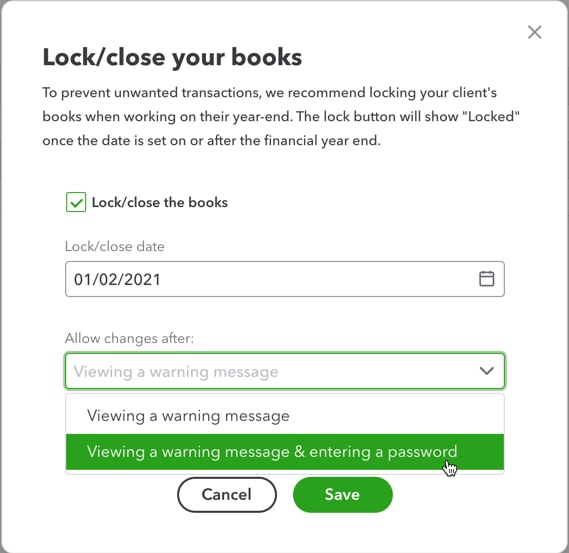

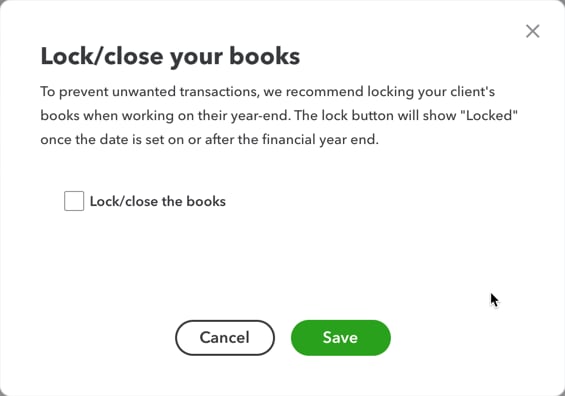

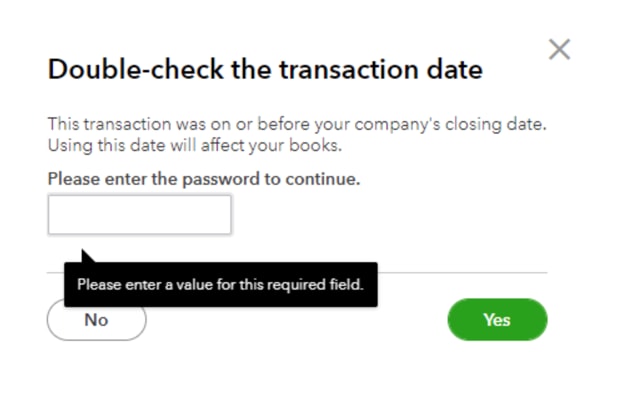

If you're an accountant or bookkeeper who does year-end work, it will bring you some comfort that we are introducing our new feature User Lock. This feature allows you to lock the year-end Workpapers as you review and adjust the financial statements.