Here's everything you need to know about managing NEST contributions in QuickBooks Online, @andy-bate.

When you enroll for workplace (NEST) pensions, you'll need to enter the default contribution rates. This way, the pension scheme will properly operate a net or gross pay arrangement.

I'd recommend contacting NEST directly to know further how the rates affect your gross salary or net system. You can also seek help from an accountant or a tax advisor on the best way to handle this.

After that, you can record your pension payments. First, you'll have to create an expense account to track them.

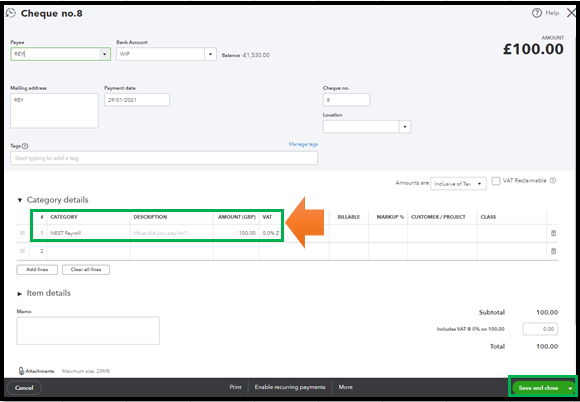

Here's how to create a pension payment:

- Click the +New button, and then select either Expense or Cheque.

- Fill out the necessary fields.

- Click Save and close.

You'll want to run some workplace pension reports to get a glimpse of your employee and contribution details.

I'm a post away if you need more insights about managing your workplace pensions in QuickBooks. I can always help you anytime.