Welcome to the Community, orders10.

I recognize the importance of having a balanced amount for all records (bank and QuickBooks. Allow me to help clarify your bank balance is lower compared to the one in QuickBooks.

The data on the Bank balance depends on what your financial institution shares with us and the added or matched transactions. Also, the information in the QuickBooks balance is based on the register.

Aside from that, this can happen for a few different reasons. For example, there may be duplicated or edited transactions, outstanding checks, or new transactions for a connected account.

To resolve the issue, review the entry one at a time. For each downloaded transaction, you’ll have the option to match, add, or view multiple matches. To help and guide you, see the Categorise and match online bank transactions in QuickBooks Online article and perform Steps 2-3.

Since QBO is a diary of your business, make sure to record all transactions into the company. This is to mirror what happened to the actual data.

In regard to your NEST or payroll payments, we’ll have to input them by creating an expense transaction. To ensure your records are correct, I suggest contacting an accountant. They can recommend which specific account to use when recording the payments.

- To find one, click on this link: Accountants Near Me | Chartered Accountants.

- Then, enter the postcode or town and click the Find an accountant button.

Once you have all the complete details, set up the account in QBO. When you’re ready, let me walk you through the steps on how to enter the payments.

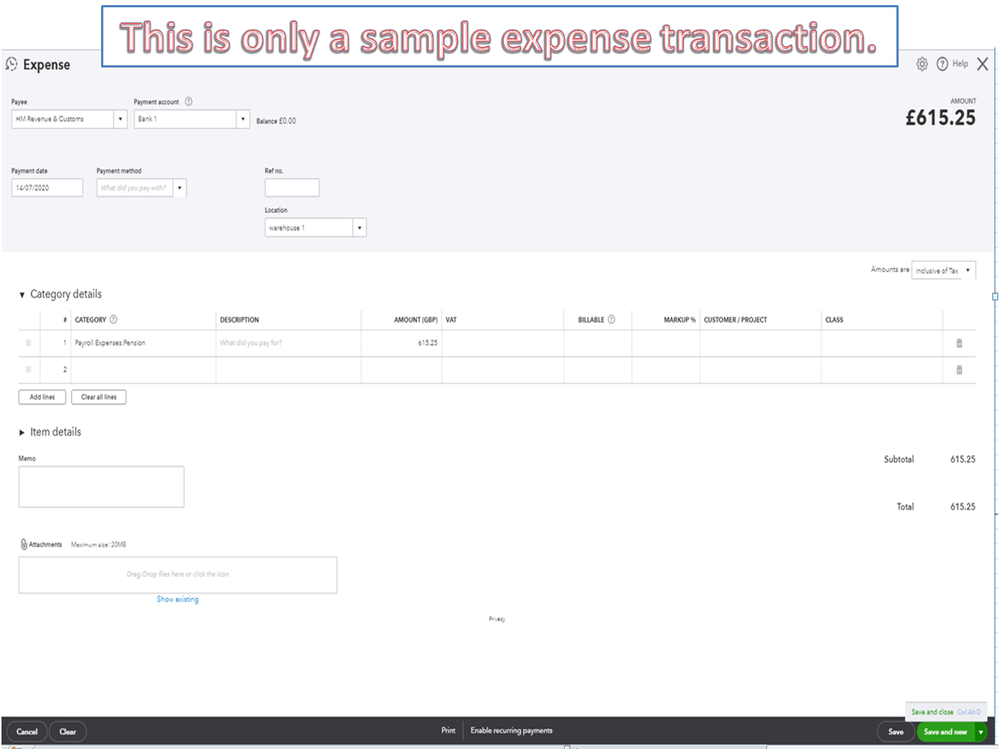

- Click on the New menu in the upper left to choose Expense under Suppliers.

- Form the Payee drop-down, select the vendor’s name and type the account where you want to post the transaction in the Payment account field box.

- Go to the Category details section and key in the account in the Category column.

- Fill in the remaining field boxes.

- Hit Save and close to keep the changes.

You can bookmark these links for future reference. From there, you'll find instructions on how to resolve beginning balance issues in QBO.

The resolution steps will correct your balances in no time.

Click the Reply button if you need assistance balancing the data in QBO. I’ll pop right back in to help you. Have a great rest of the day.