- UK QuickBooks Community

- :

- QuickBooks Q & A

- :

- Do More with QuickBooks

- :

- Can anyone tell me where I can get a list of the expense categories in QB's Self Employed?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Can anyone tell me where I can get a list of the expense categories in QB's Self Employed?

Solved! Go to Solution.

Labels:

Best answer December 11, 2020

Solved

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Can anyone tell me where I can get a list of the expense categories in QB's Self Employed?

Hi there, @fr4.

I can guide you on how you can get the list of your expense categories in QuickBooks Self-Employed (QBSE).

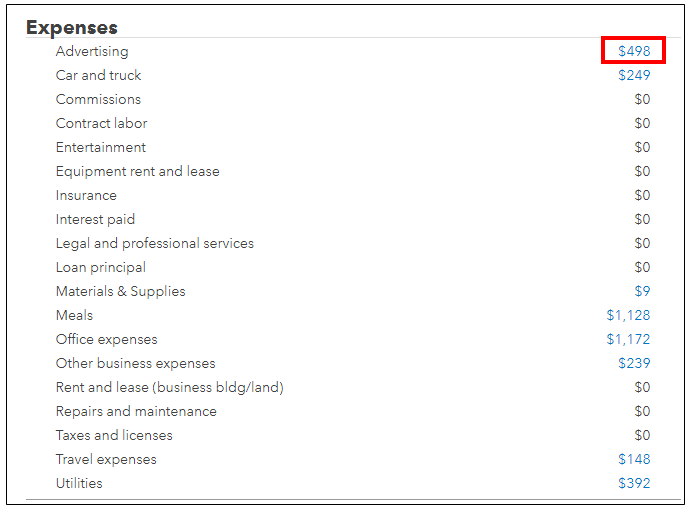

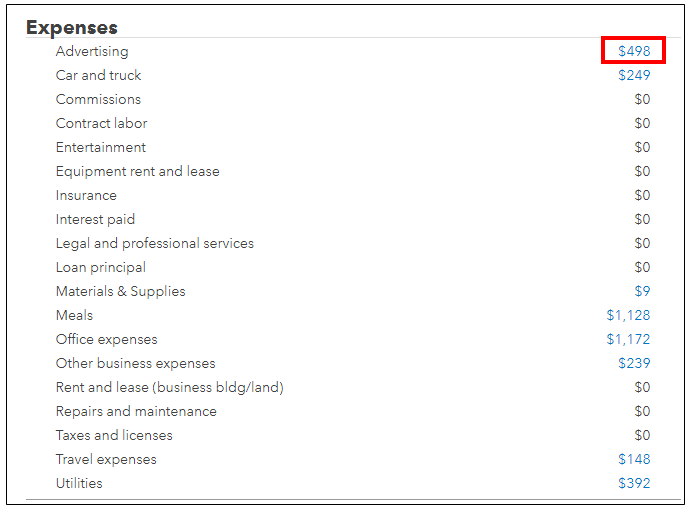

You can run the Profit and loss report to view your expense accounts in QuickBooks. Here's how:

- Go to Reports and look for the Profit and loss report.

- Filter the report's period, then click View.

This will show you the list of your expense categories. You can click its amount to view the transactions that are linked to your accounts.

In addition, check out the article about the SA103F Categories. This will describe the SA103F deduction categories you can claim as allowable expenses for self-employment.

I'm just a reply away if you have other questions with the QuickBooks Self-Employed. Just add the details of your concerns in this thread and I'll help you out.

2 REPLIES 2

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Can anyone tell me where I can get a list of the expense categories in QB's Self Employed?

Hi there, @fr4.

I can guide you on how you can get the list of your expense categories in QuickBooks Self-Employed (QBSE).

You can run the Profit and loss report to view your expense accounts in QuickBooks. Here's how:

- Go to Reports and look for the Profit and loss report.

- Filter the report's period, then click View.

This will show you the list of your expense categories. You can click its amount to view the transactions that are linked to your accounts.

In addition, check out the article about the SA103F Categories. This will describe the SA103F deduction categories you can claim as allowable expenses for self-employment.

I'm just a reply away if you have other questions with the QuickBooks Self-Employed. Just add the details of your concerns in this thread and I'll help you out.

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Can anyone tell me where I can get a list of the expense categories in QB's Self Employed?

Hi Raymond0

Thank you for your response.

I do not have access to the Self Assessment module as I use the pro advisor standard online version.

I am giving a basic training session tomorrow, so I just needed to know how the self assessment version differs and what the category options were for his expenses.

I get the impression that it is quite rigid and you can't add new categories. So I was thinking this may be difficult for my client. i.e capital allowances will have to be separate. Receiving financial gifts from parents.

However, now that I realise QB self assessment has categories inline with the SA103, that helps.

Thank you.

Recommendations

Featured

Ready to get started with QuickBooks Online? This walkthrough guides you

th...